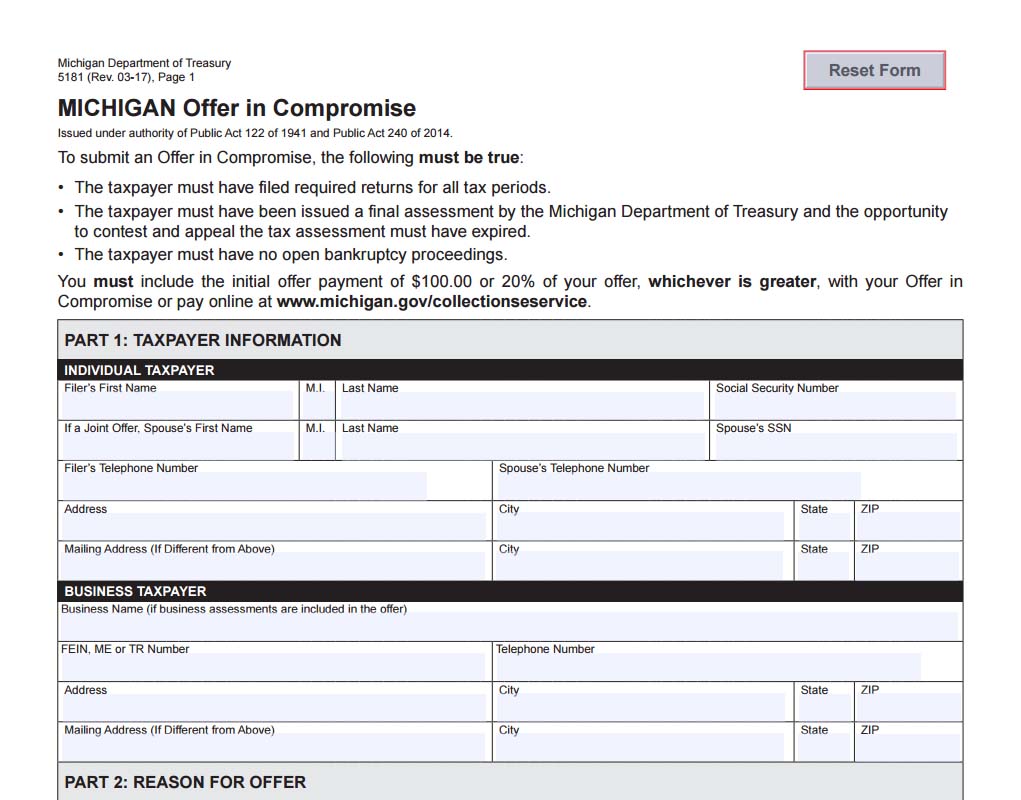

Michigan Offer In Compromise Form 5181 - Michigan's new offer in compromise (oic) program provides taxpayers. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Michigan form 5181 is used to request an offer in compromise from the state of michigan. Michigan department of treasury allows taxpayers to submit three different offer types. Under the offer in compromise program, treasury may compromise all or part of any outstanding.

Michigan's new offer in compromise (oic) program provides taxpayers. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Michigan form 5181 is used to request an offer in compromise from the state of michigan. Under the offer in compromise program, treasury may compromise all or part of any outstanding. Michigan department of treasury allows taxpayers to submit three different offer types. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan.

An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Michigan department of treasury allows taxpayers to submit three different offer types. Under the offer in compromise program, treasury may compromise all or part of any outstanding. Michigan's new offer in compromise (oic) program provides taxpayers. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Michigan form 5181 is used to request an offer in compromise from the state of michigan.

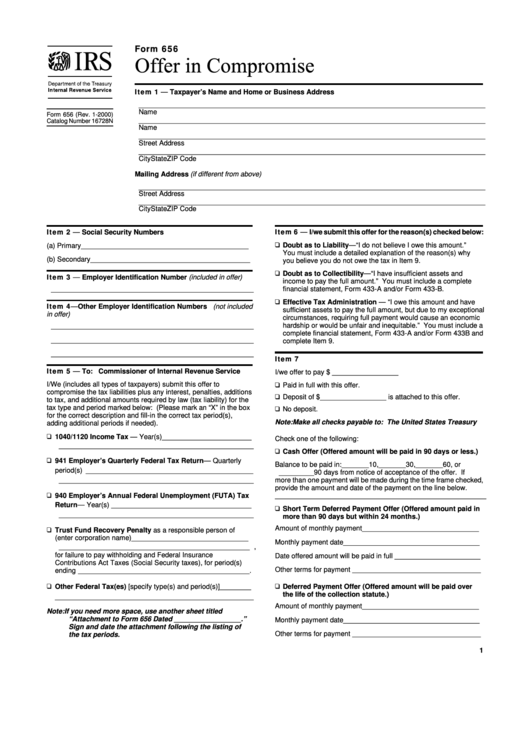

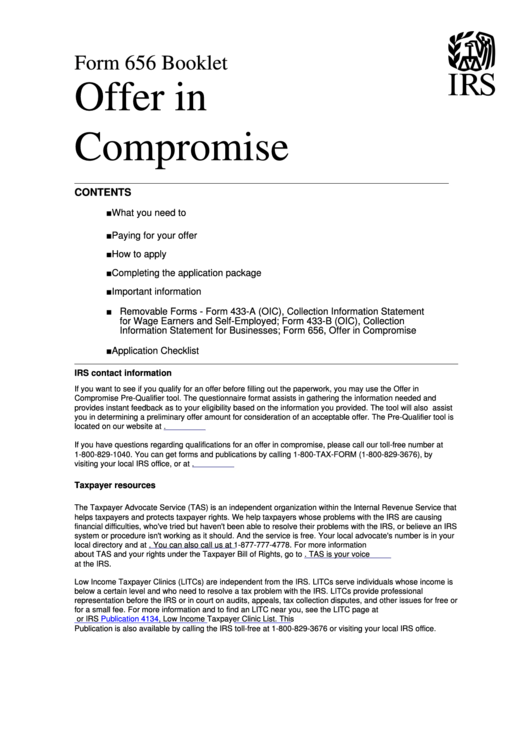

Form 656 Offer In Compromise printable pdf download

An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Michigan's new offer in compromise (oic) program provides taxpayers. Michigan department of treasury allows taxpayers to submit three different offer types. Michigan form 5181 is used to request an offer.

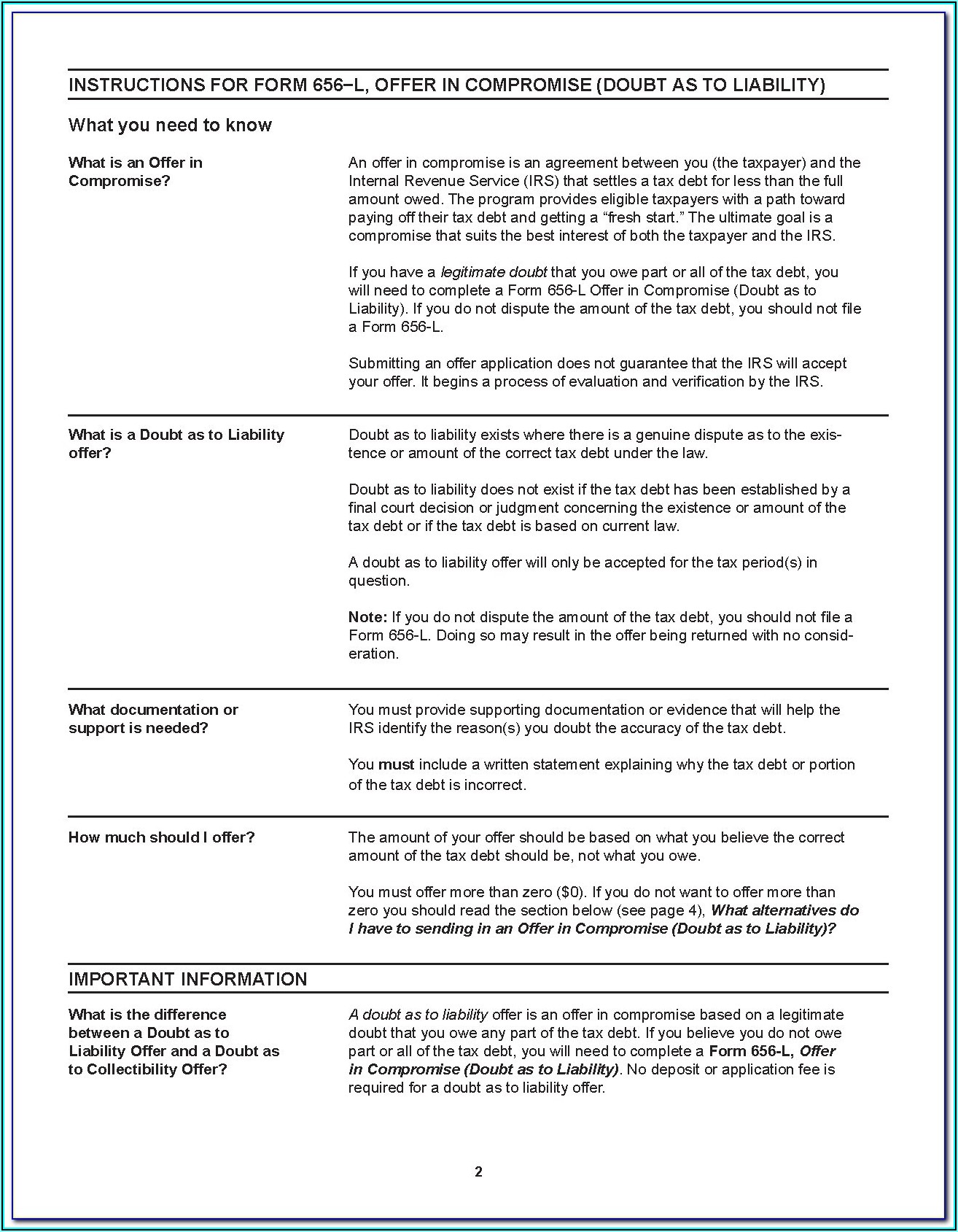

Irs Offer In Compromise Fillable Form Form Resume Examples Mj1vNaGP1w

Michigan's new offer in compromise (oic) program provides taxpayers. Under the offer in compromise program, treasury may compromise all or part of any outstanding. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Michigan form 5181 is used to.

Compromise Form For Lok Adalat PDF

Under the offer in compromise program, treasury may compromise all or part of any outstanding. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Michigan's new offer in compromise (oic) program provides taxpayers. Michigan department of treasury allows taxpayers to submit three different offer types. Michigan form 5181 is used to request an offer.

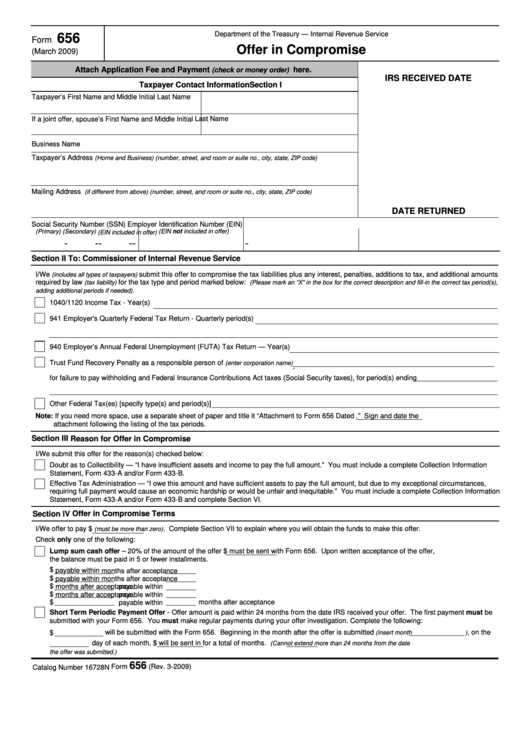

Fillable Offer In Compromise Form 656 (2009) printable pdf download

Michigan form 5181 is used to request an offer in compromise from the state of michigan. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Under the offer in compromise program, treasury may compromise all or part of any outstanding. Michigan's new offer in compromise (oic) program provides taxpayers. Michigan department of treasury allows.

