Form 941 Late Filing Penalty No Tax Due - Failed to file the form even after. Filed form 941 late by 16 days or more: If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. 10% of the amount due will be calculated as a penalty. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment.

Failed to file the form even after. If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. 10% of the amount due will be calculated as a penalty. Filed form 941 late by 16 days or more:

Filed form 941 late by 16 days or more: Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. Failed to file the form even after. If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. 10% of the amount due will be calculated as a penalty.

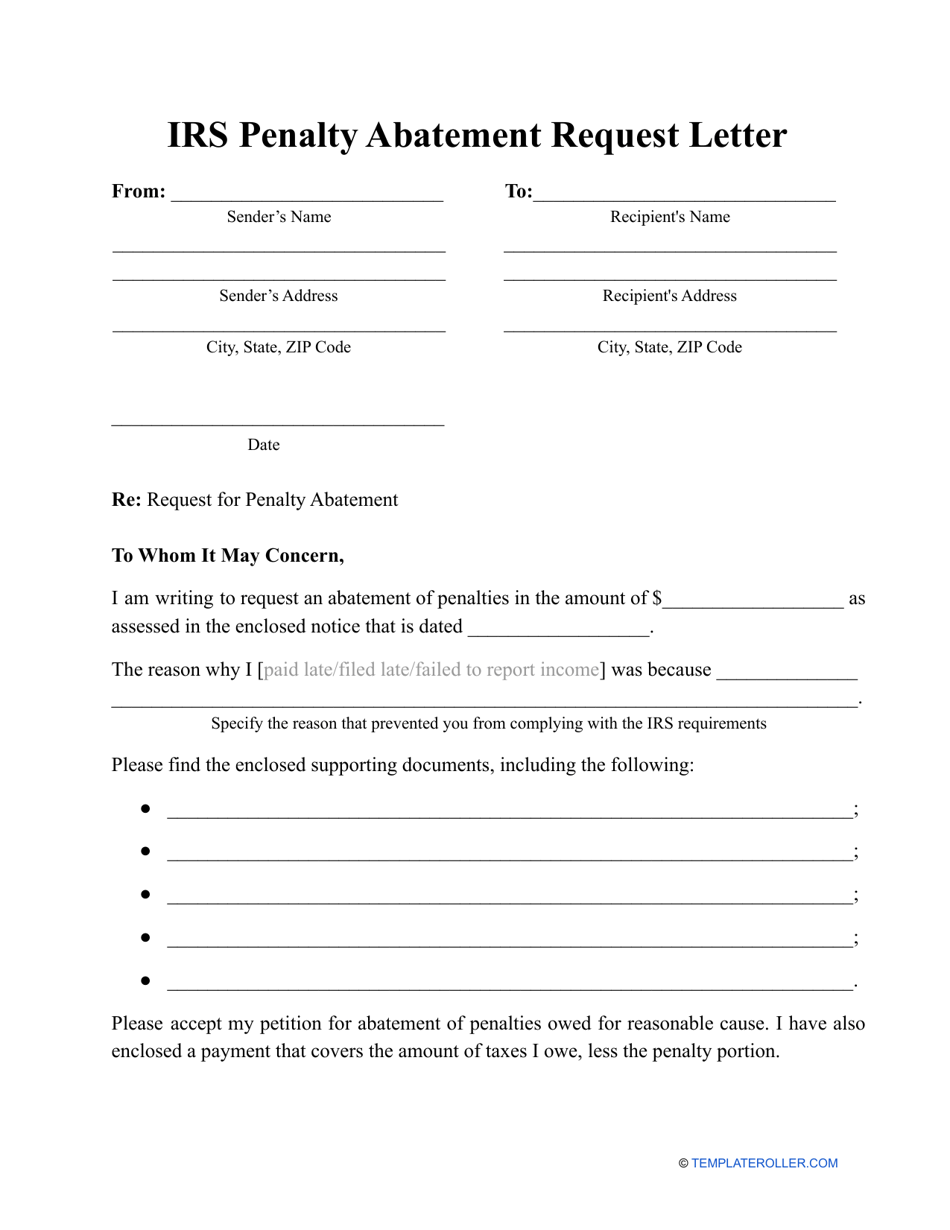

Irs Late Filing Penalty Abatement Letter Sle

Failed to file the form even after. Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. Filed form 941 late by 16 days or more: 10% of the amount due will be calculated as a penalty. If you do not pay the owed tax bill,.

