15Ca Form Online - You can submit form 15ca through both online and offline channels. Declaration under section 197a(1) and section 197a(1a) to be made by an. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance.

Declaration under section 197a(1) and section 197a(1a) to be made by an. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels.

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels.

Form 15CA Filed Form Download Free PDF Tax Taxes

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels.

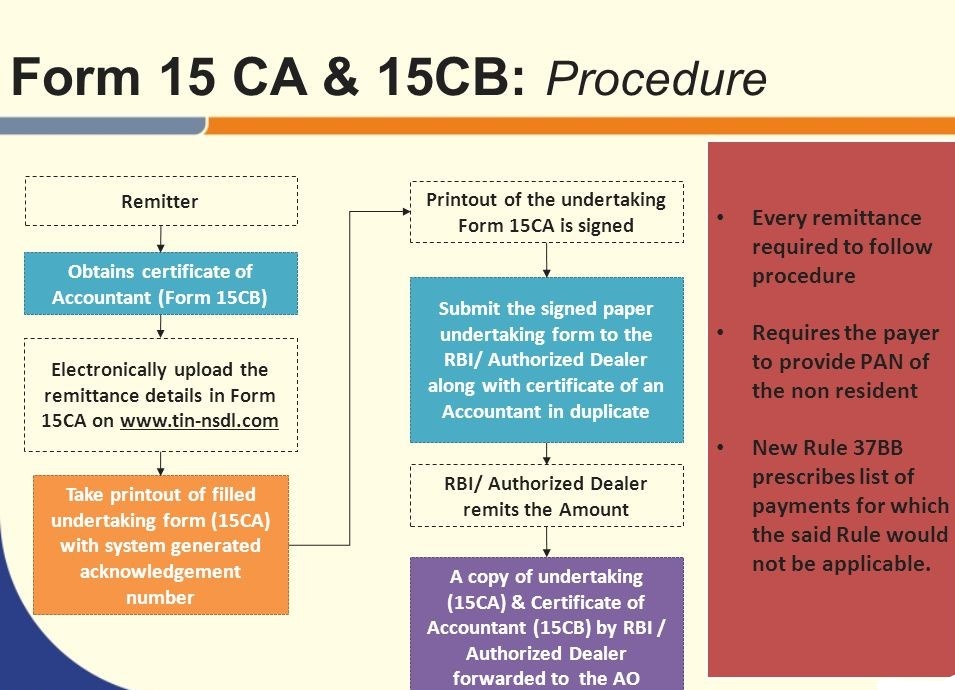

Form 15CA and 15CB of Tax, Online Filling, New Rules 2022

Declaration under section 197a(1) and section 197a(1a) to be made by an. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels.

Further relaxation in Online filing of Form 15CA/CB KNM India

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels. Declaration under section 197a(1) and section 197a(1a) to be made by an.

Apply Online to File form 15CA of Tax

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels. Declaration under section 197a(1) and section 197a(1a) to be made by an.

All About Form 15CA Form 15CB Taxation Public Finance

Declaration under section 197a(1) and section 197a(1a) to be made by an. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels.

Form 15ca Format Remittance Tax Deduction

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels. Declaration under section 197a(1) and section 197a(1a) to be made by an.

Complete Understanding about Form 15CA, Form 15CB RJA

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels. Declaration under section 197a(1) and section 197a(1a) to be made by an.

Form 15CA and 15CB of Tax, Online Filling, New Rules 2022

Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance.

What are Form 15CA and 15CB, and how do you file them?

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels.

Declaration Under Section 197A(1) And Section 197A(1A) To Be Made By An.

You can submit form 15ca through both online and offline channels. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance.