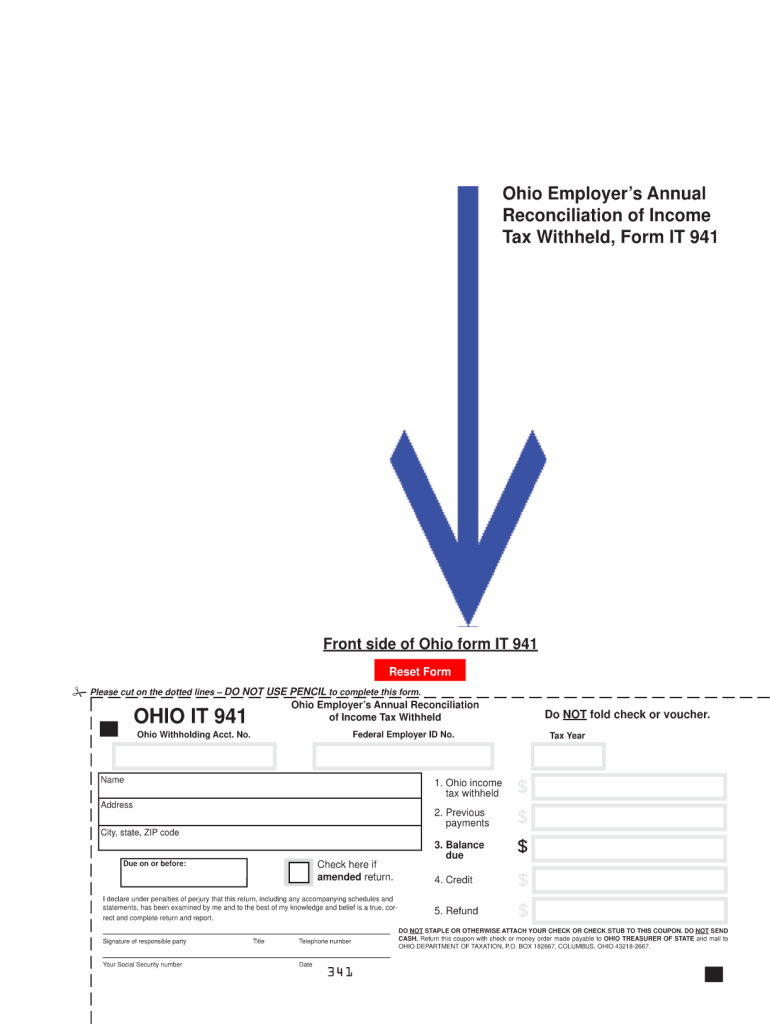

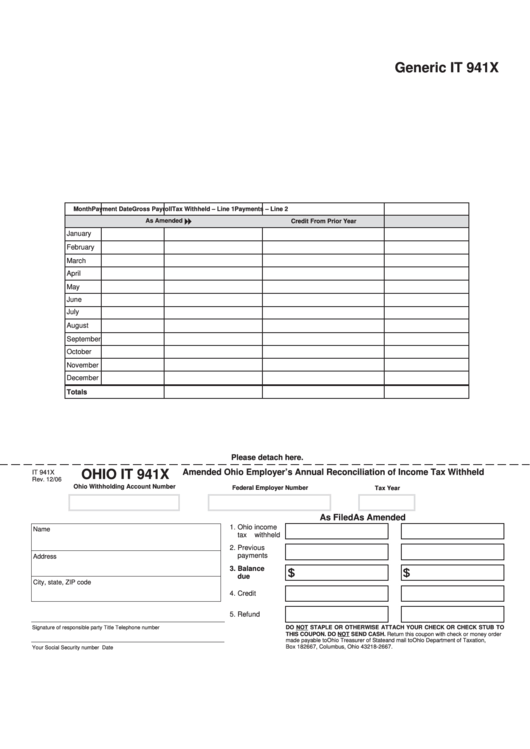

Ohio Form It 941 - Ohio it 941 annual reconciliation of income tax withheld: Access the forms you need to file taxes or do business in ohio. Electronic filing is mandatory for employer withholding and employer withholding school. Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. Your business is required to electronically file a final withholding annual reconciliation (ohio. The employer is required to have each employee that works in ohio to complete this form.

Ohio it 941 annual reconciliation of income tax withheld: Electronic filing is mandatory for employer withholding and employer withholding school. Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. The employer is required to have each employee that works in ohio to complete this form. Your business is required to electronically file a final withholding annual reconciliation (ohio. Access the forms you need to file taxes or do business in ohio.

Electronic filing is mandatory for employer withholding and employer withholding school. The employer is required to have each employee that works in ohio to complete this form. Access the forms you need to file taxes or do business in ohio. Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. Your business is required to electronically file a final withholding annual reconciliation (ohio. Ohio it 941 annual reconciliation of income tax withheld:

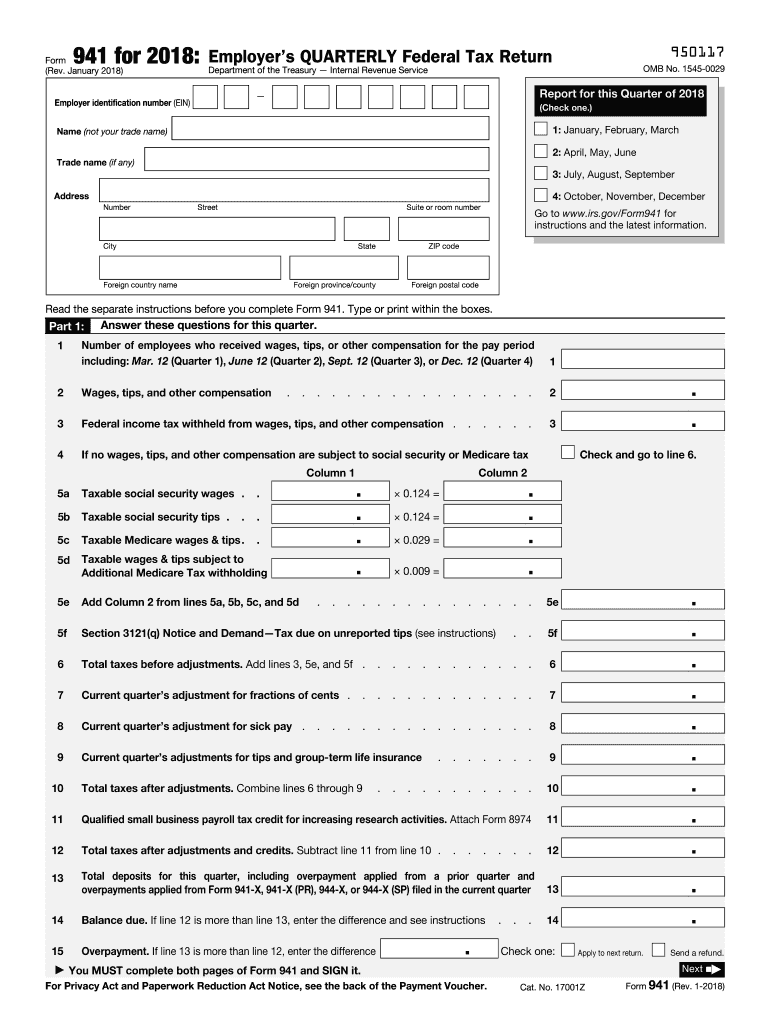

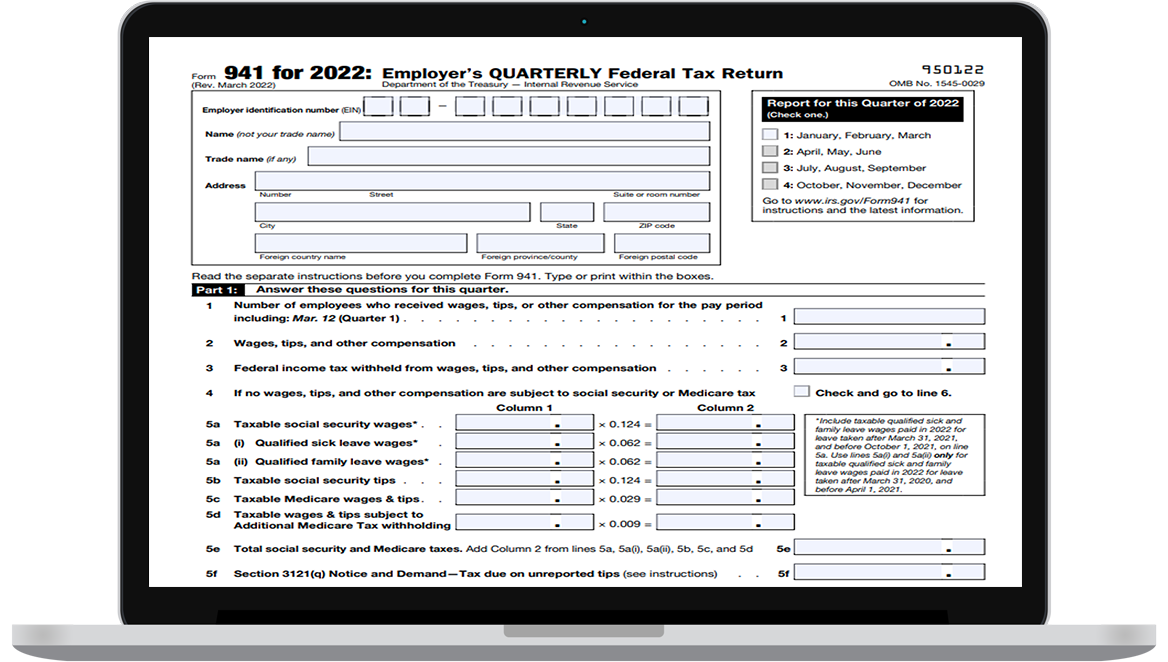

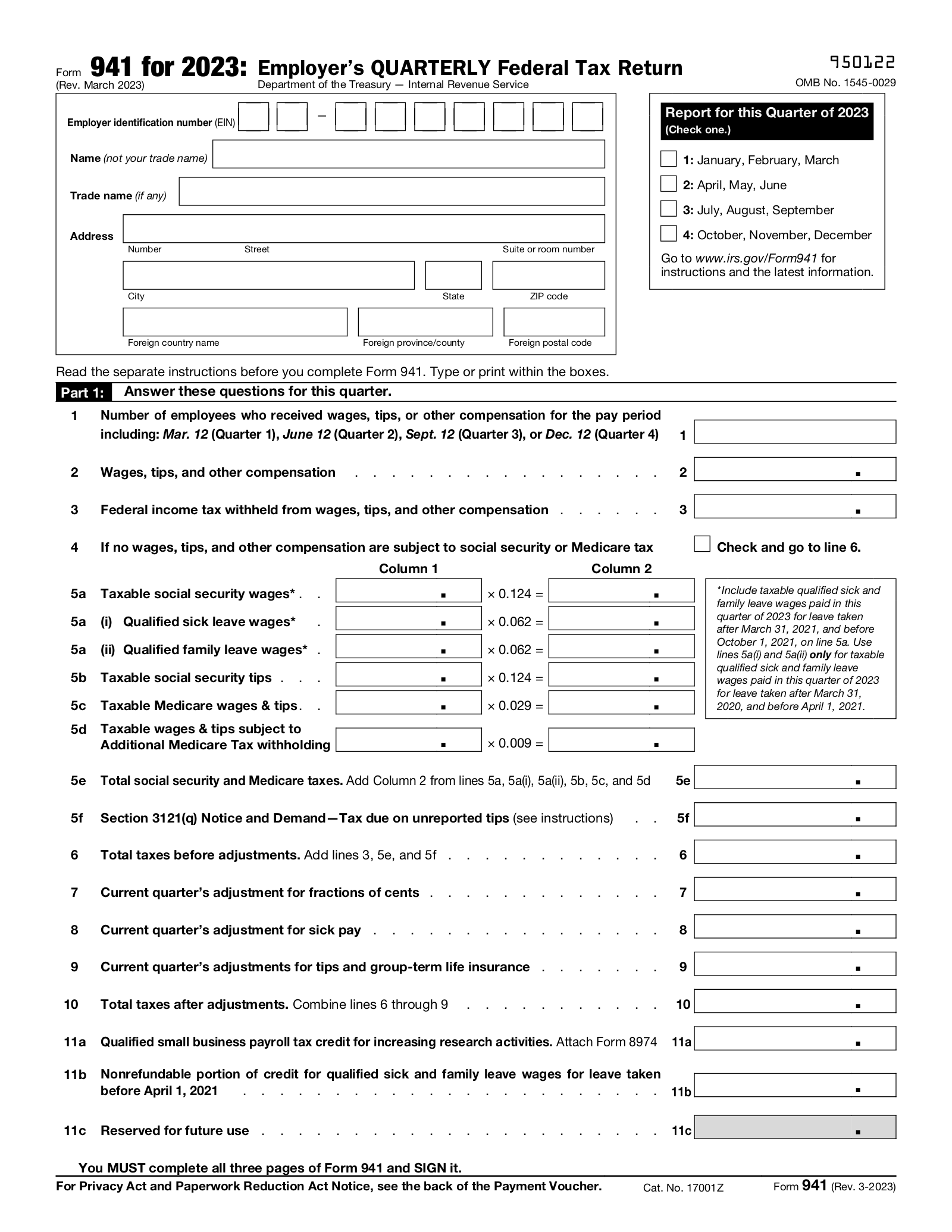

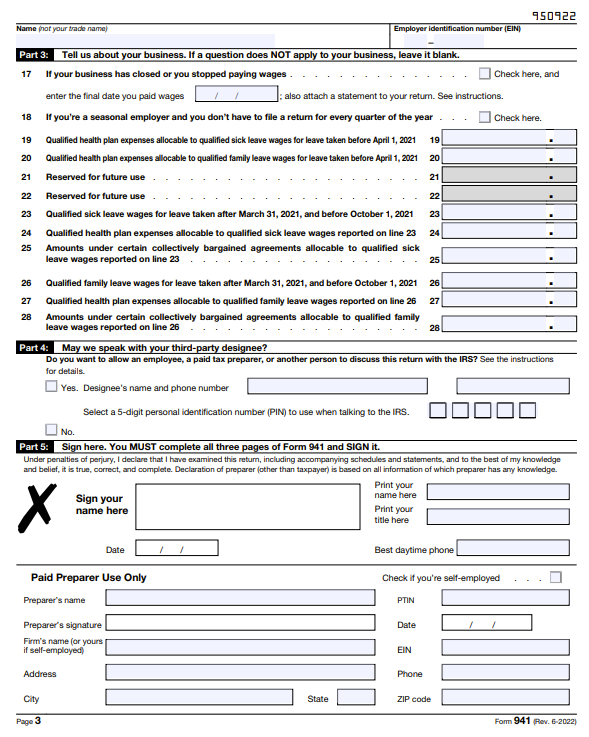

Form 941What It is and How to File It

Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. Your business is required to electronically file a final withholding annual reconciliation (ohio. Ohio it 941 annual reconciliation of income tax withheld: Access the forms you need to file taxes or do business in ohio. Electronic filing is mandatory for employer withholding and employer withholding school.

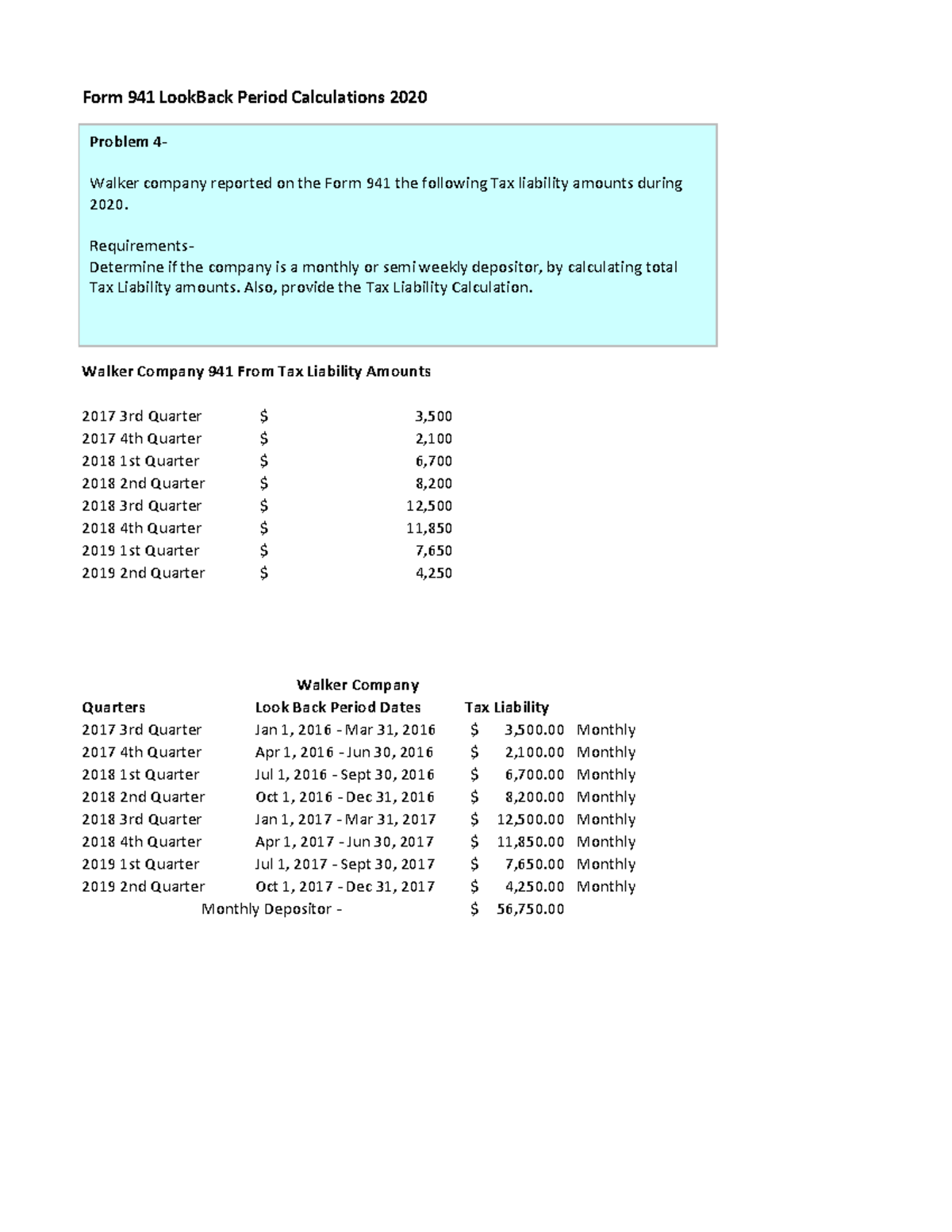

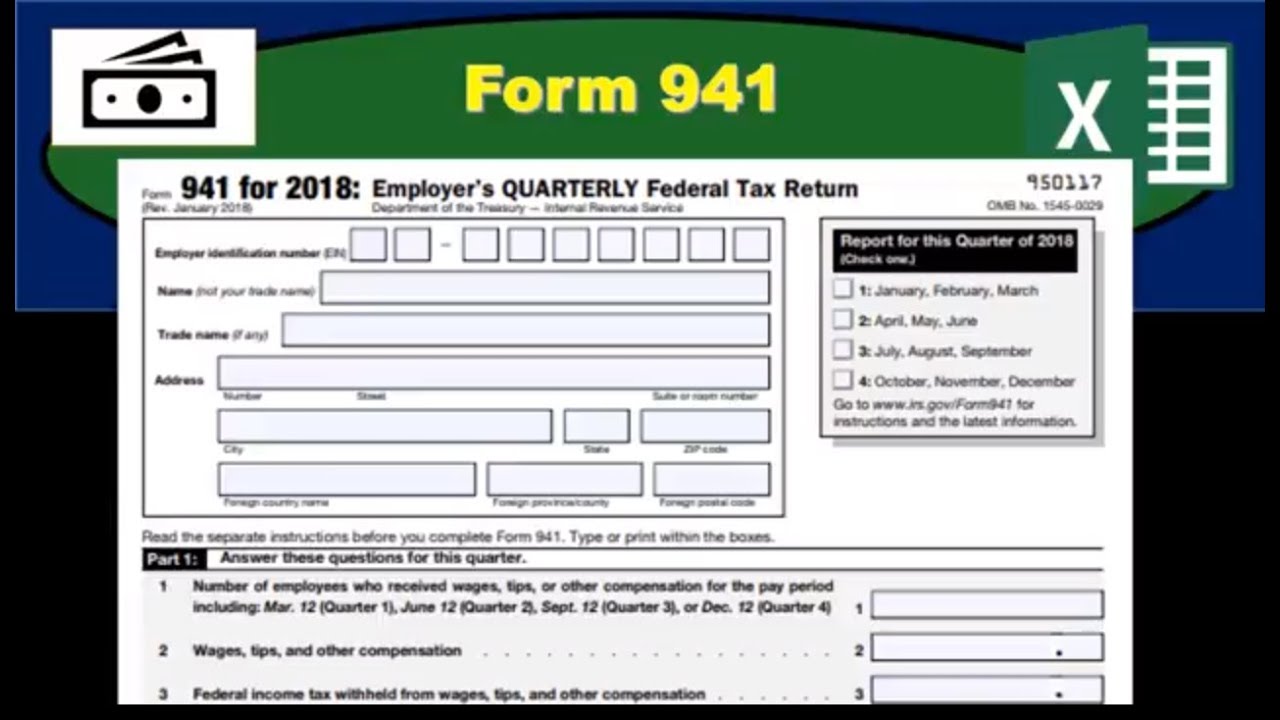

Unit 3 Assignment Form 941 LookBack Period Calculations 2020 Walker

Access the forms you need to file taxes or do business in ohio. Your business is required to electronically file a final withholding annual reconciliation (ohio. Electronic filing is mandatory for employer withholding and employer withholding school. Ohio it 941 annual reconciliation of income tax withheld: Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later.

000 Ohio Fill Online, Printable, Fillable, Blank pdfFiller

Ohio it 941 annual reconciliation of income tax withheld: Your business is required to electronically file a final withholding annual reconciliation (ohio. Access the forms you need to file taxes or do business in ohio. The employer is required to have each employee that works in ohio to complete this form. Electronic filing is mandatory for employer withholding and employer.

IRS 941 2018 Fill out Tax Template Online US Legal Forms

Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. Access the forms you need to file taxes or do business in ohio. Your business is required to electronically file a final withholding annual reconciliation (ohio. Electronic filing is mandatory for employer withholding and employer withholding school. Ohio it 941 annual reconciliation of income tax withheld:

Ohio It 941 Fillable Form Printable Forms Free Online

Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. The employer is required to have each employee that works in ohio to complete this form. Access the forms you need to file taxes or do business in ohio. Electronic filing is mandatory for employer withholding and employer withholding school. Ohio it 941 annual reconciliation of income tax.

EFile Form 941 for 2022 File form 941 electronically

The employer is required to have each employee that works in ohio to complete this form. Access the forms you need to file taxes or do business in ohio. Electronic filing is mandatory for employer withholding and employer withholding school. Ohio it 941 annual reconciliation of income tax withheld: Your business is required to electronically file a final withholding annual.

