Canada Ca En Revenue Agency Services Forms Publications Forms T1135 - Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax. For frequently asked questions or examples, see questions and answers about form t1135 on. For frequently asked questions or examples, see questions and answers about. Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and.

For frequently asked questions or examples, see questions and answers about form t1135 on. For frequently asked questions or examples, see questions and answers about. Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax.

Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. For frequently asked questions or examples, see questions and answers about. For frequently asked questions or examples, see questions and answers about form t1135 on. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax.

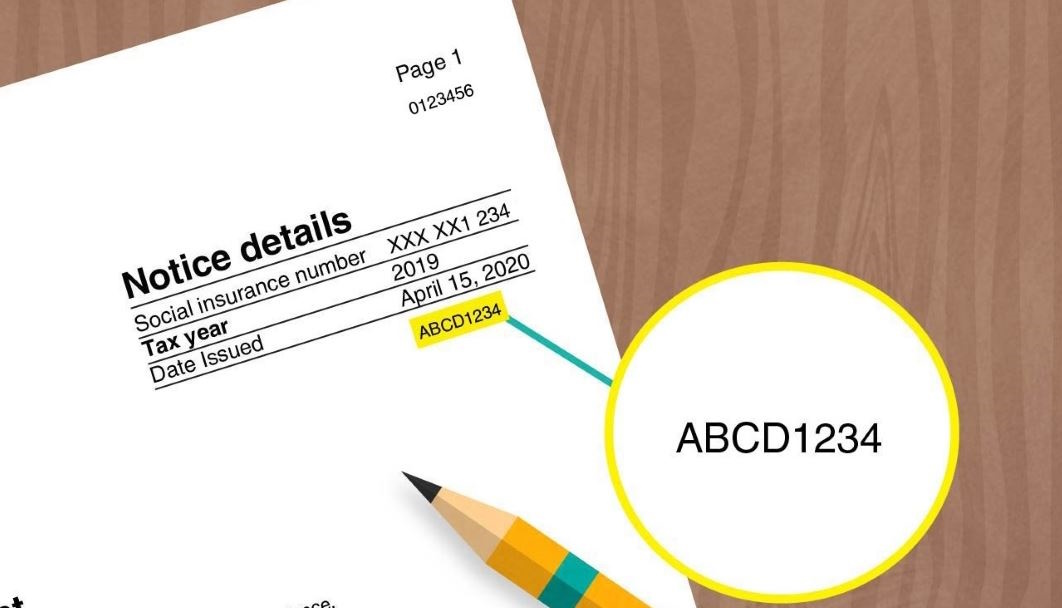

File your taxes online Certified tax software Canada.ca

Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. For frequently asked questions or examples, see questions and answers about. For frequently asked questions or examples, see questions and answers about form t1135 on. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax.

Canada T1213(OAS) E 20202022 Fill and Sign Printable Template Online

Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax. For frequently asked questions or examples, see questions and answers about form t1135 on. For frequently asked questions or examples, see questions and answers about.

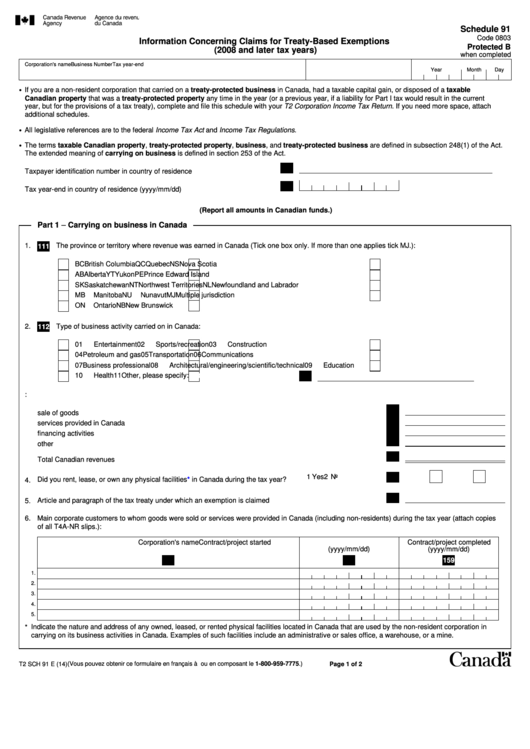

Canada Revenue Agency Corporate Tax Remittance Form Ethel

For frequently asked questions or examples, see questions and answers about. For frequently asked questions or examples, see questions and answers about form t1135 on. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax. Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and.

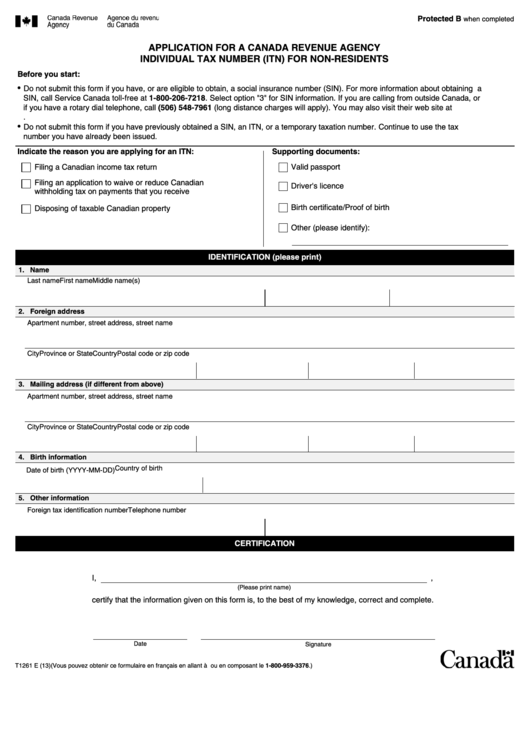

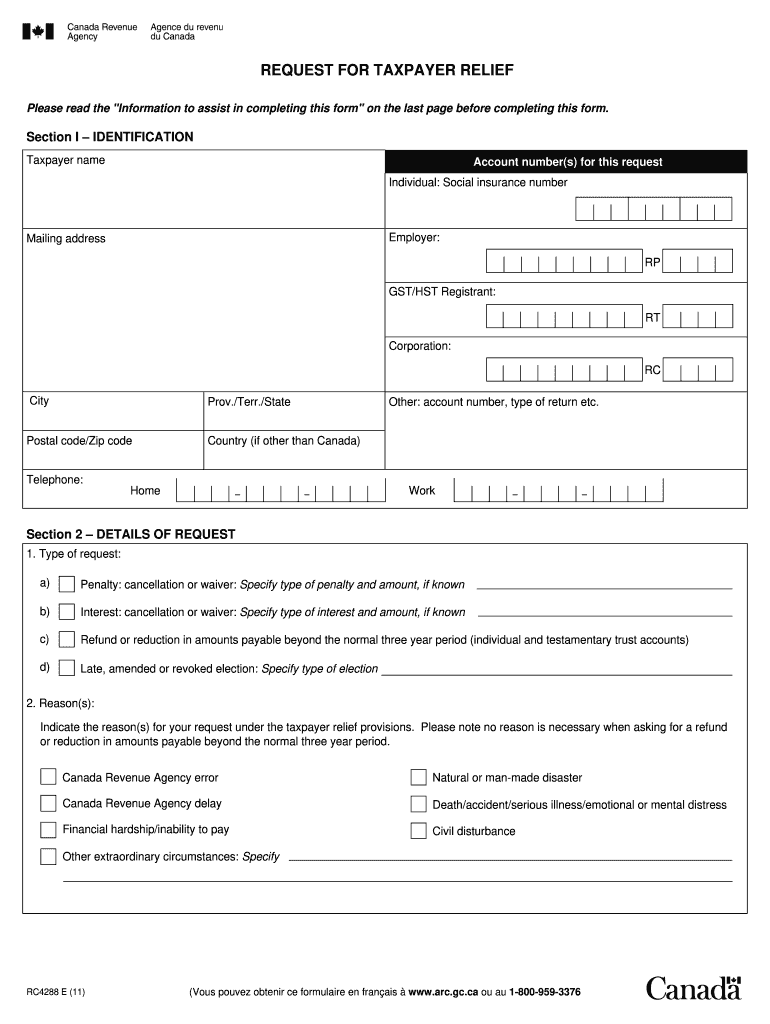

Application For A Canada Revenue Agency printable pdf download

For frequently asked questions or examples, see questions and answers about. Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. For frequently asked questions or examples, see questions and answers about form t1135 on. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax.

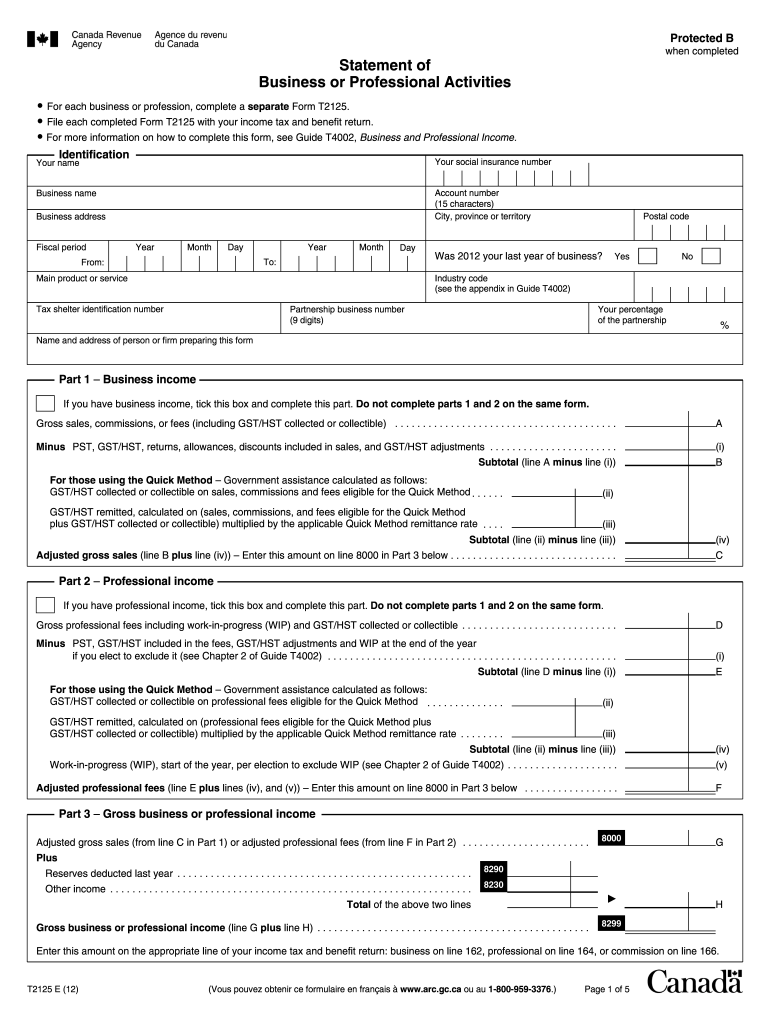

Canada T2125 2012 Fill and Sign Printable Template Online US Legal

Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. For frequently asked questions or examples, see questions and answers about. For frequently asked questions or examples, see questions and answers about form t1135 on. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax.

