Military Differential Pay - For 2023, the standard deduction amount has been increased for all filers. A payment made to eligible federal civilian employees who are members of the reserve or national guard during periods when they are called or ordered to. What is a reservist differential? Differential pay is any payment made by an employer to an employee when they are performing active duty for more than 30 days. Under section 5538, federal agencies must provide a payment—hereafter referred to as a “reservist differential”—equal to the amount by which an employee’s projected. Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under certain specified provisions. For more information, see the instructions for form 1040. It represents all or a portion of the wages the.

What is a reservist differential? For more information, see the instructions for form 1040. It represents all or a portion of the wages the. A payment made to eligible federal civilian employees who are members of the reserve or national guard during periods when they are called or ordered to. Under section 5538, federal agencies must provide a payment—hereafter referred to as a “reservist differential”—equal to the amount by which an employee’s projected. For 2023, the standard deduction amount has been increased for all filers. Differential pay is any payment made by an employer to an employee when they are performing active duty for more than 30 days. Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under certain specified provisions.

What is a reservist differential? It represents all or a portion of the wages the. For more information, see the instructions for form 1040. For 2023, the standard deduction amount has been increased for all filers. Differential pay is any payment made by an employer to an employee when they are performing active duty for more than 30 days. A payment made to eligible federal civilian employees who are members of the reserve or national guard during periods when they are called or ordered to. Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under certain specified provisions. Under section 5538, federal agencies must provide a payment—hereafter referred to as a “reservist differential”—equal to the amount by which an employee’s projected.

DIFFERENTIAL CARRIER Midwest Military Store

Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under certain specified provisions. For 2023, the standard deduction amount has been increased for all filers. Under section 5538, federal agencies must provide a payment—hereafter referred to as a “reservist differential”—equal to the amount by which.

Eligible County employees to receive Military Differential Pay

What is a reservist differential? Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under certain specified provisions. For more information, see the instructions for form 1040. It represents all or a portion of the wages the. A payment made to eligible federal civilian employees.

Military Differential Pay » Human Resources » TPG The Platinum Group

It represents all or a portion of the wages the. What is a reservist differential? A payment made to eligible federal civilian employees who are members of the reserve or national guard during periods when they are called or ordered to. Differential pay is any payment made by an employer to an employee when they are performing active duty for.

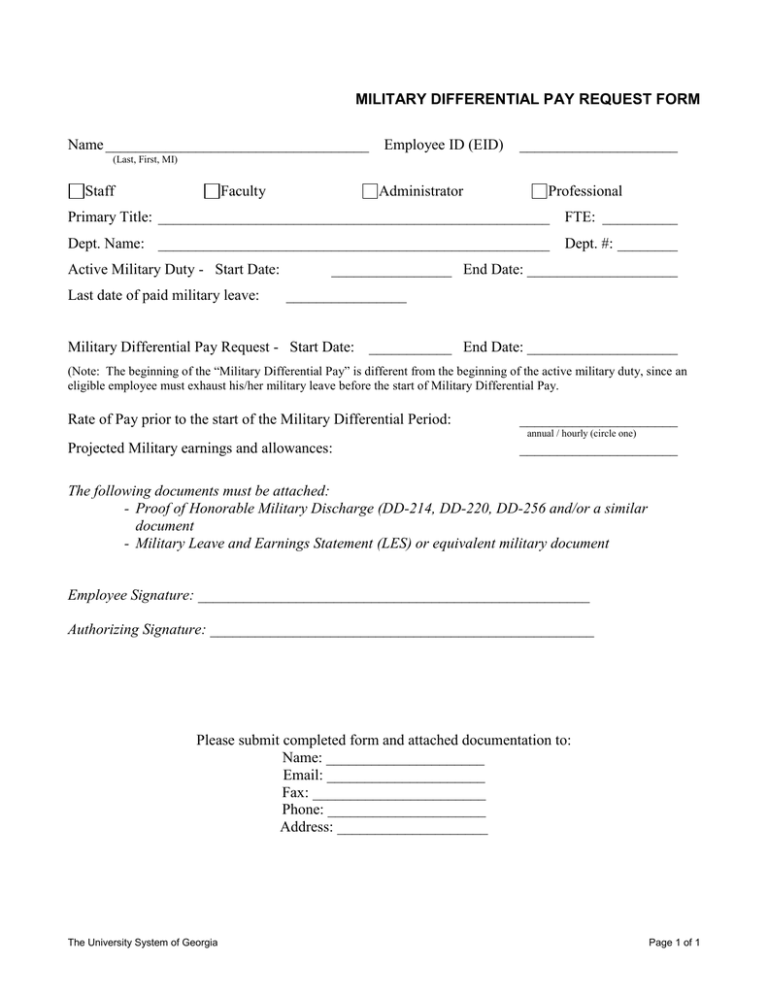

MILITARY DIFFERENTIAL PAY REQUEST FORM Staff

Differential pay is any payment made by an employer to an employee when they are performing active duty for more than 30 days. For more information, see the instructions for form 1040. A payment made to eligible federal civilian employees who are members of the reserve or national guard during periods when they are called or ordered to. It represents.

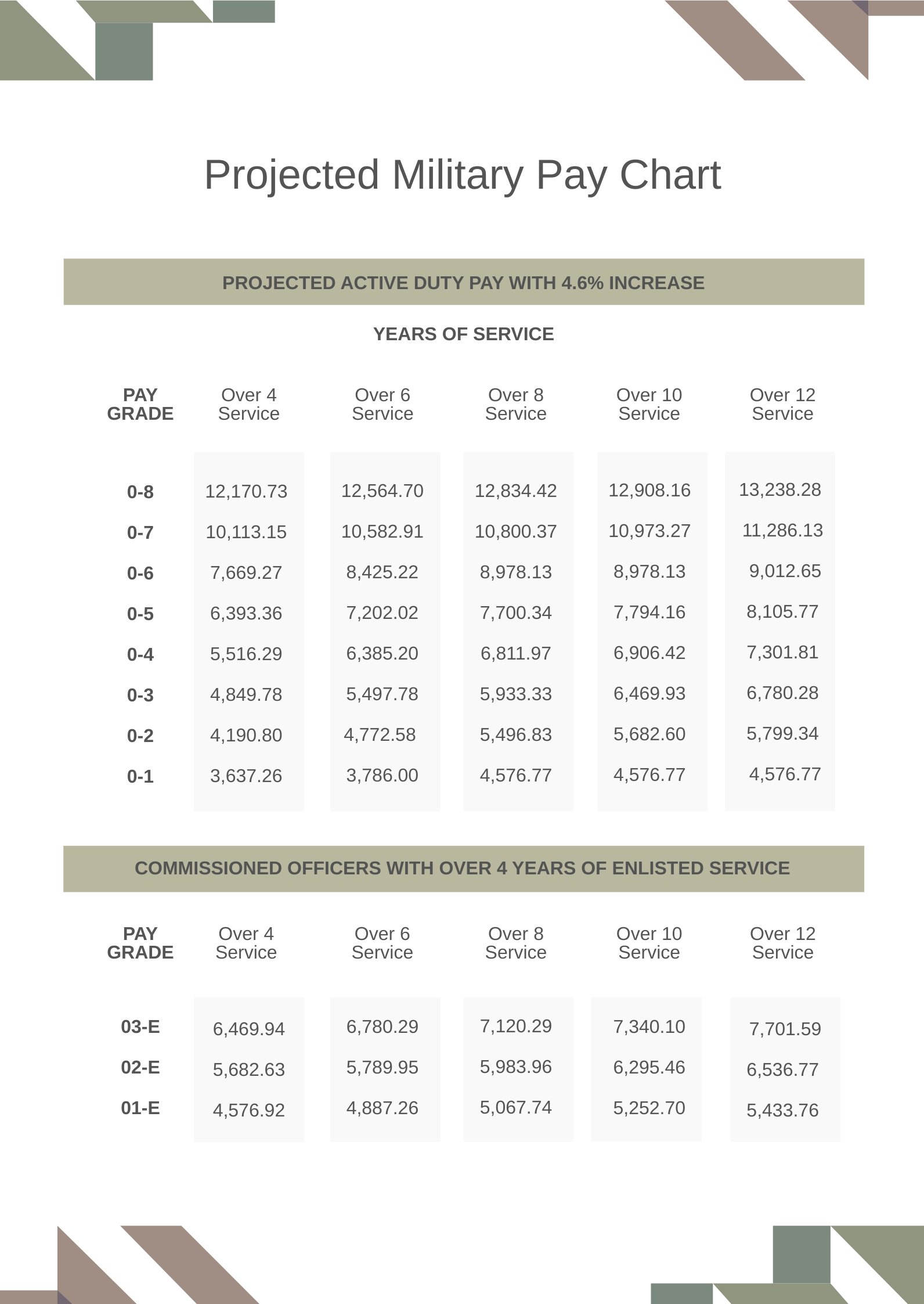

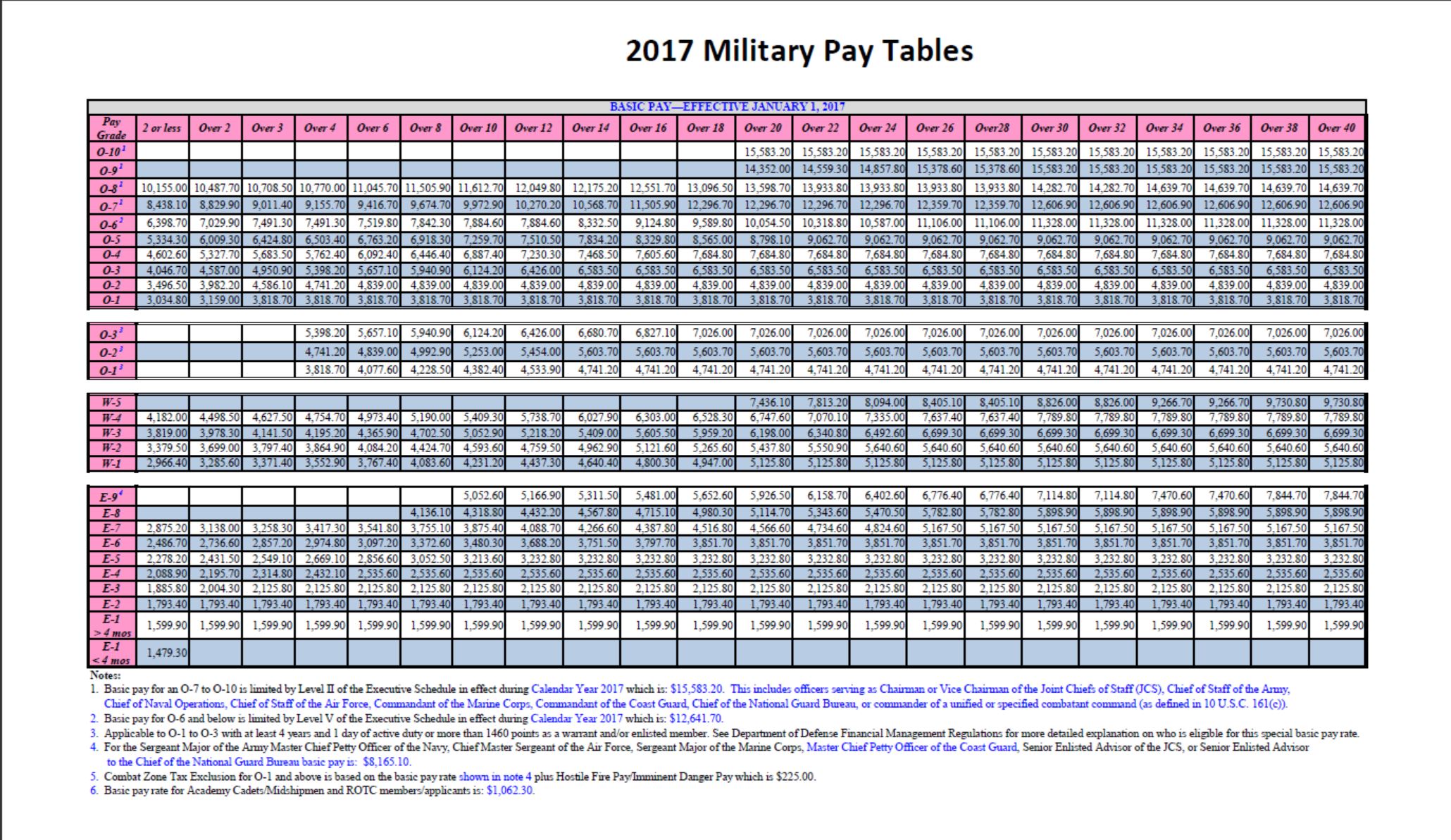

Military Pay Tables Matttroy

For more information, see the instructions for form 1040. For 2023, the standard deduction amount has been increased for all filers. Differential pay is any payment made by an employer to an employee when they are performing active duty for more than 30 days. A payment made to eligible federal civilian employees who are members of the reserve or national.

A nononsense guide on succeeding with differential pay

Differential pay is any payment made by an employer to an employee when they are performing active duty for more than 30 days. Under section 5538, federal agencies must provide a payment—hereafter referred to as a “reservist differential”—equal to the amount by which an employee’s projected. Reservist differentials are payable to eligible federal civilian employees who are members of the.

What is shift differential pay? Zippia

Under section 5538, federal agencies must provide a payment—hereafter referred to as a “reservist differential”—equal to the amount by which an employee’s projected. Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under certain specified provisions. What is a reservist differential? It represents all or.

Military Pay Tables Matttroy

Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under certain specified provisions. What is a reservist differential? For more information, see the instructions for form 1040. Under section 5538, federal agencies must provide a payment—hereafter referred to as a “reservist differential”—equal to the amount.

Eligible County employees to receive Military Differential Pay

Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under certain specified provisions. For more information, see the instructions for form 1040. Differential pay is any payment made by an employer to an employee when they are performing active duty for more than 30 days..

Military Flight Pay Chart 2021 Military Pay Chart For 2025

For 2023, the standard deduction amount has been increased for all filers. Differential pay is any payment made by an employer to an employee when they are performing active duty for more than 30 days. Reservist differentials are payable to eligible federal civilian employees who are members of the reserve or national guard called or ordered to active duty under.

Differential Pay Is Any Payment Made By An Employer To An Employee When They Are Performing Active Duty For More Than 30 Days.

It represents all or a portion of the wages the. For 2023, the standard deduction amount has been increased for all filers. For more information, see the instructions for form 1040. Under section 5538, federal agencies must provide a payment—hereafter referred to as a “reservist differential”—equal to the amount by which an employee’s projected.

Reservist Differentials Are Payable To Eligible Federal Civilian Employees Who Are Members Of The Reserve Or National Guard Called Or Ordered To Active Duty Under Certain Specified Provisions.

A payment made to eligible federal civilian employees who are members of the reserve or national guard during periods when they are called or ordered to. What is a reservist differential?