Director Fee Malaysia - In malaysia, the payment of directors’ fees and. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank. In addition, director remuneration is also subject. Both director fee and director remuneration are subject to monthly tax deductions (pcb). Directors’ remuneration and directors’ service contracts: The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. 什么是董事费? •the annual fees paid by any employer, including retainer fees and meetings fees as compensation for serving.

Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. Both director fee and director remuneration are subject to monthly tax deductions (pcb). The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. Directors’ remuneration and directors’ service contracts: In malaysia, the payment of directors’ fees and. 什么是董事费? •the annual fees paid by any employer, including retainer fees and meetings fees as compensation for serving. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such. In addition, director remuneration is also subject. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank.

In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such. In addition, director remuneration is also subject. Directors’ remuneration and directors’ service contracts: The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. In malaysia, the payment of directors’ fees and. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank. 什么是董事费? •the annual fees paid by any employer, including retainer fees and meetings fees as compensation for serving. Both director fee and director remuneration are subject to monthly tax deductions (pcb).

Is Director Fees Taxable In Malaysia

Both director fee and director remuneration are subject to monthly tax deductions (pcb). In malaysia, the payment of directors’ fees and. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such..

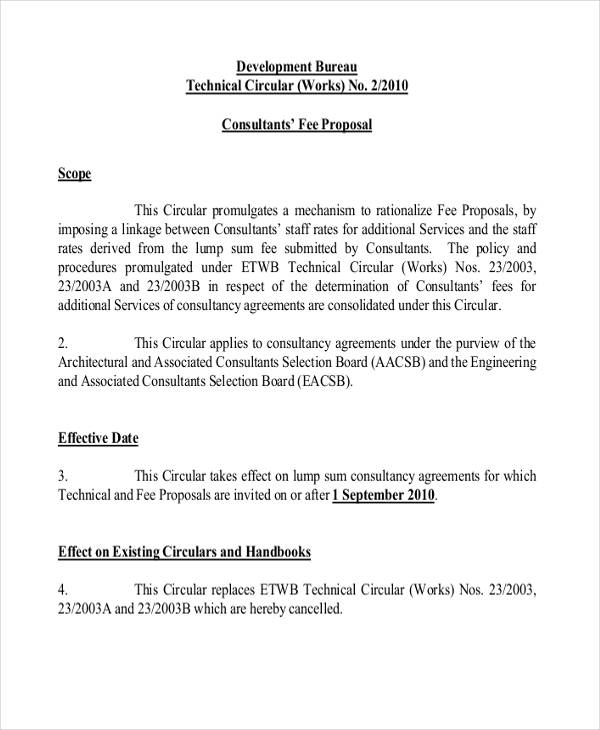

Fee Schedule Interior Design Fee Structure Template

什么是董事费? •the annual fees paid by any employer, including retainer fees and meetings fees as compensation for serving. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank. In malaysia, the payment of directors’ fees and. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts.

Directors' Fees vs Directors' Salary

Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. 什么是董事费? •the annual fees paid by any employer, including retainer fees and meetings fees as compensation for serving. Both director fee and director remuneration are subject to monthly tax deductions (pcb). In addition, director remuneration is also subject..

Difference Between Director Fee And Director Remuneration Malaysia

Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. Directors’ remuneration and directors’ service contracts: If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such. Both director fee and director remuneration are subject to monthly.

difference between director fee and director remuneration malaysia

Directors’ remuneration and directors’ service contracts: In malaysia, the payment of directors’ fees and. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such. Both director.

Malaysia Local Council (Majlis Perbandaran) License Application

In malaysia, the payment of directors’ fees and. In addition, director remuneration is also subject. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. In.

Director Fees Taxation Malaysia Quoting directly from the inland

Both director fee and director remuneration are subject to monthly tax deductions (pcb). Directors’ remuneration and directors’ service contracts: Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank. In malaysia, the payment of directors’ fees and. If a company, whether public or private, intends to pay fees and.

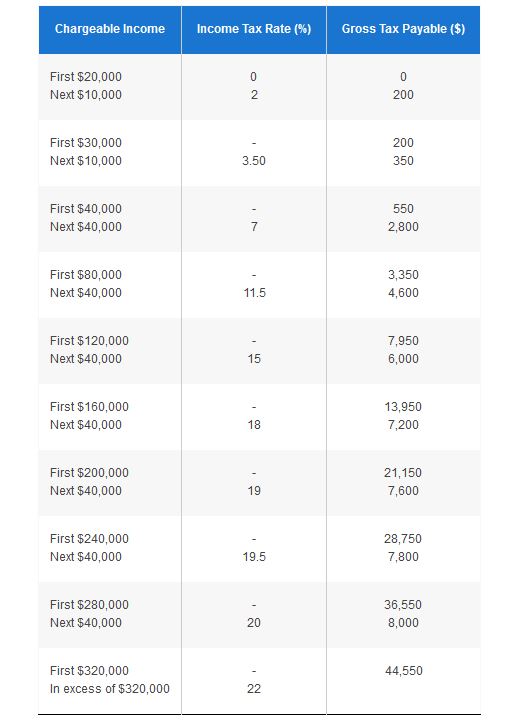

Is the Director Fee In Singapore Taxable? Learn More

Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank. Both director fee and director remuneration are subject to monthly tax deductions (pcb). In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal. Directors’ remuneration and directors’ service contracts: Directors’ fees.

Director Fees Taxation Malaysia / Malaysia Taxation Junior Diary

什么是董事费? •the annual fees paid by any employer, including retainer fees and meetings fees as compensation for serving. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank. In malaysia, the payment of directors’ fees and. If a company, whether public or private, intends to pay fees and benefits.

KTP & Company PLT Audit, Tax, Accountancy in Johor Bahru.

Both director fee and director remuneration are subject to monthly tax deductions (pcb). 什么是董事费? •the annual fees paid by any employer, including retainer fees and meetings fees as compensation for serving. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank. If a company, whether public or private, intends.

Directors’ Remuneration And Directors’ Service Contracts:

什么是董事费? •the annual fees paid by any employer, including retainer fees and meetings fees as compensation for serving. In malaysia, the payment of directors’ fees and. Both director fee and director remuneration are subject to monthly tax deductions (pcb). Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank.

In Malaysia, The Payment Of Directors’ Fees And Benefits And Directors’ Service Contracts Are Subject To Certain Legal.

Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such. In addition, director remuneration is also subject.