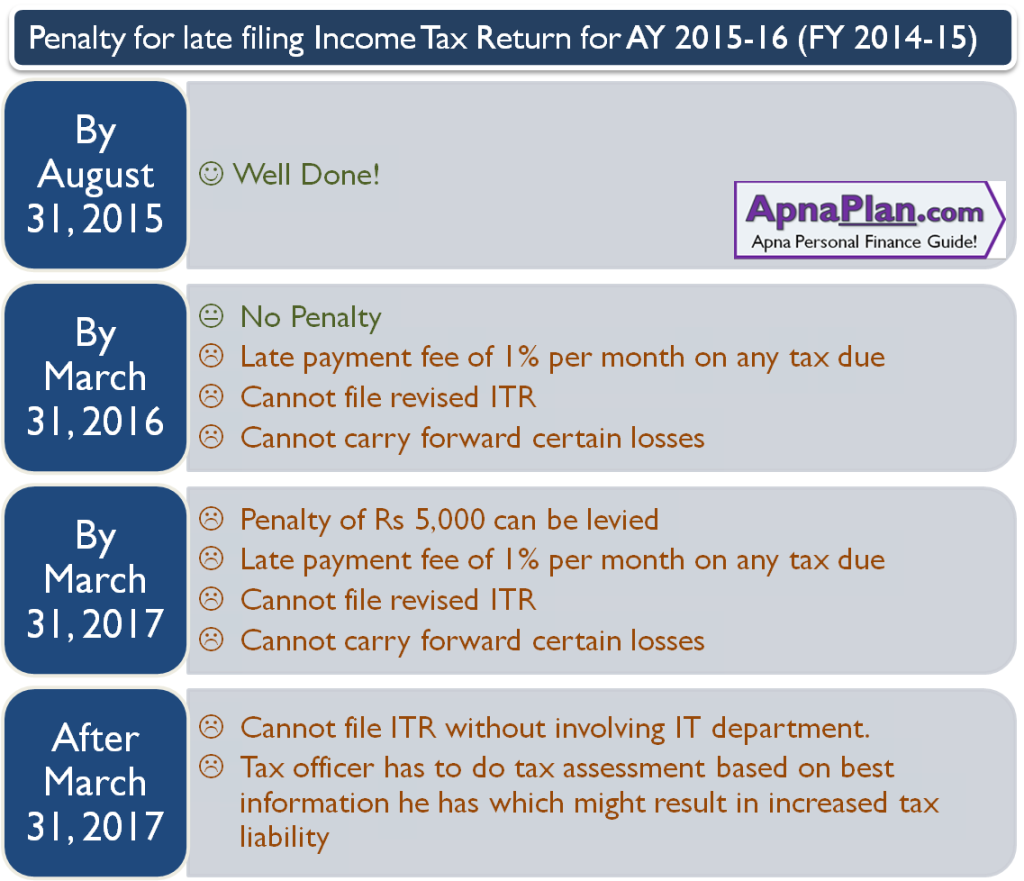

Penalty for Late Filing of Tax Return

If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. Filed form 941 late by 16 days or more: Failed to file the form even after. 10% of the amount due will be calculated as a penalty. Learn how to file.

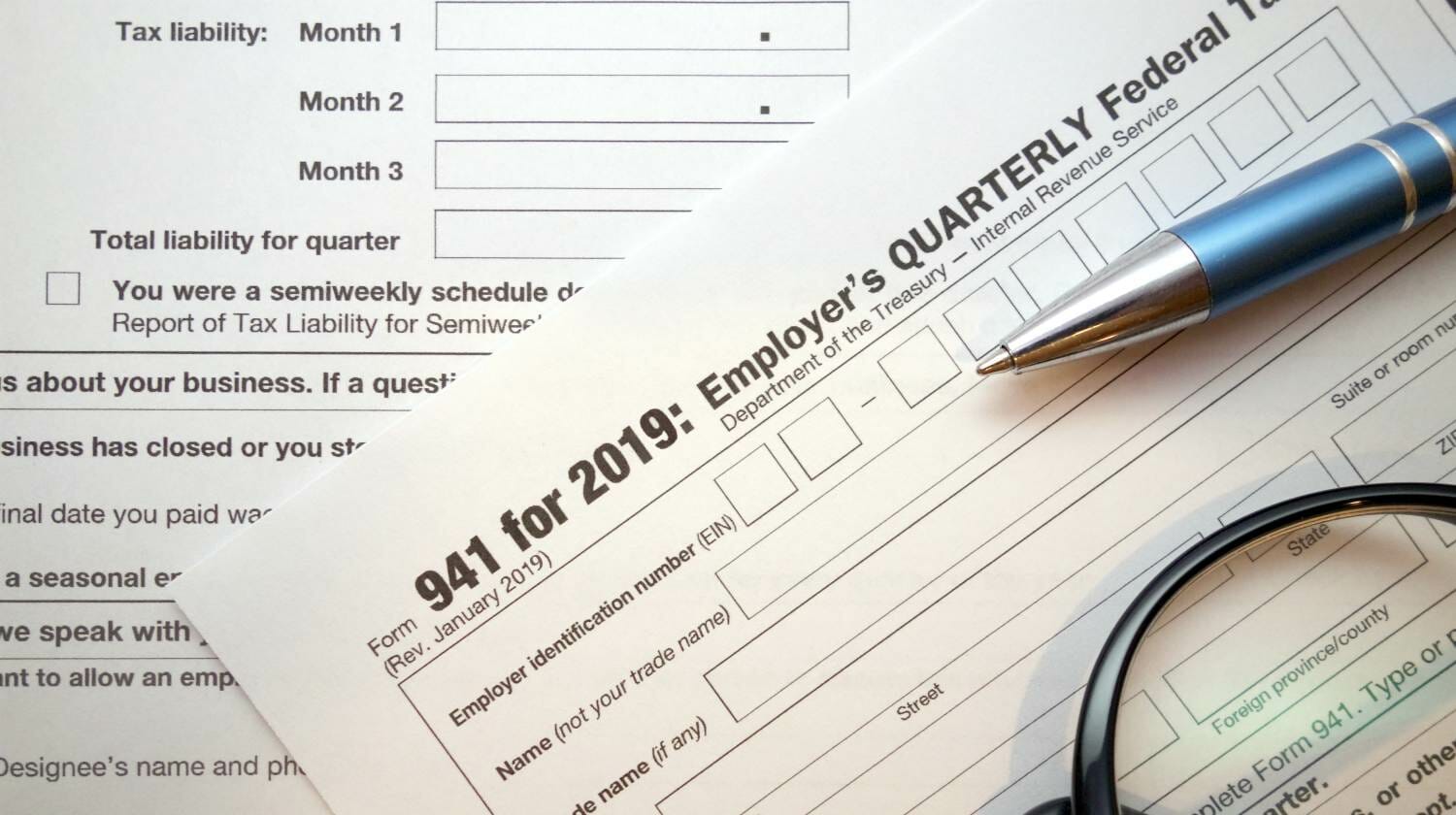

Form 941 Due Date 2024 Pam Lavina

10% of the amount due will be calculated as a penalty. If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. Failed to file the form even after. Learn how to file form 941 or 944 to report wages and taxes,.

Penalty Under Section 234F of the Tax Act

10% of the amount due will be calculated as a penalty. Filed form 941 late by 16 days or more: If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. Failed to file the form even after. Learn how to file.

Failure To Deposit IRS 941 Late Payment Penalties Tax Relief Center

Failed to file the form even after. If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. Filed form 941 late by 16 days or more: Learn how to file form 941 or 944 to report wages and taxes, and when.

SuperCA

10% of the amount due will be calculated as a penalty. Failed to file the form even after. Filed form 941 late by 16 days or more: Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. If you do not pay the owed tax bill,.

Failure To Deposit IRS 941 Late Payment Penalties Tax Relief Center

Learn how to file form 941 or 944 to report wages and taxes, and when to pay the penalties for late filing or underpayment. 10% of the amount due will be calculated as a penalty. Filed form 941 late by 16 days or more: Failed to file the form even after. If you do not pay the owed tax bill,.

Penalty for Late Filing of Tax Return(ITR) 5paisa

Filed form 941 late by 16 days or more: 10% of the amount due will be calculated as a penalty. If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. Failed to file the form even after. Learn how to file.

Failure To Deposit IRS 941 Late Payment Penalties Tax Relief Center

10% of the amount due will be calculated as a penalty. If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. Failed to file the form even after. Learn how to file form 941 or 944 to report wages and taxes,.

Failure To Deposit IRS 941 Late Payment Penalties Tax Relief Center

If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. 10% of the amount due will be calculated as a penalty. Failed to file the form even after. Learn how to file form 941 or 944 to report wages and taxes,.

Learn How To File Form 941 Or 944 To Report Wages And Taxes, And When To Pay The Penalties For Late Filing Or Underpayment.

10% of the amount due will be calculated as a penalty. Filed form 941 late by 16 days or more: If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. Failed to file the form even after.