A Disadvantage Of The Corporate Form Of Business Is - The corporate form of business organization has several advantages, such as limited liability for. The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The primary disadvantage of the corporate form is the double taxation to shareholders of.

The corporate form of business organization has several advantages, such as limited liability for. The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The primary disadvantage of the corporate form is the double taxation to shareholders of.

The primary disadvantage of the corporate form is the double taxation to shareholders of. The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The corporate form of business organization has several advantages, such as limited liability for.

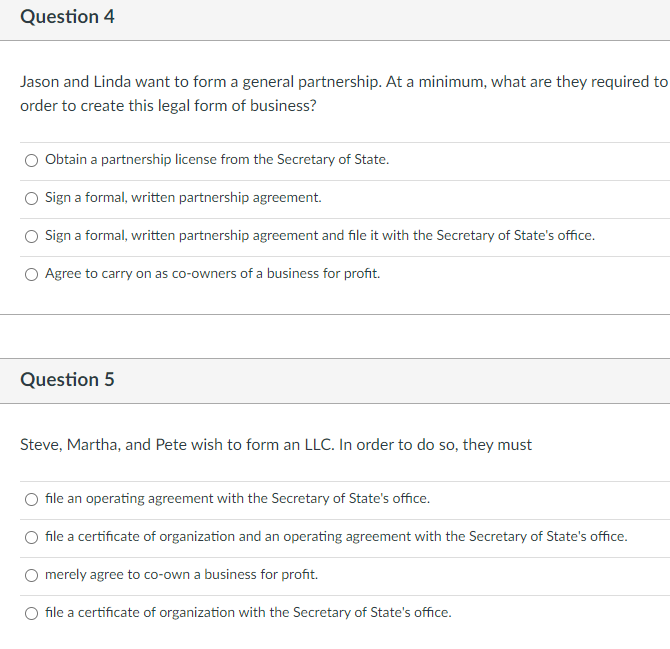

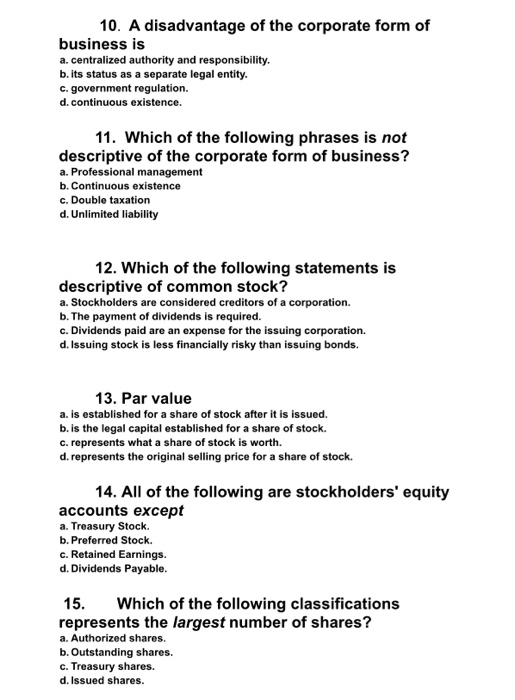

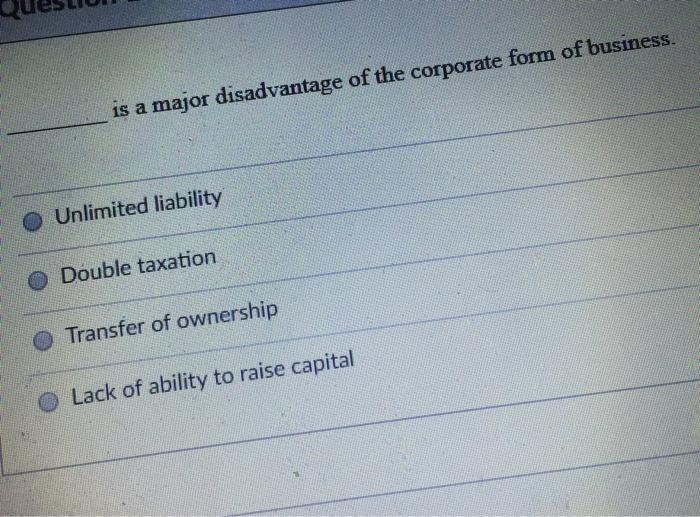

Solved A major disadvantage of the corporate form of

The corporate form of business organization has several advantages, such as limited liability for. The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The primary disadvantage of the corporate form is the double taxation to shareholders of.

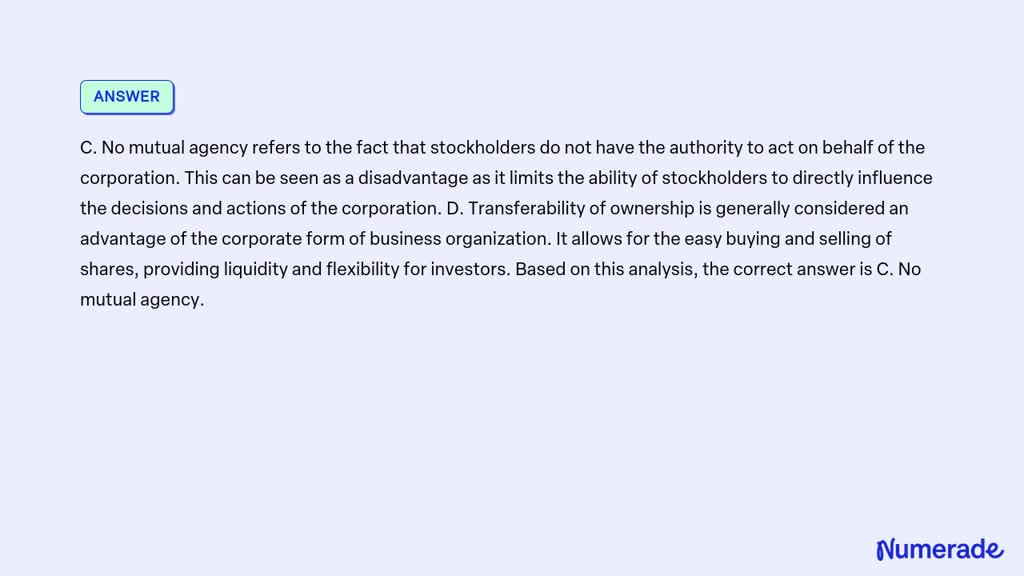

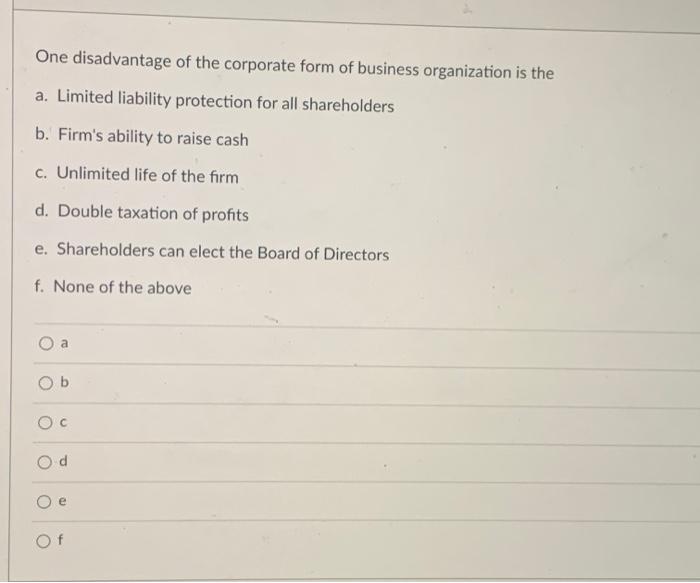

Solved 10. A disadvantage of the corporate form of business

The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The primary disadvantage of the corporate form is the double taxation to shareholders of. The corporate form of business organization has several advantages, such as limited liability for.

