Does The Irs Send Certified Letters - If you receive a certified letter from the irs, it’s safe to assume that it’s important. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification. However, don’t panic just yet, as the irs is.

If you receive a certified letter from the irs, it’s safe to assume that it’s important. However, don’t panic just yet, as the irs is. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification.

If you receive a certified letter from the irs, it’s safe to assume that it’s important. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification. However, don’t panic just yet, as the irs is.

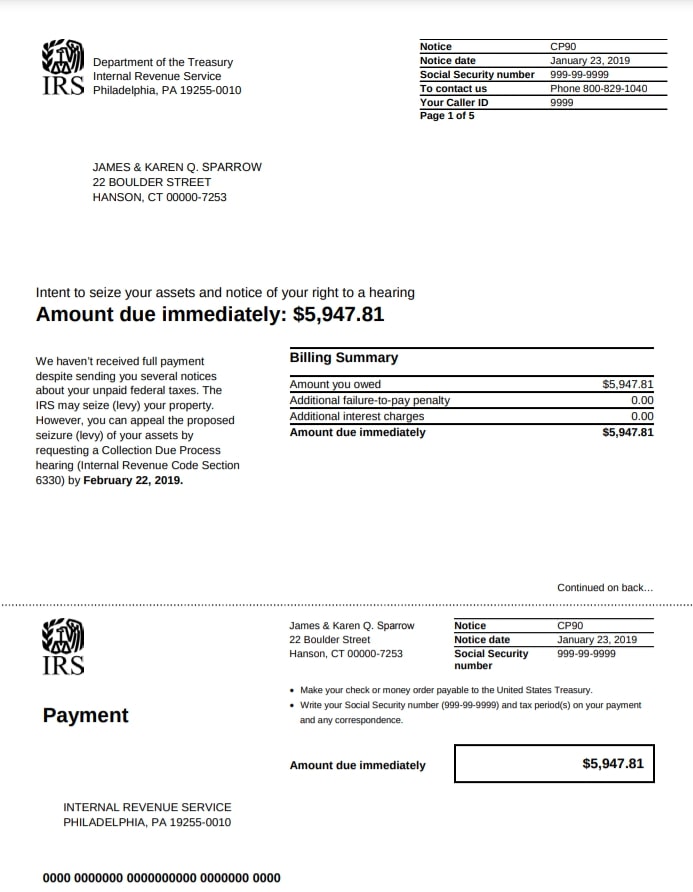

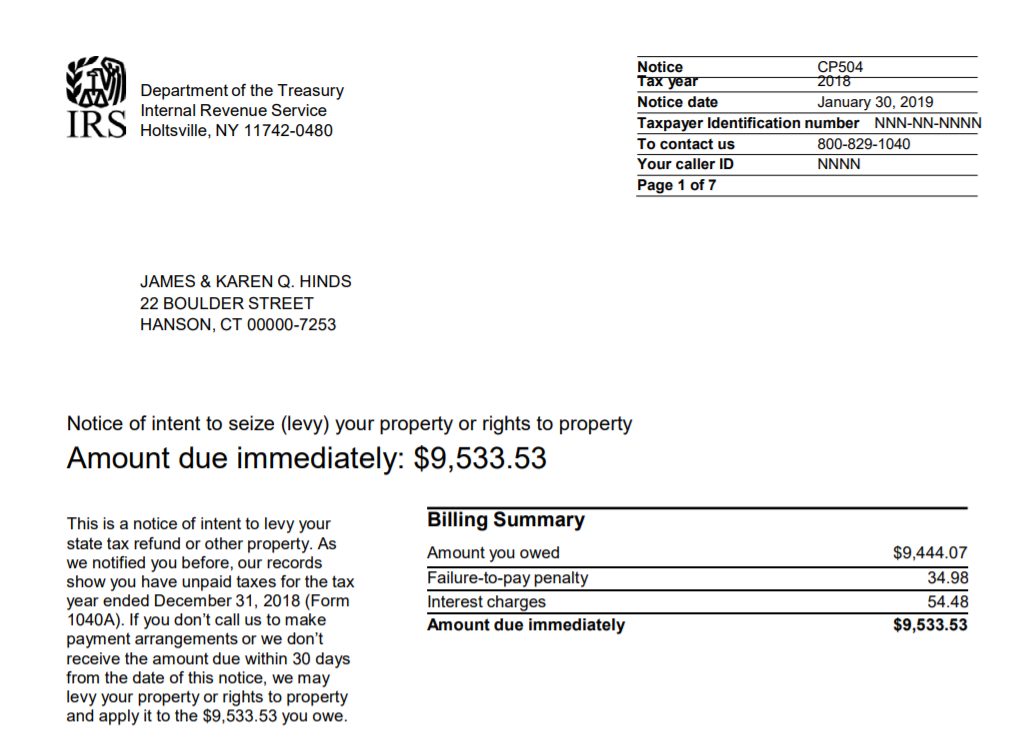

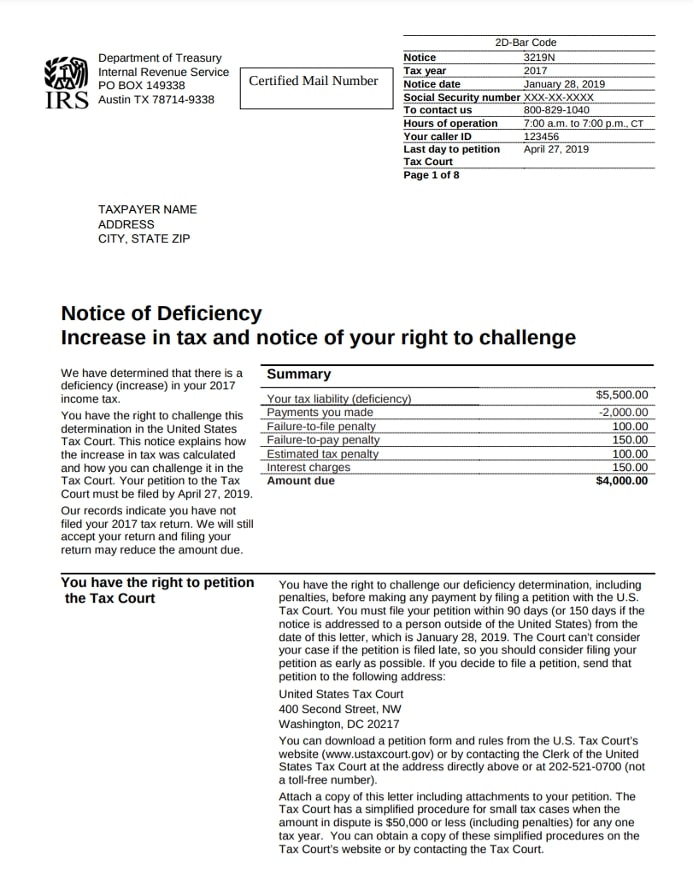

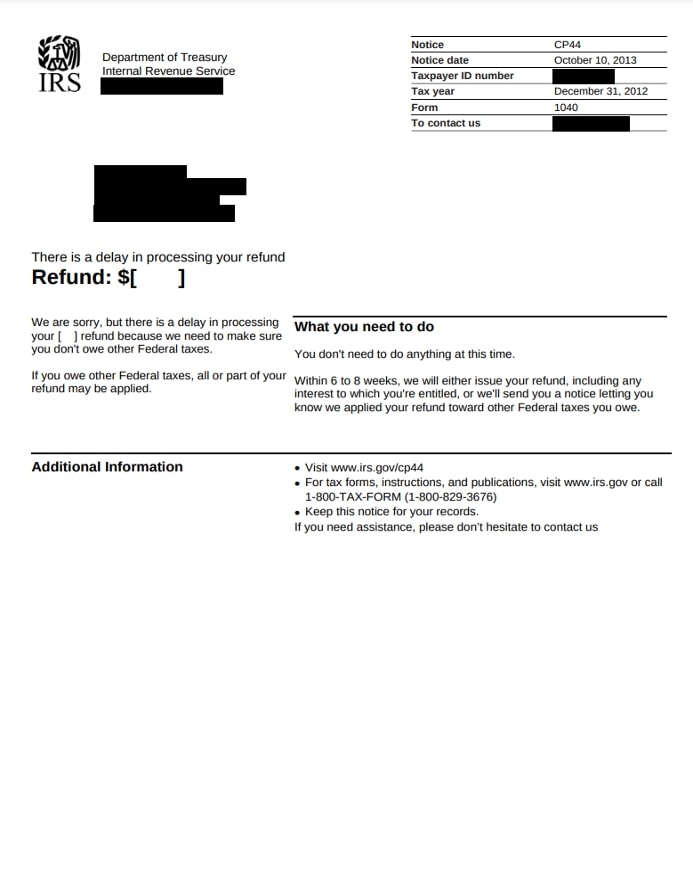

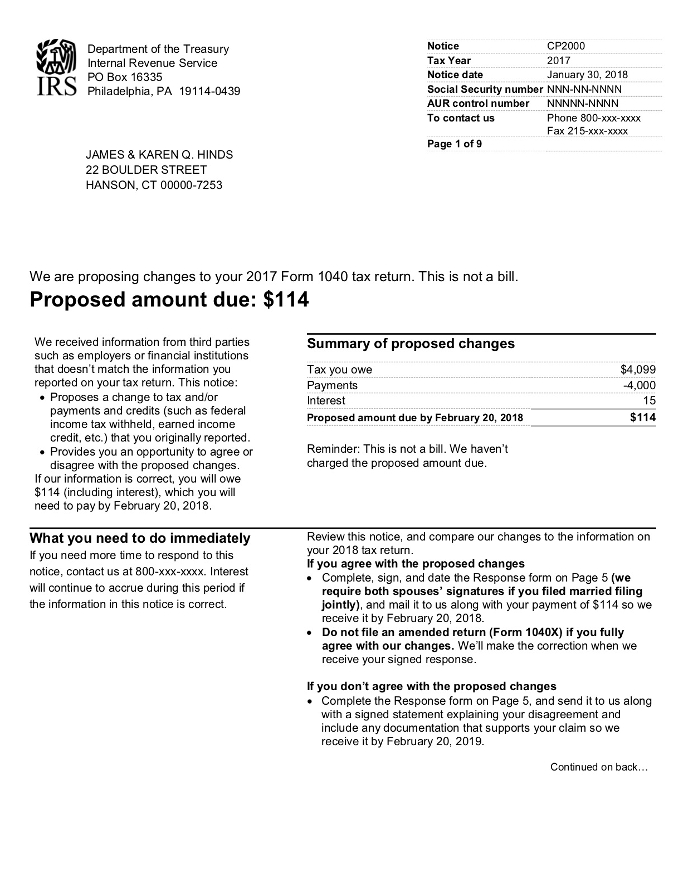

Why Would the IRS Send a Certified Letter? To Begin...

If you receive a certified letter from the irs, it’s safe to assume that it’s important. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification. However, don’t panic just yet, as the irs is.

Why Would Irs Send Certified Letter

If you receive a certified letter from the irs, it’s safe to assume that it’s important. However, don’t panic just yet, as the irs is. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification.

IRS Demand Letters What are They and What You Need to Know

If you receive a certified letter from the irs, it’s safe to assume that it’s important. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification. However, don’t panic just yet, as the irs is.

IRS Certified Mail Understanding Your Letter And Responding

The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification. However, don’t panic just yet, as the irs is. If you receive a certified letter from the irs, it’s safe to assume that it’s important.

How to address Certified Mail for the Department of the Treasury IRS

The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification. However, don’t panic just yet, as the irs is. If you receive a certified letter from the irs, it’s safe to assume that it’s important.

IRS Certified Mail Understanding Your Letter And Responding

If you receive a certified letter from the irs, it’s safe to assume that it’s important. However, don’t panic just yet, as the irs is. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification.

IRS Certified Mail Understanding Your Letter And Responding

However, don’t panic just yet, as the irs is. If you receive a certified letter from the irs, it’s safe to assume that it’s important. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification.

IRS Certified Mail Understanding Your Letter And Responding

However, don’t panic just yet, as the irs is. If you receive a certified letter from the irs, it’s safe to assume that it’s important. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification.

IRS Tax Letters Explained Landmark Tax Group

If you receive a certified letter from the irs, it’s safe to assume that it’s important. However, don’t panic just yet, as the irs is. The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification.

If You Receive A Certified Letter From The Irs, It’s Safe To Assume That It’s Important.

The irs mails letters or notices to taxpayers for various reasons, such as balance due, refund, or identity verification. However, don’t panic just yet, as the irs is.