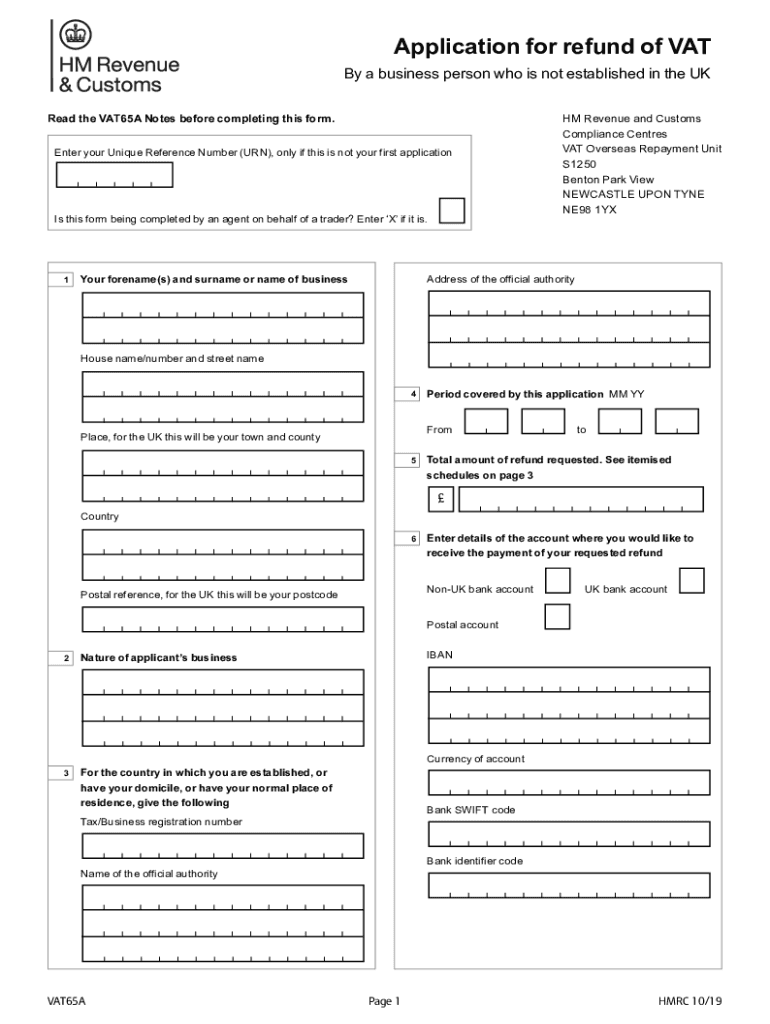

Form For Vat Refund - Tax incurred on the following supplies will not be refunded by the uk tax authority: (a) supplies of goods which have been or are about to be. Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Forms for claiming a vat refund if your business is registered in a country outside the uk

When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Forms for claiming a vat refund if your business is registered in a country outside the uk Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Tax incurred on the following supplies will not be refunded by the uk tax authority: (a) supplies of goods which have been or are about to be.

When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. (a) supplies of goods which have been or are about to be. Forms for claiming a vat refund if your business is registered in a country outside the uk Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Tax incurred on the following supplies will not be refunded by the uk tax authority: Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the.

