De 4 Tax Form - Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this.

For state withholding, use the worksheets on this. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding.

For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax.

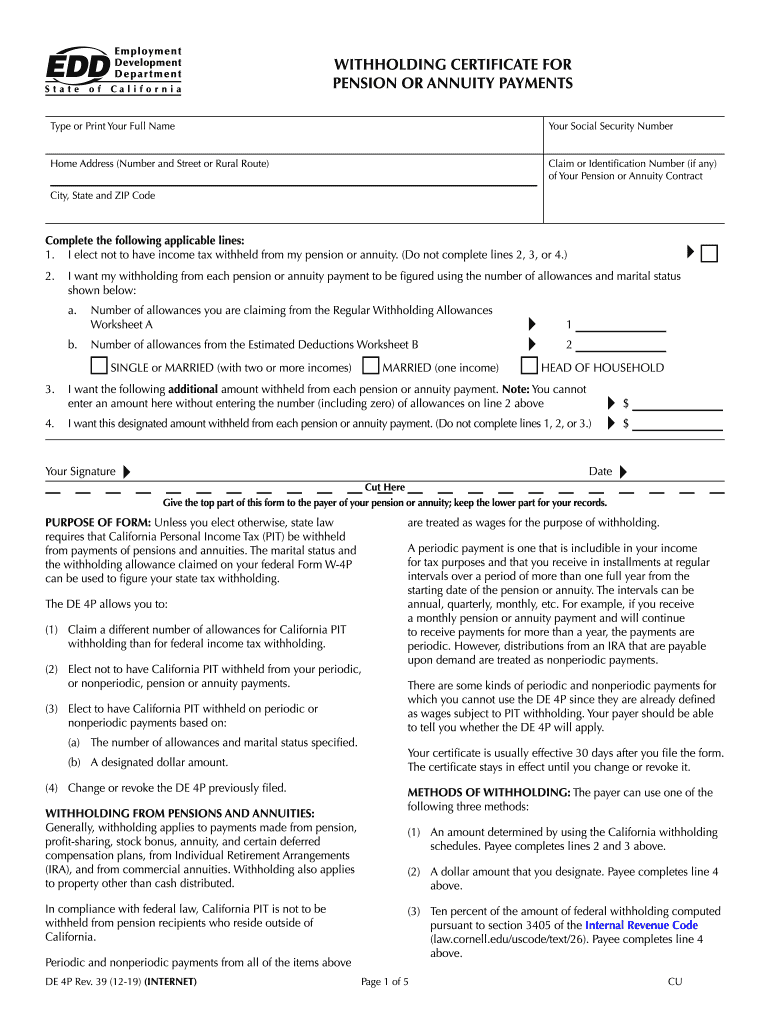

CA EDD DE 4P 20192022 Fill and Sign Printable Template Online US

For state withholding, use the worksheets on this. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The de 4 is used to compute the amount of taxes to be.

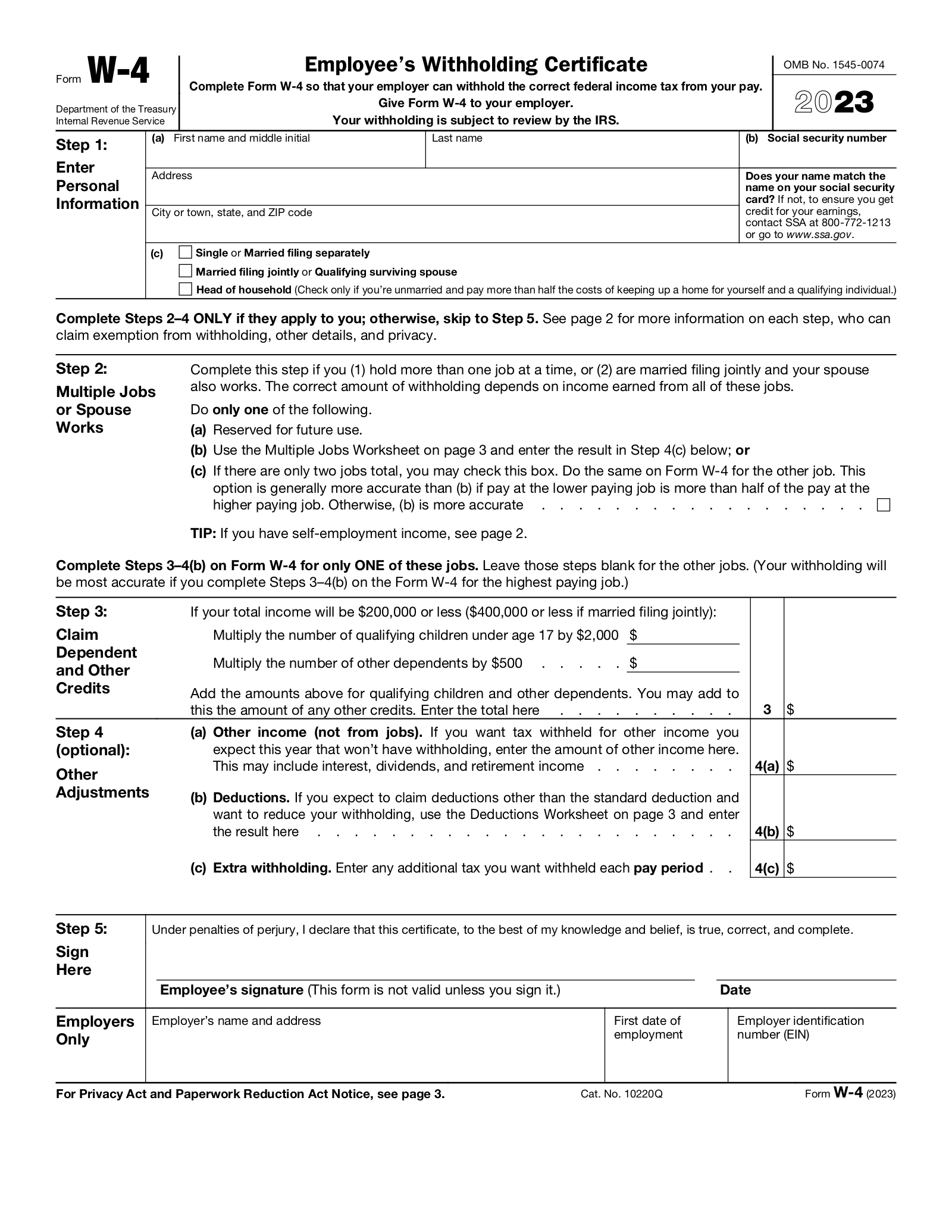

Irs Form W4 2024 Olga Tiffie

For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Filling out the california withholding form de 4 is.

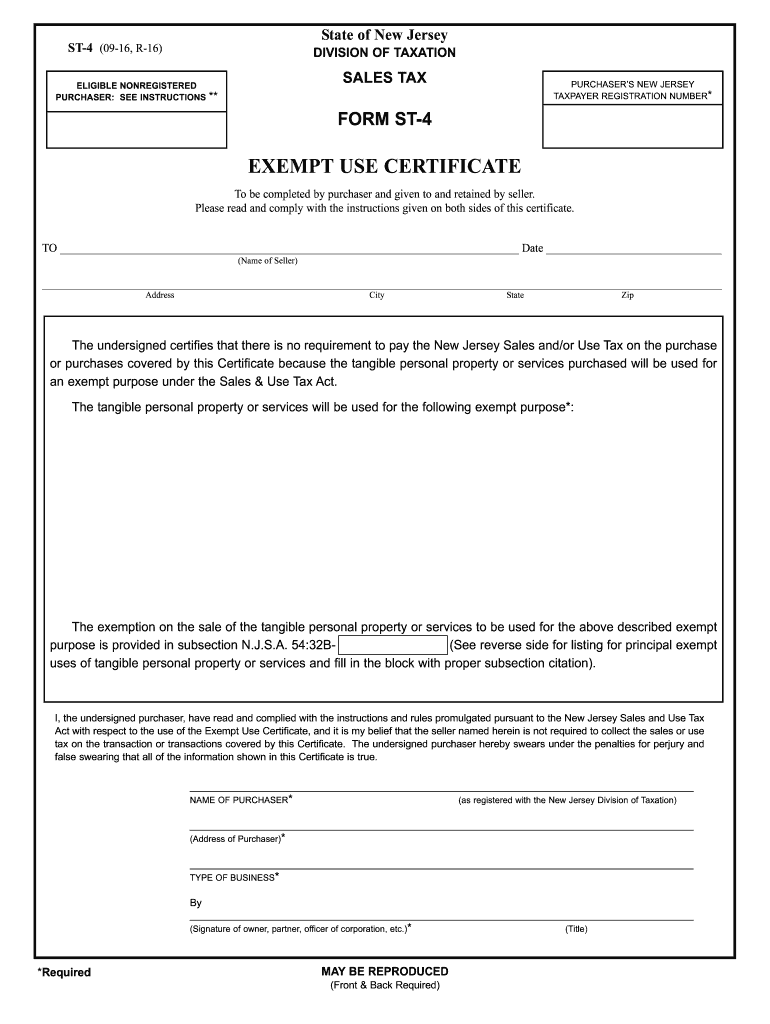

20162024 Form NJ ST4 Fill Online, Printable, Fillable, Blank pdfFiller

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. For state withholding, use the worksheets on this. De 4.

W4 Form 2025 Withholding Adjustment W4 Forms TaxUni

De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The de 4 is used to compute the amount of taxes to be.

Is There A New W4 Form For 2024 Anny Malina

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to.

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. Filling out the california withholding form de 4 is.

Tax Form 2024 Pdf Download Joya Rubina

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be.

Everything you need to know about the new W4 tax form Good Morning

The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. Filling out the california withholding form de 4 is.

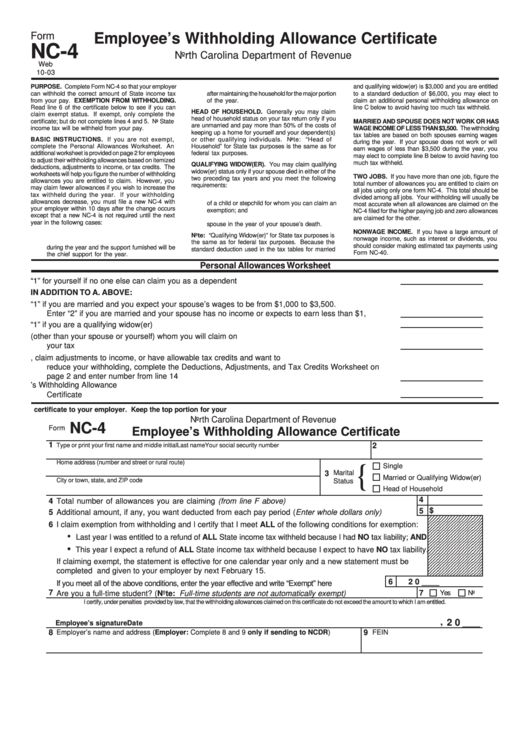

Form Nc 4 2003 Employee S Withholding Allowance Certificate Printable

The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. For state withholding, use the worksheets on this. De 4.

IRS Tax Forms eForms

De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding.

For State Withholding, Use The Worksheets On This.

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding.