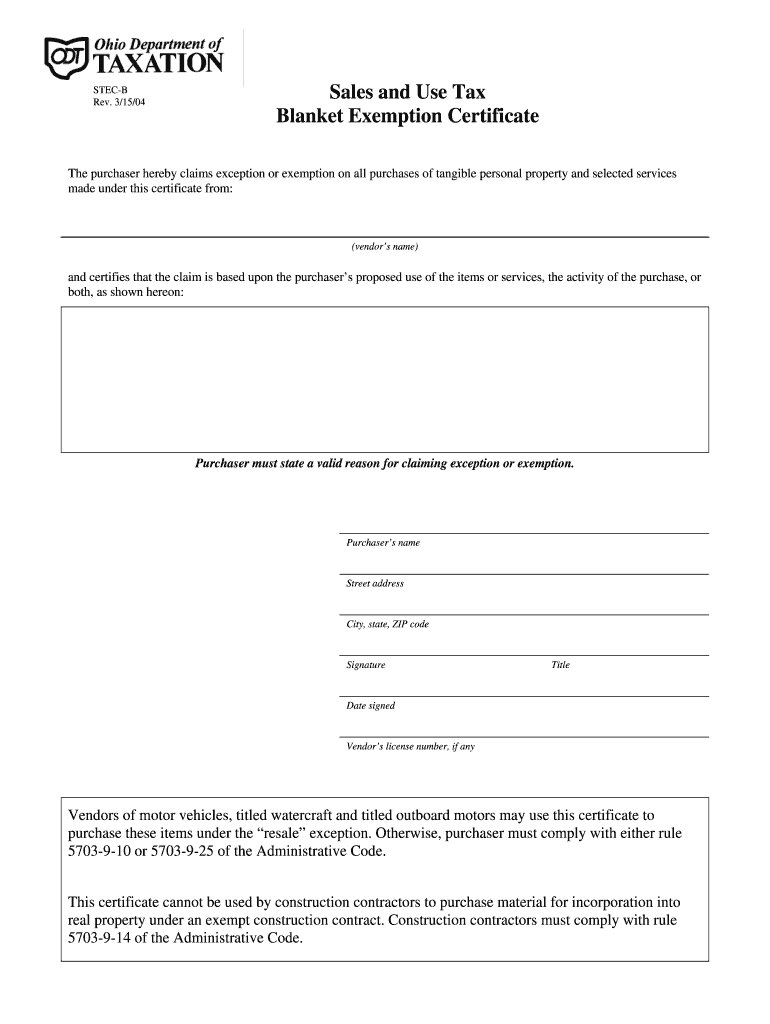

Ohio Tax Exempt Form Example - Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Building and construction materials and services sold for incorporation into real property.

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Building and construction materials and services sold for incorporation into real property. Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption.

Building and construction materials and services sold for incorporation into real property. Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate.

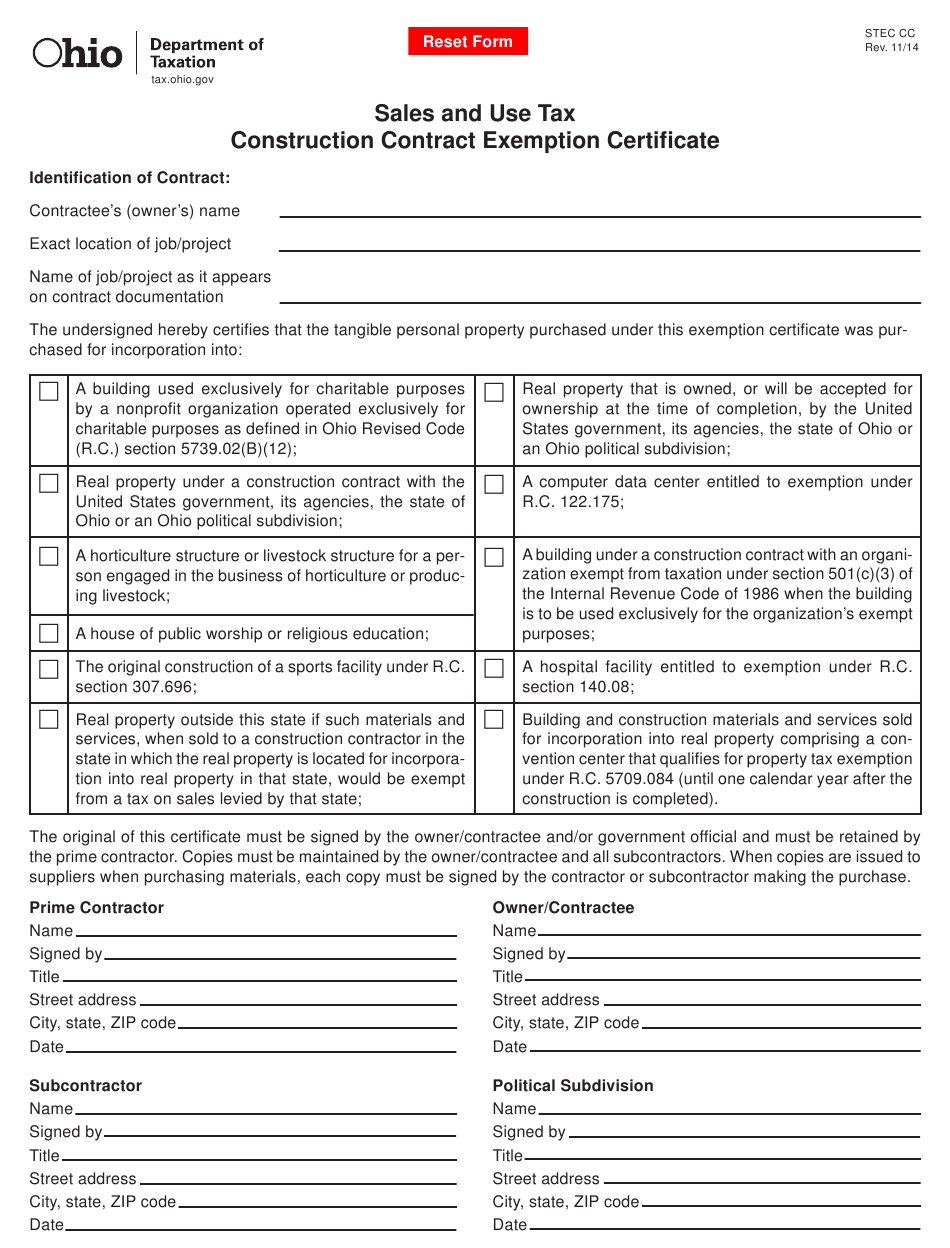

State Of Ohio Contractor Tax Exempt Form

Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption. Building and construction materials and services sold for incorporation into real property.

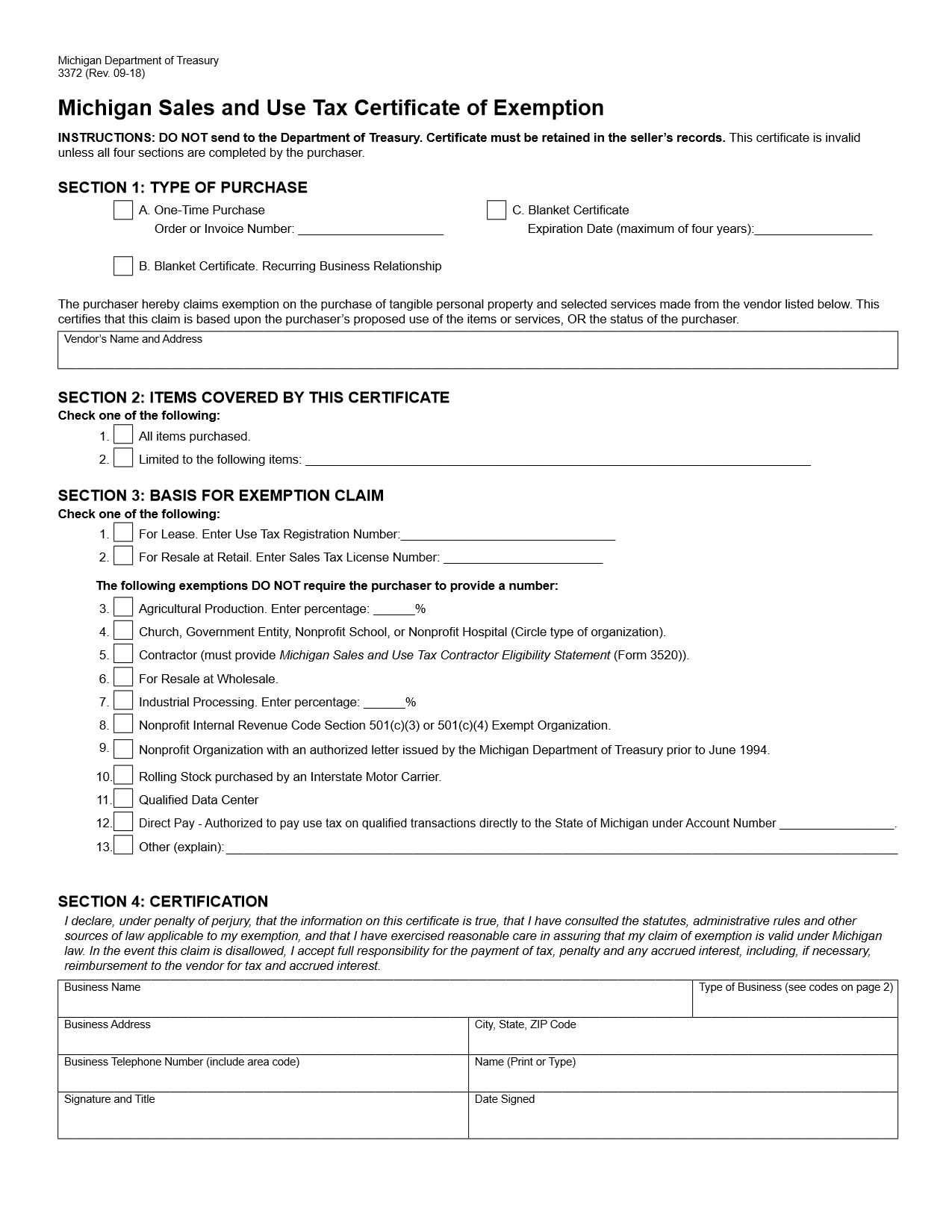

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

Purchaser must state a valid reason for claiming exception or exemption. Building and construction materials and services sold for incorporation into real property. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Building and construction materials and services sold for incorporation into real property. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption.

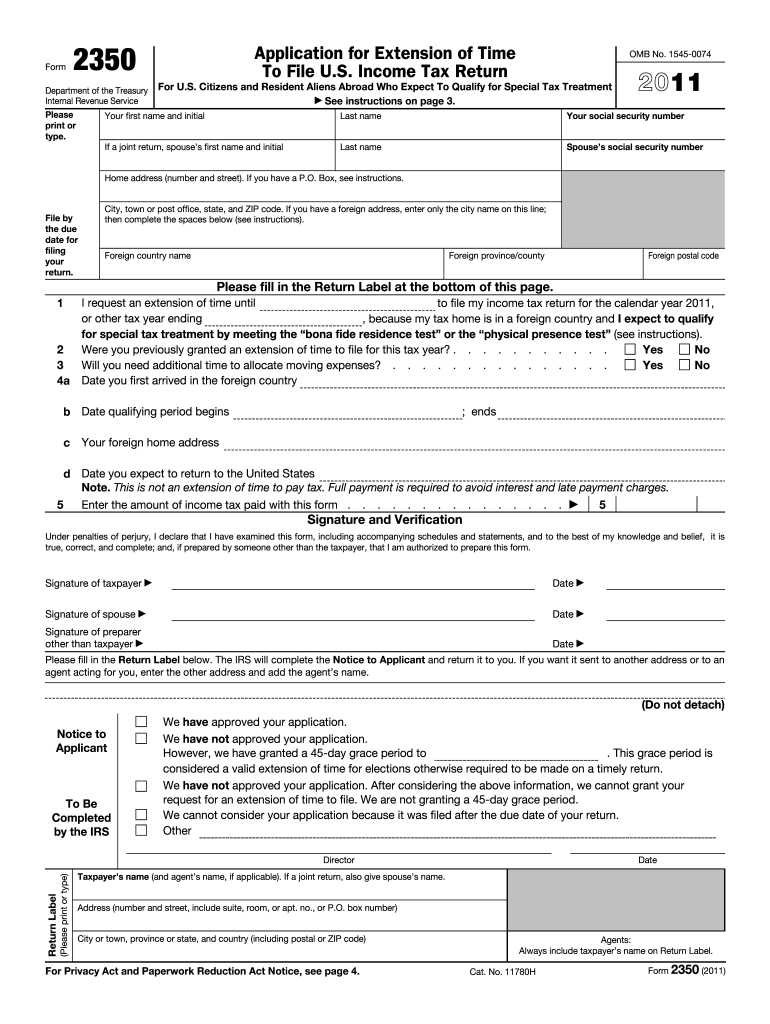

How To Fill Out Tax Exempt Form

Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption. Building and construction materials and services sold for incorporation into real property.

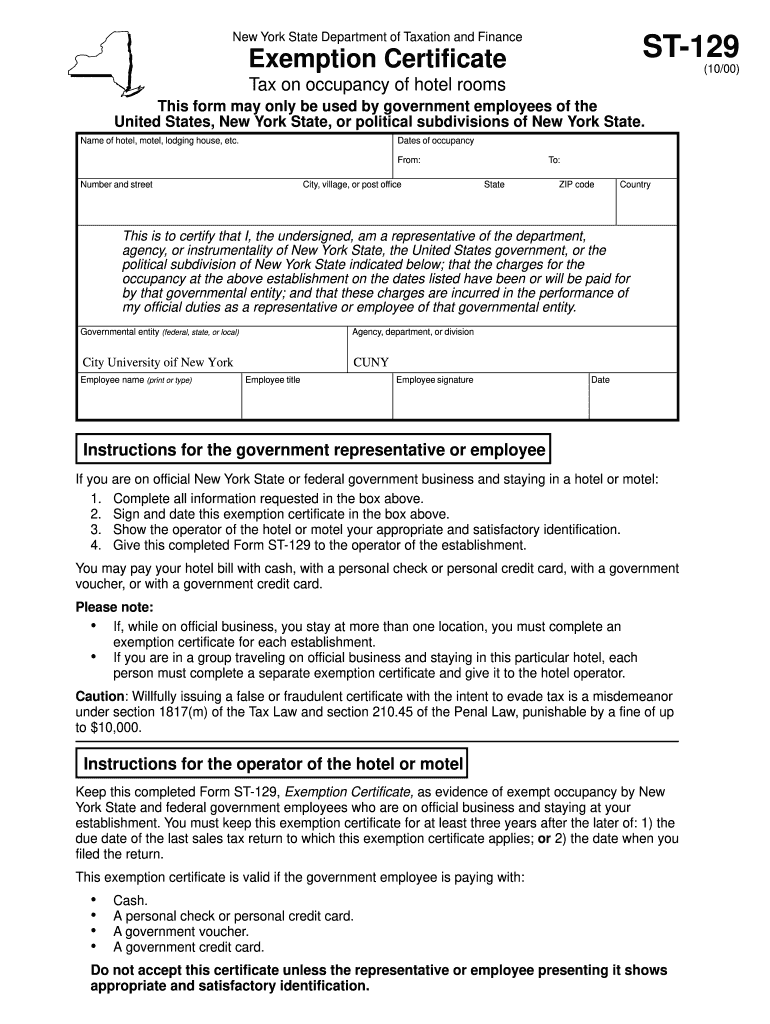

State Of Ohio Tax Exempt Form Fill Online Printable Fillable Blank

Building and construction materials and services sold for incorporation into real property. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption.

Tax Exempt Form 2025 Ohio Karen Arnold

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption. Building and construction materials and services sold for incorporation into real property. