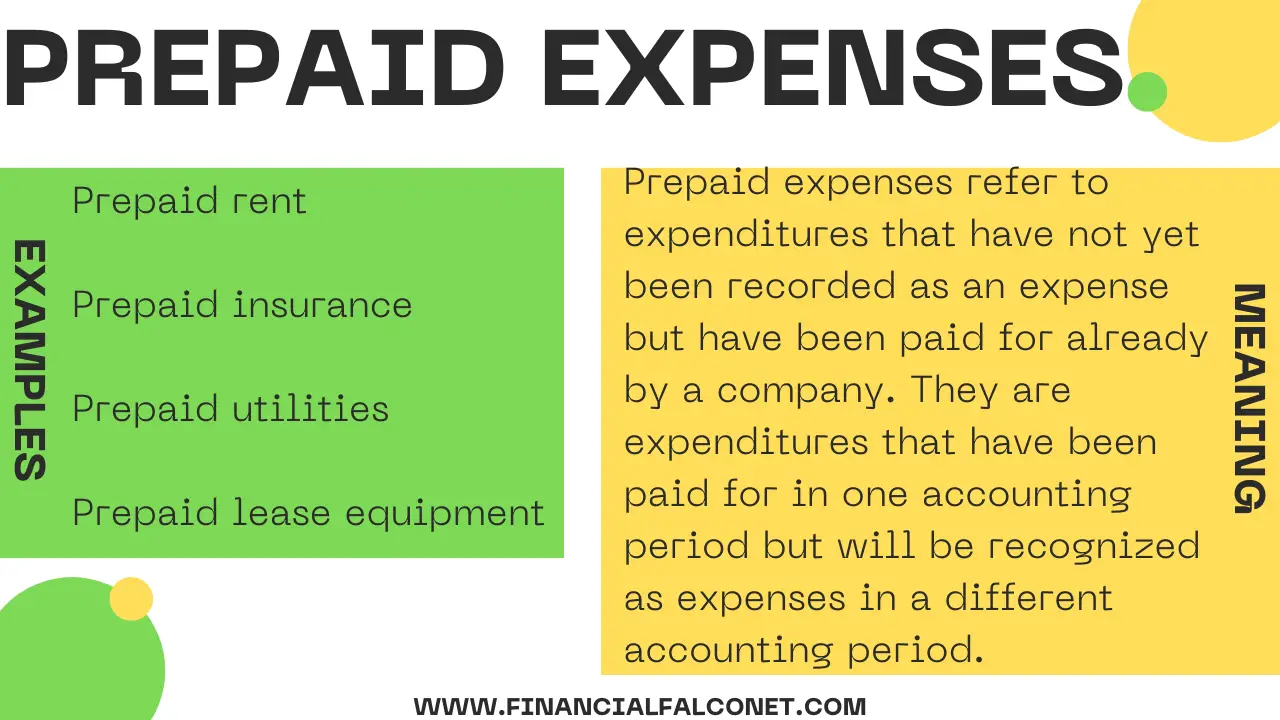

Does Prepaid Rent Go On The Balance Sheet - In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. These are both asset accounts and do not increase or.

When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. These are both asset accounts and do not increase or. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company.

These are both asset accounts and do not increase or. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being.

Where is prepaid expenses on balance sheet? Leia aqui Where do prepaid

When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. These are both asset accounts and do not increase or. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. There can be several different examples of.

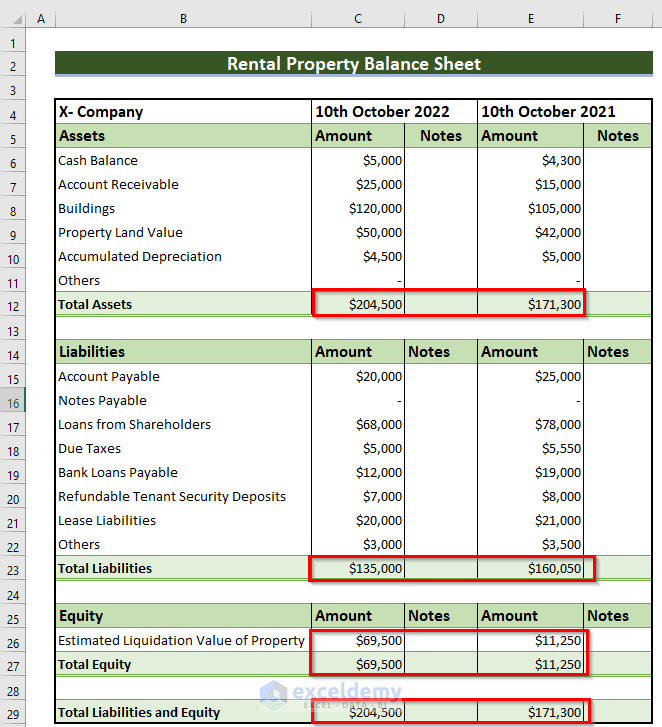

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually.

Prepaid Expenses on Balance Sheet Quant RL

There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. In short, store a prepaid rent.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. These are both asset accounts and.

Prepaid expenses balance sheet bezywave

These are both asset accounts and do not increase or. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic.

Prepaid Expenses In Statement And Balance Sheet Template South

When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is.

Help, cant balance sheet, see prepaid insurance and accumulated

There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent, often.

Where are prepaid expenses on balance sheet? Leia aqui Are prepaid

These are both asset accounts and do not increase or. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. In short, store a prepaid rent payment on the balance sheet as an asset.

Where Is Prepaid Rent On The Balance Sheet LiveWell

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually.

Prepaid Expenses Balance Sheet Ppt Powerpoint Presentation Infographics

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being. In short, store a prepaid rent payment on the balance sheet as an asset until the month.

When A Company Prepays For An Expense, It Is Recognized As A Prepaid Asset On The Balance Sheet, With A Simultaneous Entry Being.

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. These are both asset accounts and do not increase or. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-recirc-blue-1d8d154bf0c94ba6858fe12907d2b694.jpg)