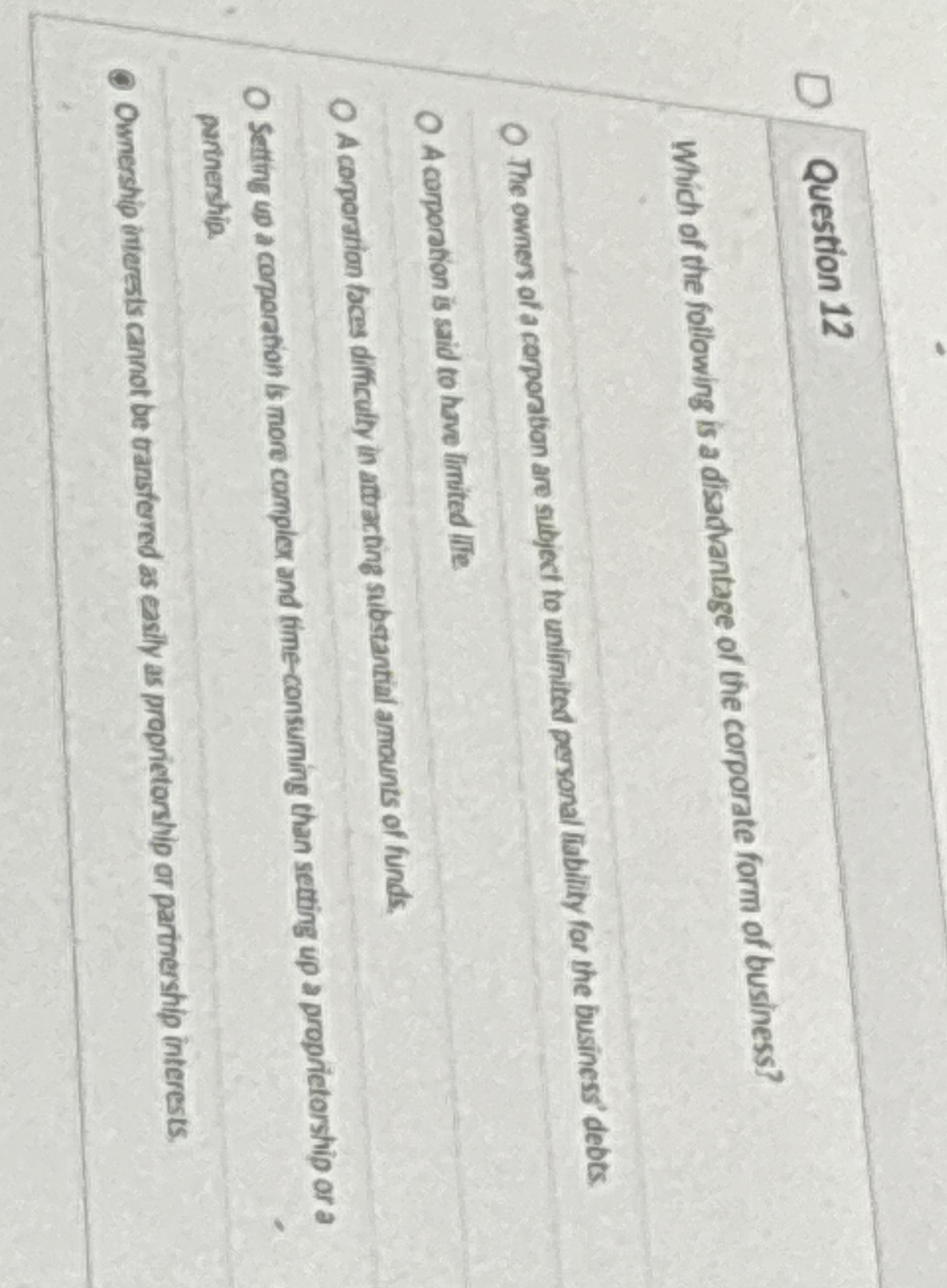

SOLVED Which of the following is a disadvantage of the corporate form

The primary disadvantage of the corporate form is the double taxation to shareholders of. The corporate form of business organization has several advantages, such as limited liability for. The corporate form’s primary disadvantage is that distributed earnings and dividends are double.

Solved A major disadvantage of the corporate form of

The corporate form of business organization has several advantages, such as limited liability for. The primary disadvantage of the corporate form is the double taxation to shareholders of. The corporate form’s primary disadvantage is that distributed earnings and dividends are double.

Solved Question 12Which of the following is a disadvantage

The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The corporate form of business organization has several advantages, such as limited liability for. The primary disadvantage of the corporate form is the double taxation to shareholders of.

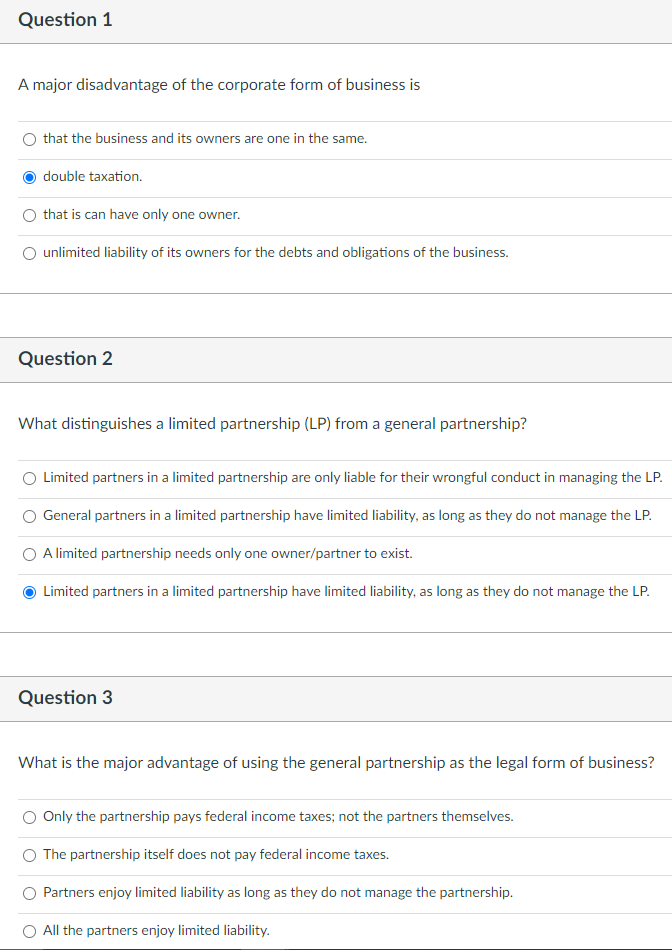

SOLUTION Corporate form disadvantage Studypool

The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The corporate form of business organization has several advantages, such as limited liability for. The primary disadvantage of the corporate form is the double taxation to shareholders of.

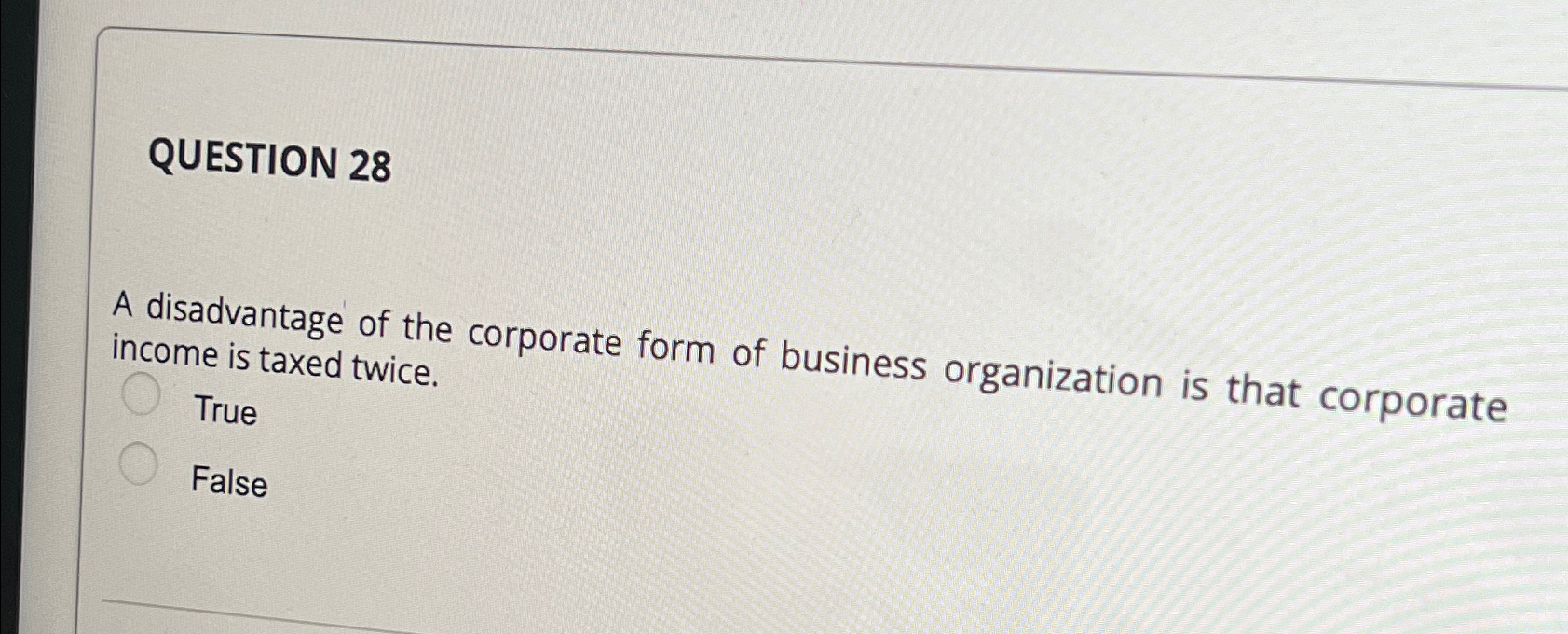

Solved A primary disadvantage of the corporate form of

The primary disadvantage of the corporate form is the double taxation to shareholders of. The corporate form of business organization has several advantages, such as limited liability for. The corporate form’s primary disadvantage is that distributed earnings and dividends are double.

Solved is a major disadvantage of the corporate form of

The corporate form of business organization has several advantages, such as limited liability for. The primary disadvantage of the corporate form is the double taxation to shareholders of. The corporate form’s primary disadvantage is that distributed earnings and dividends are double.

Solved One disadvantage of the corporate form of business

The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The corporate form of business organization has several advantages, such as limited liability for. The primary disadvantage of the corporate form is the double taxation to shareholders of.

Solved QUESTION 28A disadvantage of the corporate form of

The corporate form’s primary disadvantage is that distributed earnings and dividends are double. The primary disadvantage of the corporate form is the double taxation to shareholders of. The corporate form of business organization has several advantages, such as limited liability for.

The Primary Disadvantage Of The Corporate Form Is The Double Taxation To Shareholders Of.

The corporate form of business organization has several advantages, such as limited liability for. The corporate form’s primary disadvantage is that distributed earnings and dividends are double.