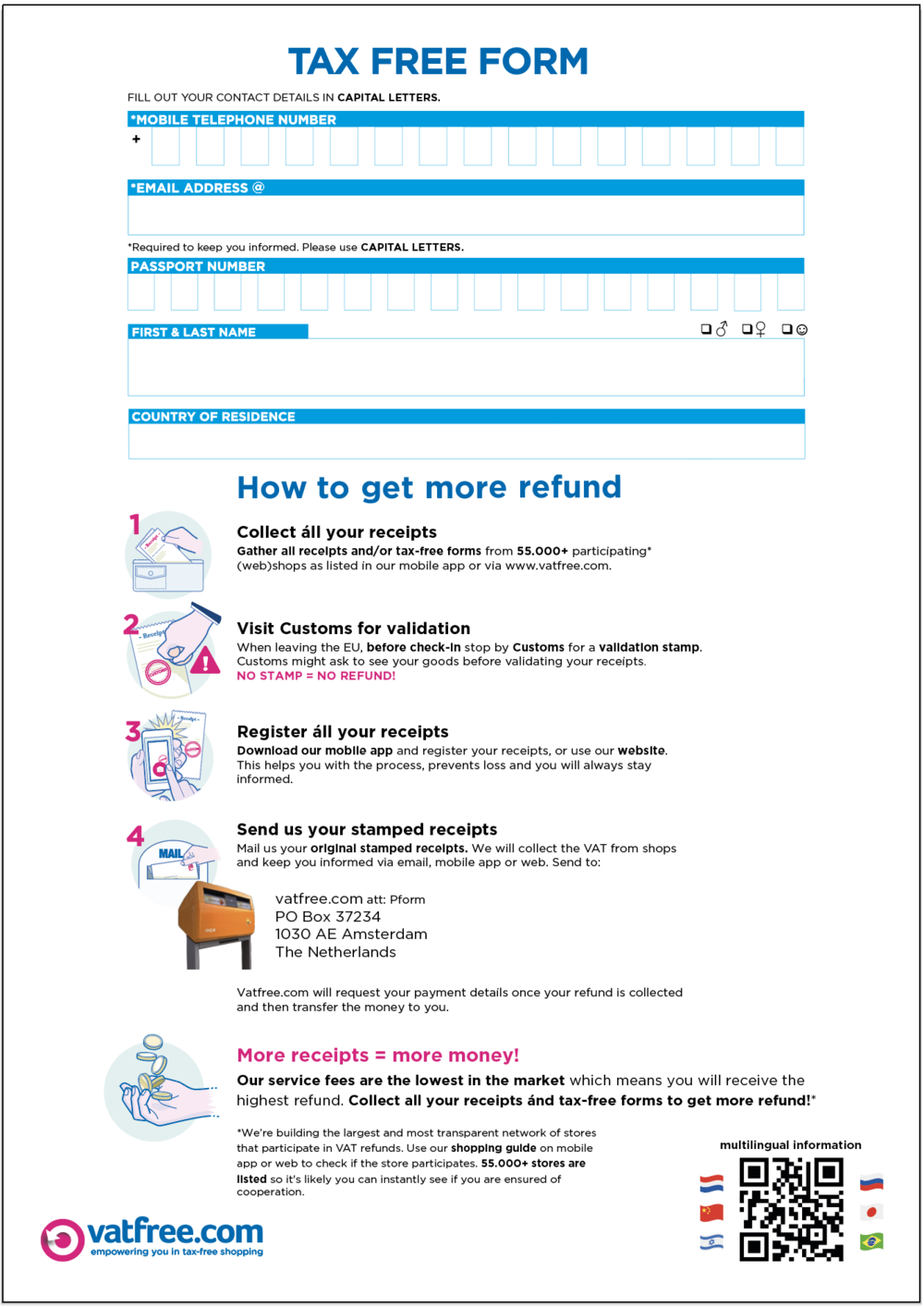

VAT refund. Tax return free. Vector stock illustration 36107576 Vector

Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. (a) supplies of goods which have been or are about to be. Tax incurred on the following supplies will not be refunded by the uk tax authority: Forms for claiming a vat refund if your business is.

Uk Vat Refund 2024 Tourist Leta Brittani

When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Tax incurred on the following supplies will not be refunded by the uk tax authority: Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible..

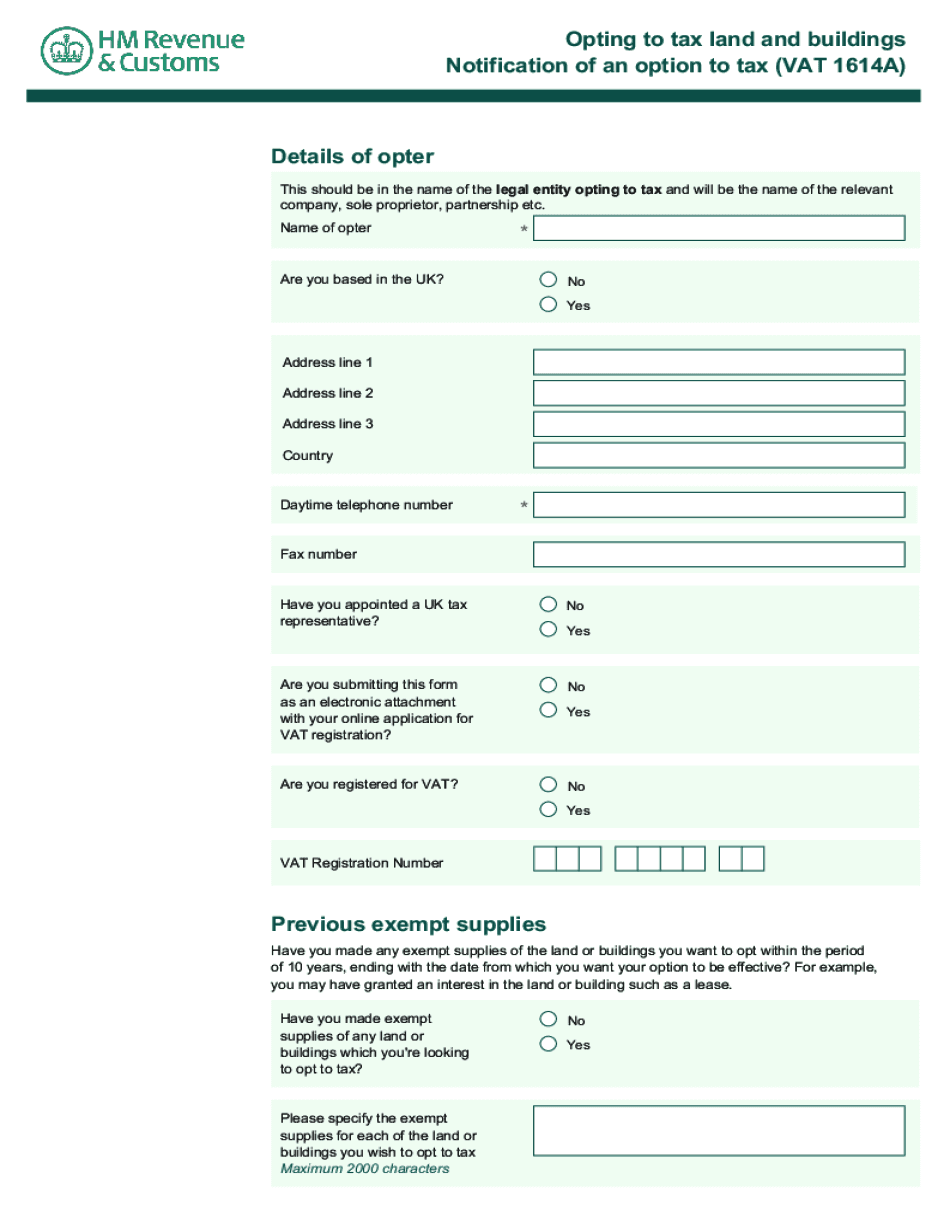

Notification Option Tax Complete with ease airSlate SignNow

Tax incurred on the following supplies will not be refunded by the uk tax authority: Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of.

Free Refund Demand Letter Template Sample PDF Word eForms

When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Forms for claiming a vat refund if your business is registered in a country outside.

Hmrc Refund 20192024 Form Fill Out and Sign Printable PDF Template

Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Forms for claiming a vat refund if your business is registered in a.

Download a VAT refund form

Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Forms for claiming a vat refund if your business is registered in a country outside the uk Tax incurred on the following supplies will not be refunded by the uk tax authority: When submitting a refund.

VAT Refund (Tax Free) или возврат 7 налога в Таиланде Азиатские

Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. (a) supplies of goods which have been or are about to be. Forms for claiming a vat refund if your business is registered in a country outside the uk Value added tax (vat) paid.

How to Claim a VAT Refund? Everything you Need to Know

Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Tax incurred on the following supplies will not be refunded by the uk tax authority: (a) supplies of goods which have been or are about to be. Value added tax (vat) paid on certain aids and appliances.

What is a VAT return? FreeAgent

When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Any person who satisfies the conditions set below may make an application for a.

Refund Application Form Excel Template And Google Sheets File For Free

When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Forms for claiming a vat refund if your business is registered in a country outside the uk Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this.

Value Added Tax (Vat) Paid On Certain Aids And Appliances For Use By Persons With Disabilities May Be Reclaimed Using This Form Or Online.

Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. Tax incurred on the following supplies will not be refunded by the uk tax authority: Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on.

(A) Supplies Of Goods Which Have Been Or Are About To Be.

Forms for claiming a vat refund if your business is registered in a country outside the uk