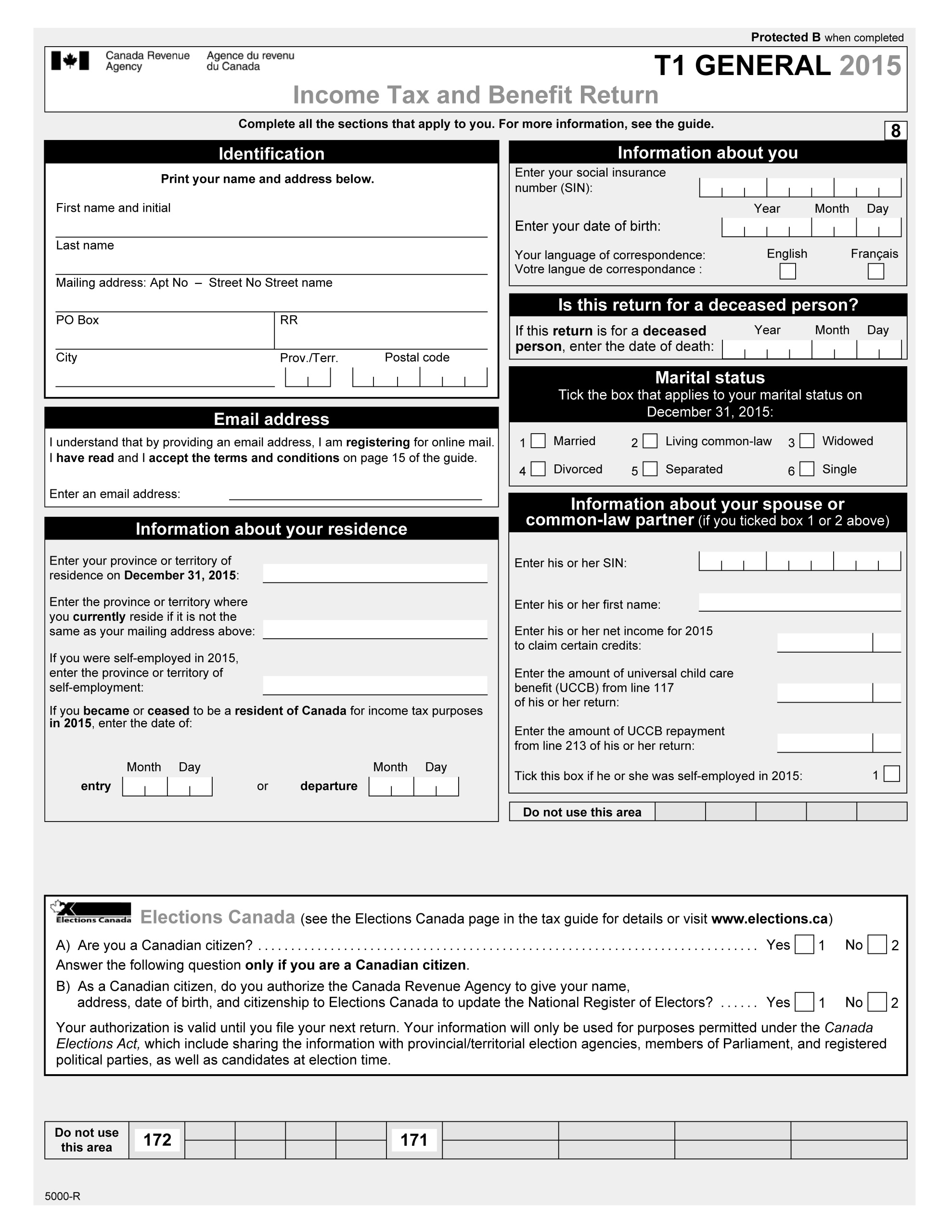

Edward Jones Revenue Revenue Canada Forms

For frequently asked questions or examples, see questions and answers about form t1135 on. For frequently asked questions or examples, see questions and answers about. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax. Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and.

Canada revenue agency forms boyscaqwe

Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. For frequently asked questions or examples, see questions and answers about. For frequently asked questions or examples, see questions and answers about form t1135 on. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax.

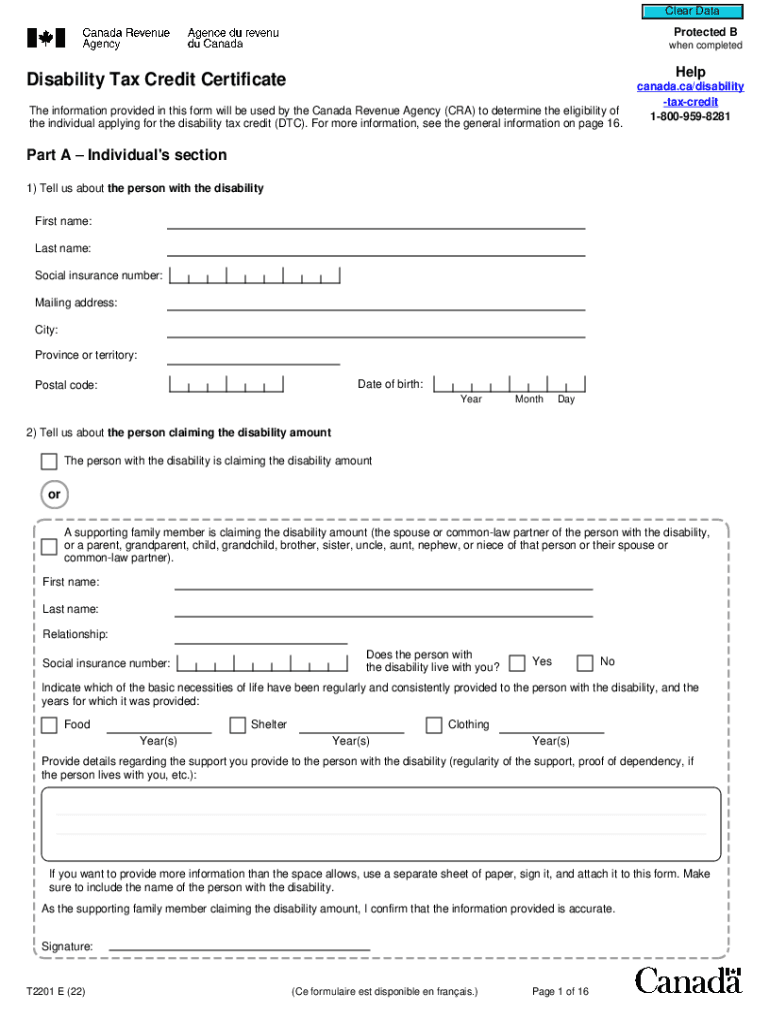

T2201 Printable Form Printable Forms Free Online

For frequently asked questions or examples, see questions and answers about. Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax. For frequently asked questions or examples, see questions and answers about form t1135 on.

The Canada Revenue Agency Will Review Around 200K Canadians’ Benefits

Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax. For frequently asked questions or examples, see questions and answers about. For frequently asked questions or examples, see questions and answers about form t1135 on. Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and.

40 Canada Revenue Agency Forms And Templates free to download in PDF

Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax. For frequently asked questions or examples, see questions and answers about form t1135 on. For frequently asked questions or examples, see questions and answers about.

For Frequently Asked Questions Or Examples, See Questions And Answers About Form T1135 On.

Individuals can file form t1135 electronically (efile or netfile) for the 2017 and later tax. Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and. For frequently asked questions or examples, see questions and answers about.