What Is Form 941 And How Do I File It? Ask Gusto, 56 OFF

Your business is required to electronically file a final withholding annual reconciliation (ohio. Access the forms you need to file taxes or do business in ohio. The employer is required to have each employee that works in ohio to complete this form. Ohio it 941 annual reconciliation of income tax withheld: Ohio employer’s eft 4th quarter/annual reconciliation of income tax.

Form 941 Employer’s Quarterly Federal Tax Return eForms

Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. Electronic filing is mandatory for employer withholding and employer withholding school. Your business is required to electronically file a final withholding annual reconciliation (ohio. Access the forms you need to file taxes or do business in ohio. Ohio it 941 annual reconciliation of income tax withheld:

Form 941 Generator ThePayStubs

Your business is required to electronically file a final withholding annual reconciliation (ohio. Ohio it 941 annual reconciliation of income tax withheld: The employer is required to have each employee that works in ohio to complete this form. Electronic filing is mandatory for employer withholding and employer withholding school. Access the forms you need to file taxes or do business.

Form 941 Generator ThePayStubs

Electronic filing is mandatory for employer withholding and employer withholding school. Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. Ohio it 941 annual reconciliation of income tax withheld: Your business is required to electronically file a final withholding annual reconciliation (ohio. Access the forms you need to file taxes or do business in ohio.

Your Business Is Required To Electronically File A Final Withholding Annual Reconciliation (Ohio.

Access the forms you need to file taxes or do business in ohio. The employer is required to have each employee that works in ohio to complete this form. Ohio employer’s eft 4th quarter/annual reconciliation of income tax withheld, no later. Electronic filing is mandatory for employer withholding and employer withholding school.