Lower Tax Rate That Prevents The Company From Being Double-Taxed - A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Legal structure to avoid double taxation. Both have their own benefits and tax perks. Following are some of the most common strategies to save on taxes: Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. To avoid double taxation, consider becoming an llc or an s corporation.

Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Both have their own benefits and tax perks. Legal structure to avoid double taxation. To avoid double taxation, consider becoming an llc or an s corporation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Following are some of the most common strategies to save on taxes:

A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Legal structure to avoid double taxation. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Both have their own benefits and tax perks. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. To avoid double taxation, consider becoming an llc or an s corporation. Following are some of the most common strategies to save on taxes:

CONVERSABLE ECONOMIST Lower Tax Rates or Less Tax Enforcement?

Following are some of the most common strategies to save on taxes: Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. To avoid double taxation, consider becoming an llc or an s corporation. Both have their own benefits and tax perks. Legal structure to avoid double taxation.

How to Lower Your Effective Tax Rate The Motley Fool

Legal structure to avoid double taxation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Both have their own benefits and tax perks. To avoid double taxation, consider becoming an llc or an s corporation. Following are some of the most common strategies to save on taxes:

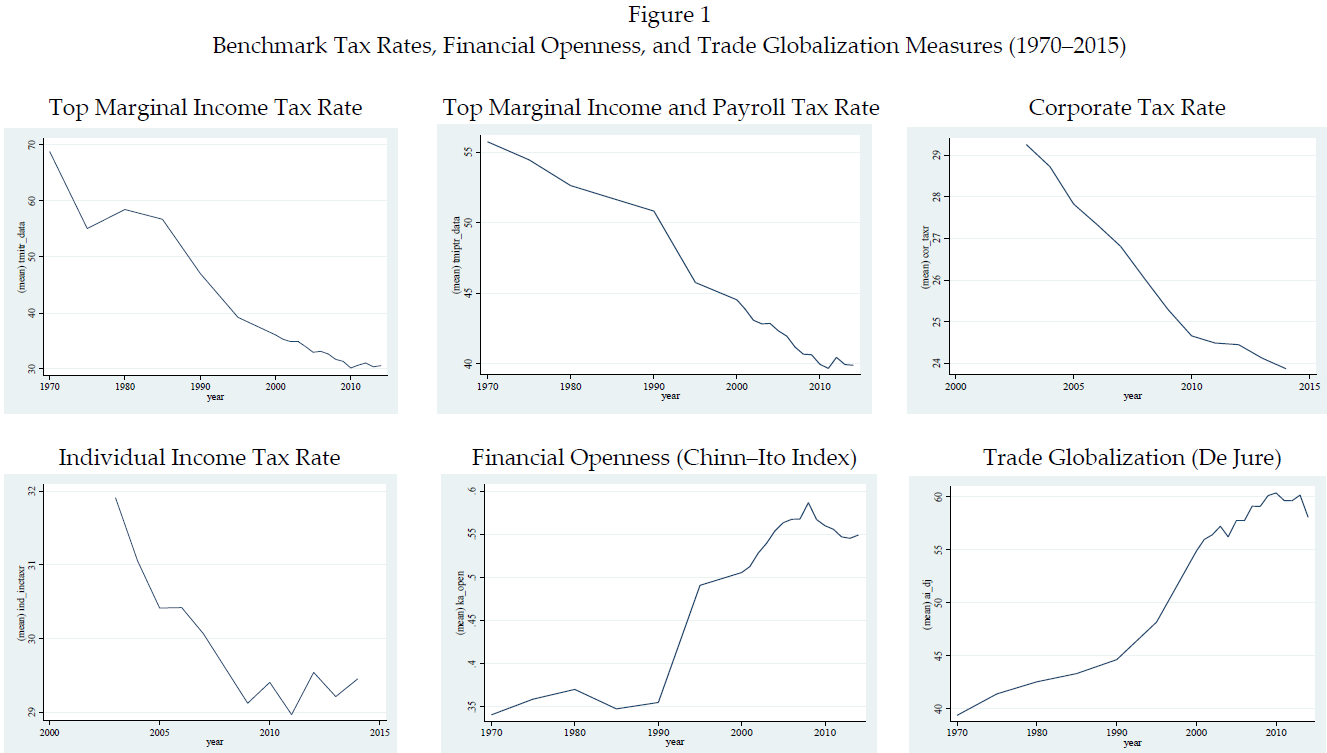

The Unassuming Economist Does Globalization Lower Tax Rates?

Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Following are some of the most common strategies to save on taxes: Legal structure to avoid double taxation. To avoid double taxation, consider becoming an llc or an s corporation.

Five Tips to Lower Taxes For Small Businesses Elite Tax

Both have their own benefits and tax perks. To avoid double taxation, consider becoming an llc or an s corporation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Legal structure to avoid double taxation. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation.

The Buffett Series A lower Tax Rate? — Investment Masters Class

Legal structure to avoid double taxation. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Following are some of the most common strategies to save on taxes: Both have their own benefits and tax perks. To avoid double taxation, consider becoming an llc or an.

Lower Tax Rates. More Jobs. GOT IT? Job Creators Network

Following are some of the most common strategies to save on taxes: A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Both have their own benefits and tax perks. Legal structure to avoid double taxation. Profits are taxed when earned, and then the shareholders' dividends.

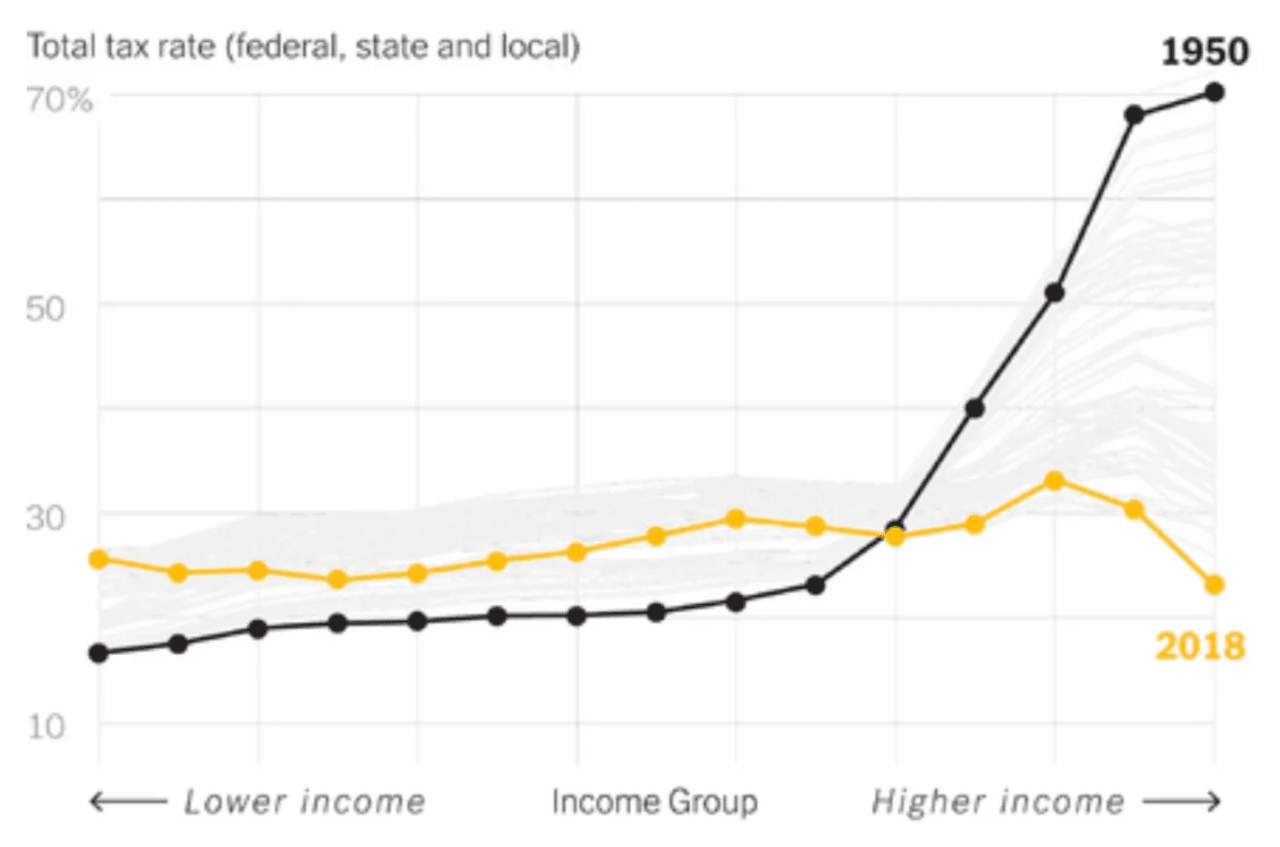

Economists America's Elite Pay Lower Tax Rate Than All Other Americans

Both have their own benefits and tax perks. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Legal structure to avoid double taxation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Following are some of the most common.

CONVERSABLE ECONOMIST Lower Tax Rates or Less Tax Enforcement?

Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Following are some of the most common strategies to save on taxes: To avoid double taxation, consider becoming an llc or an s corporation. Legal structure to avoid double taxation.

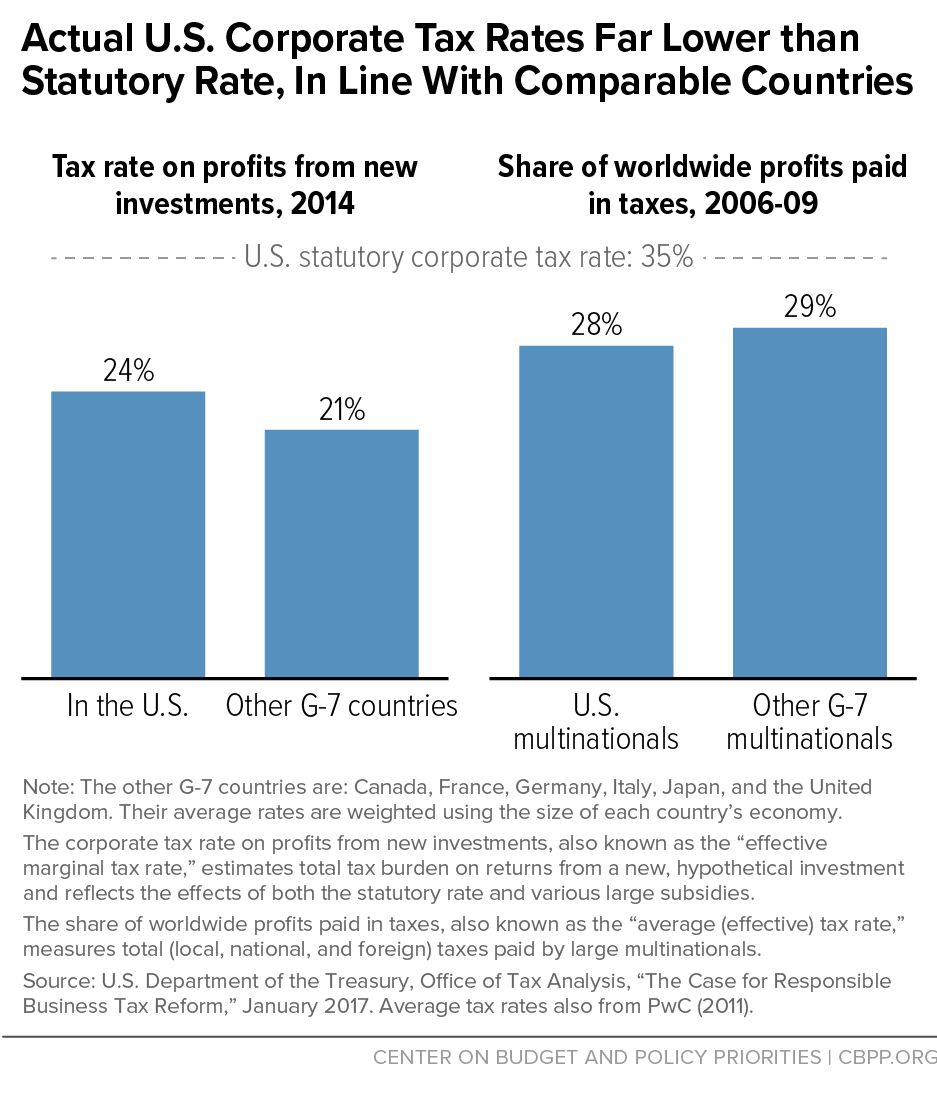

Actual U.S. Corporate Tax Rates Far Lower than Statutory Rate, In Line

Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Legal structure to avoid double taxation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Both have their own benefits and tax perks. To avoid double taxation, consider becoming an llc or an s corporation.

What Is the Corporate Tax Rate? Federal & State Tax Rates

Legal structure to avoid double taxation. Following are some of the most common strategies to save on taxes: To avoid double taxation, consider becoming an llc or an s corporation. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Profits are taxed when earned, and.

A Legal Structure With A Lower Tax Rate That Prevents A Company From Being Double Taxed Is Called An S Corporation Or S Corp.

Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Following are some of the most common strategies to save on taxes: Both have their own benefits and tax perks. To avoid double taxation, consider becoming an llc or an s corporation.

Because Progressive Tax Brackets Affect C Corps And Individuals, Income Splitting Can Minimize Double Taxation.

Legal structure to avoid double taxation.