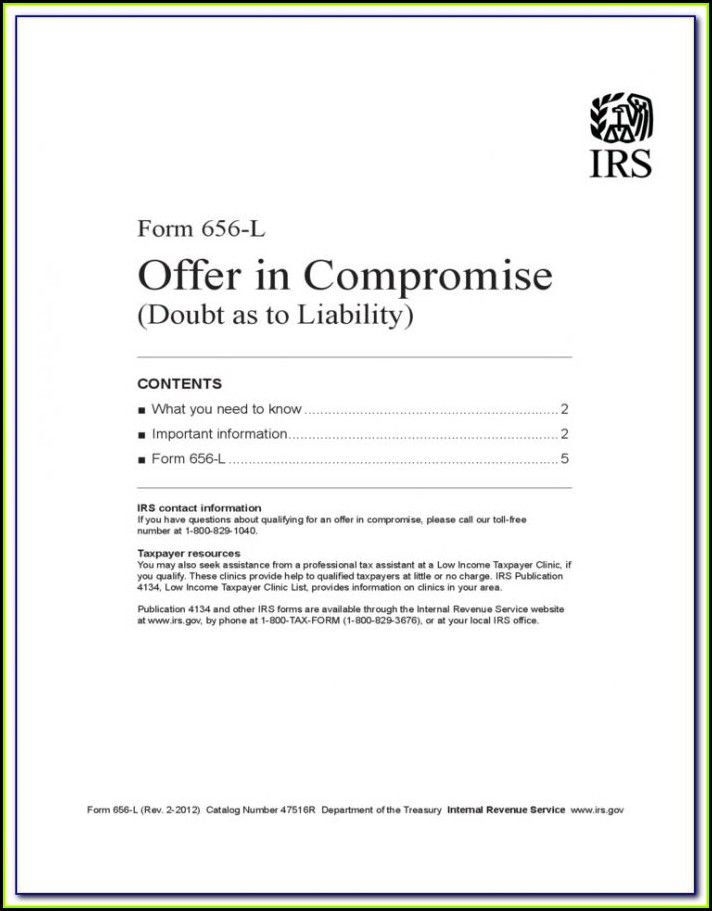

Irs Offer Compromise Form 656 L Form Resume Examples ojYqob52zl

Michigan form 5181 is used to request an offer in compromise from the state of michigan. Under the offer in compromise program, treasury may compromise all or part of any outstanding. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Michigan's new offer in compromise (oic) program provides taxpayers. Michigan department of treasury allows.

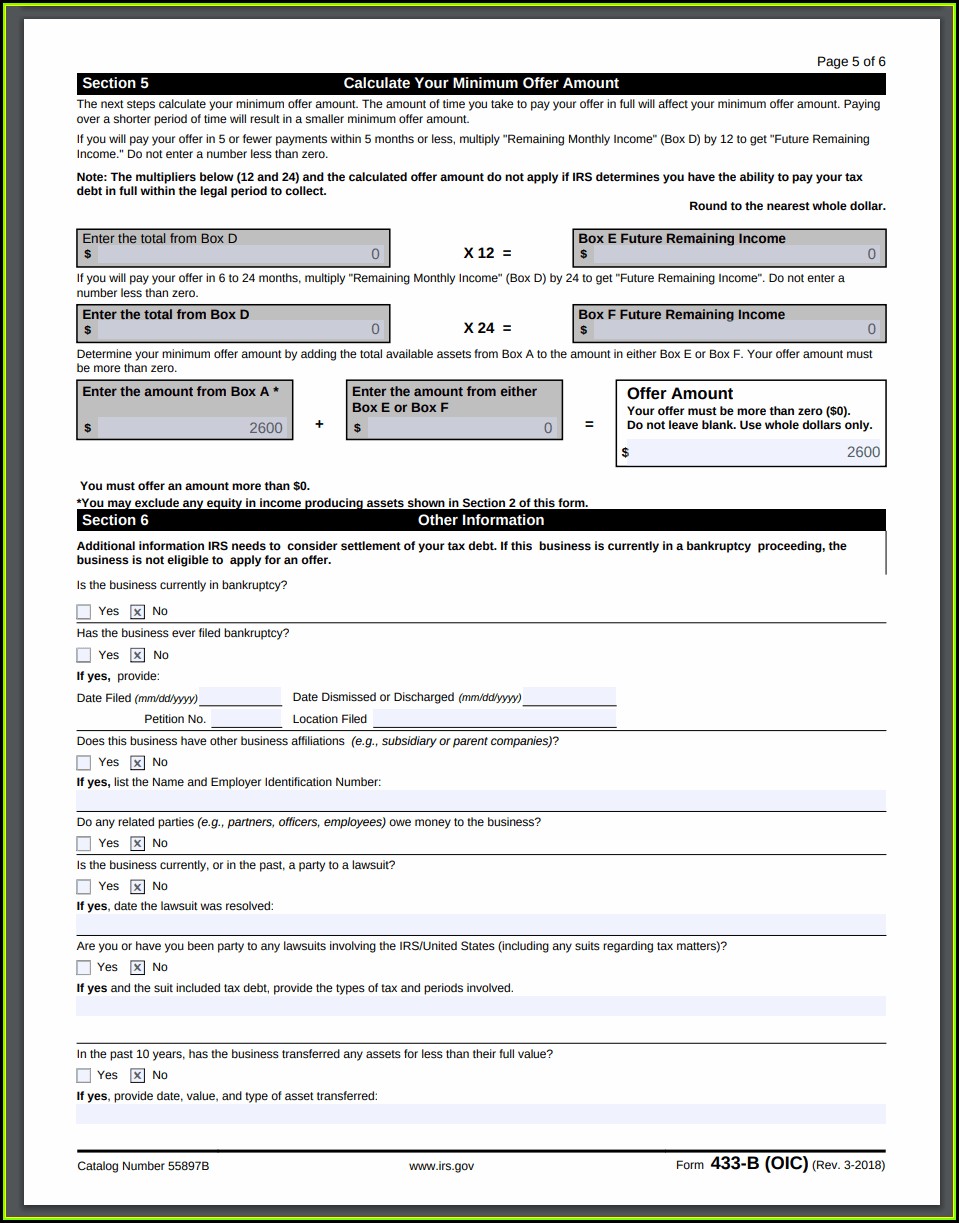

Irs Offer In Compromise Form 433 A Form Resume Examples gq96knwYOR

A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Under the offer in compromise program, treasury may compromise all or part of any outstanding. Michigan's new offer in compromise (oic) program provides taxpayers. Michigan form 5181 is used to.

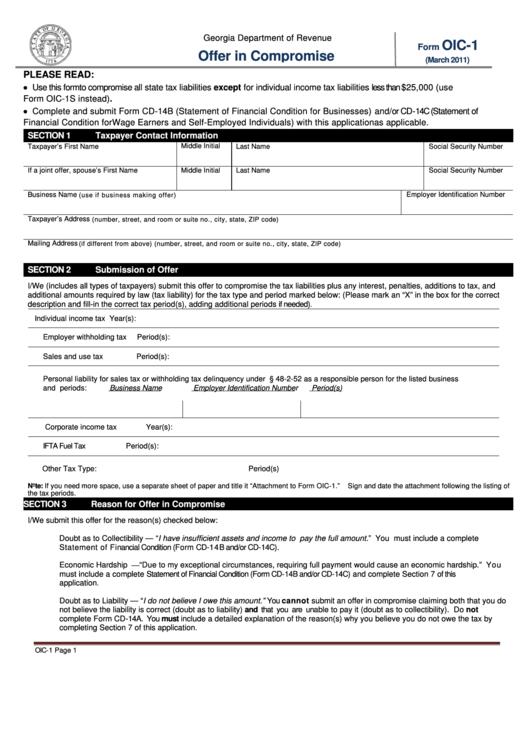

Fillable Form Oic1 Offer In Compromise printable pdf download

Michigan's new offer in compromise (oic) program provides taxpayers. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Under the offer in compromise program, treasury may compromise all or part of any outstanding. Michigan department of treasury allows taxpayers.

Form 656 Fillable Offer In Compromise Printable Forms Free Online

Michigan's new offer in compromise (oic) program provides taxpayers. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Under the offer in compromise program, treasury may compromise all or part of any outstanding. Michigan form 5181 is used to request an offer in compromise from the state of michigan. Michigan department of treasury allows.

Michigan Offer In Compromise How To Settle MI Tax Debt

Under the offer in compromise program, treasury may compromise all or part of any outstanding. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Michigan department of treasury allows taxpayers to submit three different offer types. Michigan's new offer in compromise (oic) program provides taxpayers. Michigan form 5181 is used to request an offer.

Irs Offer Compromise Form 656 L Form Resume Examples ojYqob52zl

Michigan department of treasury allows taxpayers to submit three different offer types. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Under the offer in compromise program, treasury may compromise all or part of any outstanding. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan. Michigan's new offer.

A Taxpayer Must Submit An Offer In Compromise On Michigan Offer In Compromise (Form 5181).

Under the offer in compromise program, treasury may compromise all or part of any outstanding. Michigan department of treasury allows taxpayers to submit three different offer types. Michigan's new offer in compromise (oic) program provides taxpayers. Michigan form 5181 is used to request an offer in compromise from the state of michigan.