Florida Sales And Use Tax Form - You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes.

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes.

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes.

Florida Sales And Use Tax Form Dr 15ez Tax Walls

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

Florida Appliance Sales Tax Exemption 2024 Linea Petunia

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

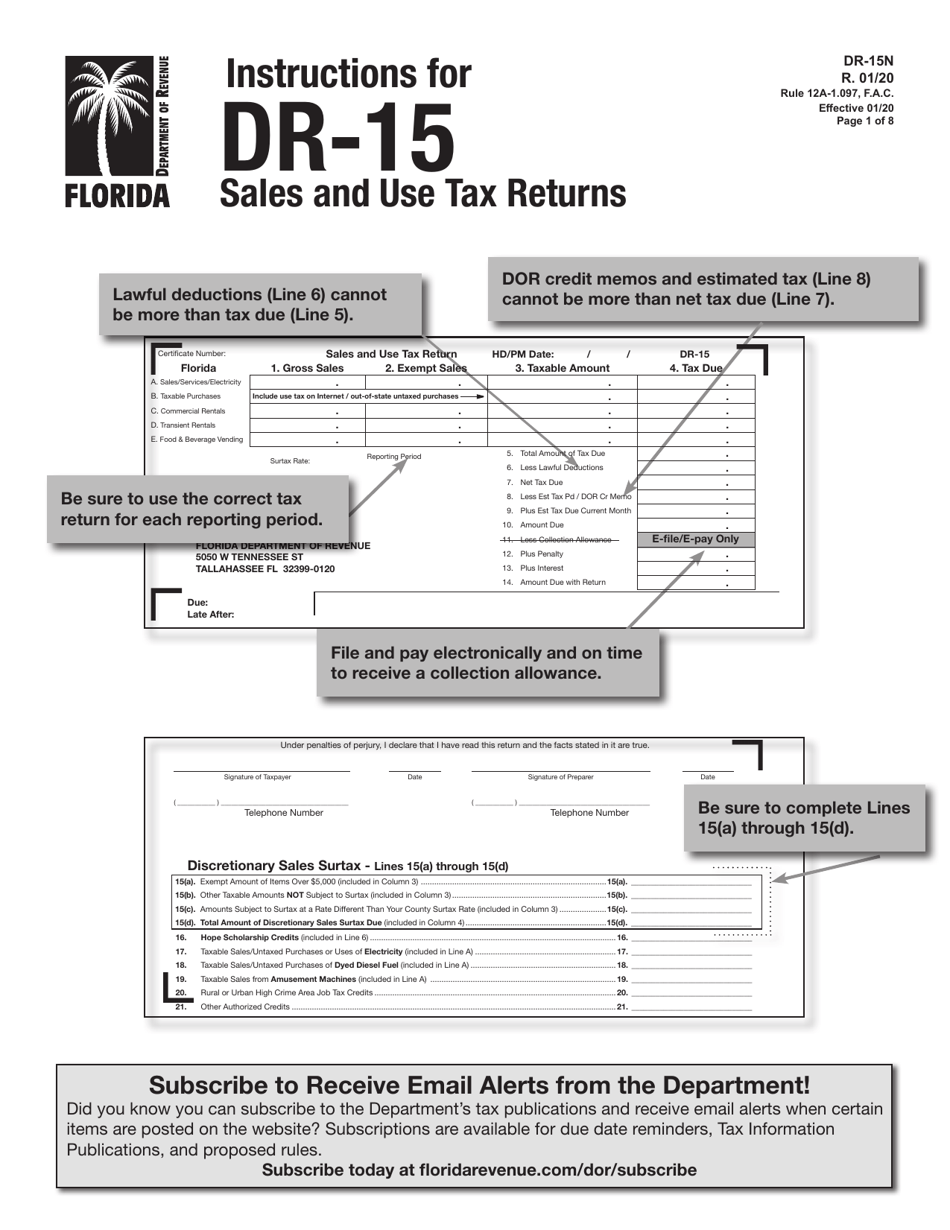

Download Instructions for Form DR15 Sales and Use Tax Return PDF

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

Florida Sales Tax Exemption Application Form

You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

Gonzales Sales And Use Tax Report Form

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

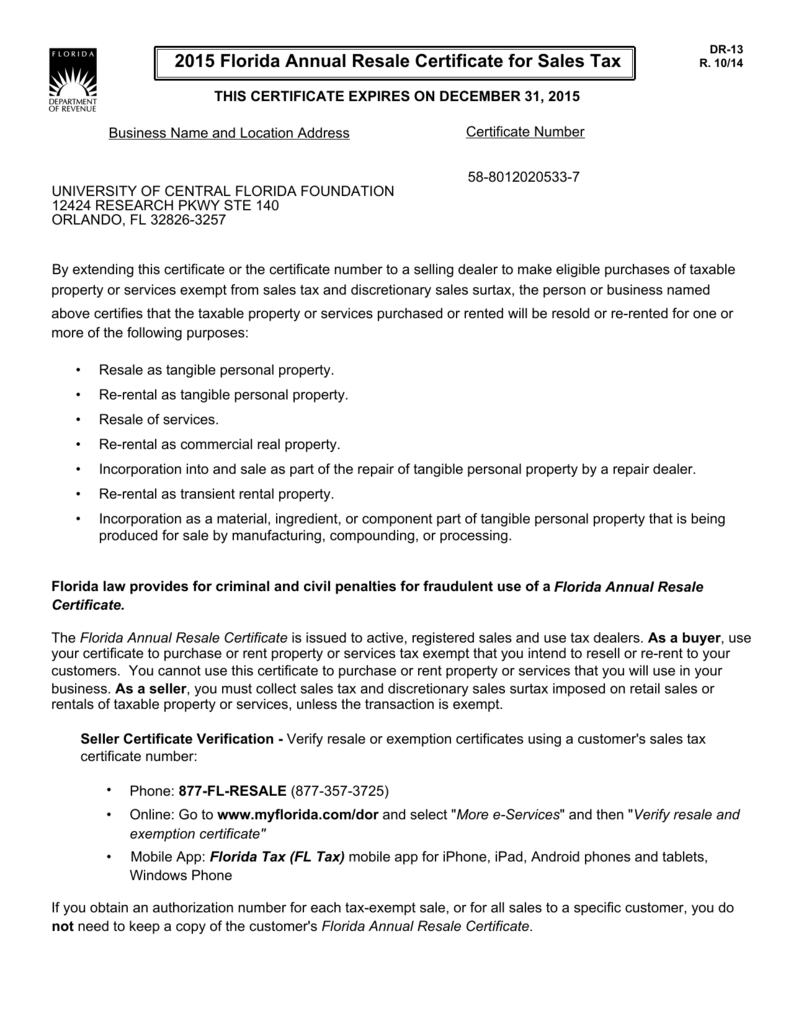

2015 Florida Annual Resale Certificate for Sales Tax

You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

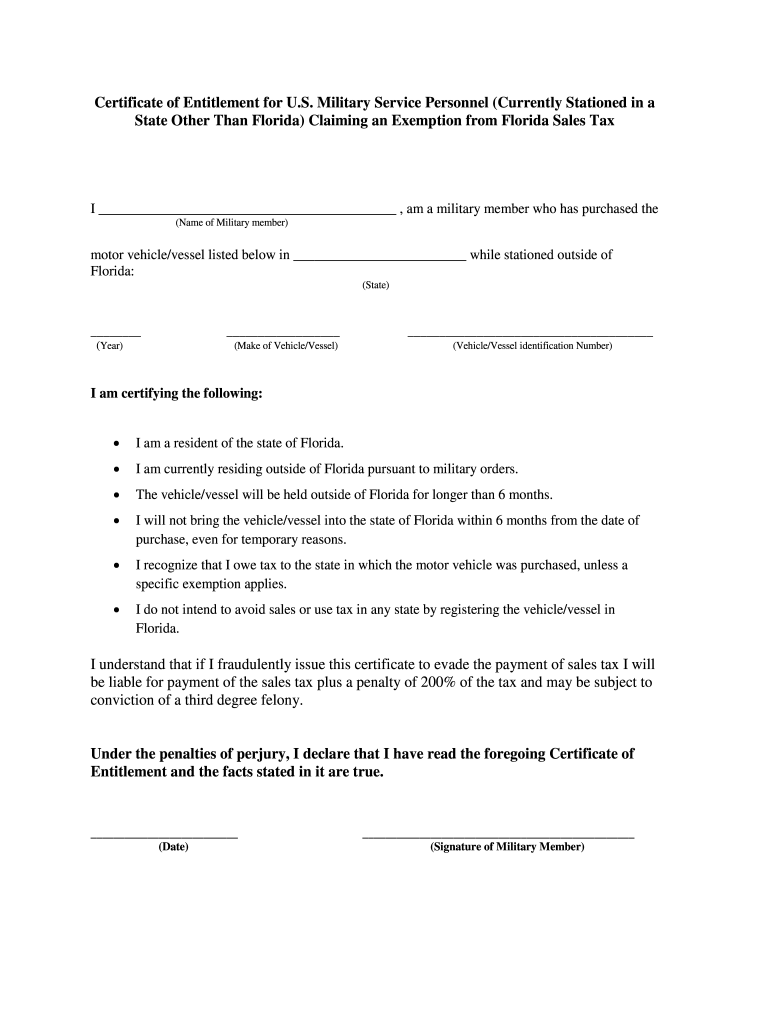

Florida Military Exemption Tax Fill Online, Printable, Fillable

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

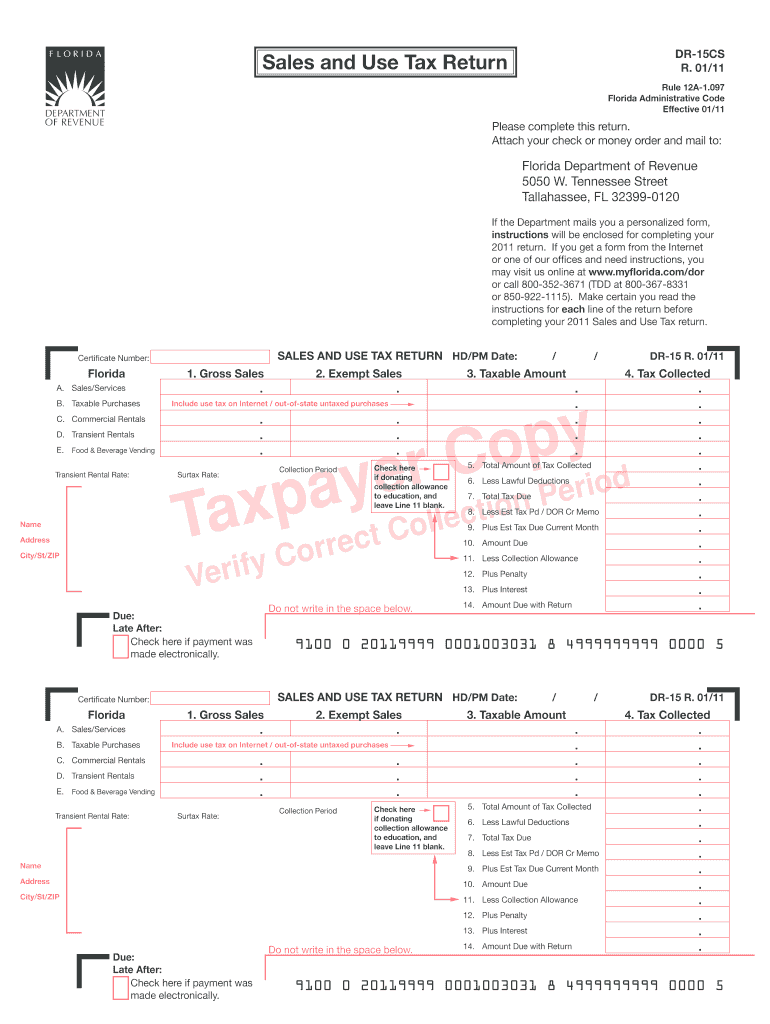

20112024 Form FL DoR DR15CS Fill Online, Printable, Fillable, Blank

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

FL Sales & Use Tax & the Annual Reports / Ft Myers, Naples / MNMW

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

State Sales Tax State Sales Tax Exemption Florida

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

You Must Collect Discretionary Sales Surtax Along With The 6% State Sales Tax On Taxable Sales When Delivery Or Use Occurs In A County That Imposes.

You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes.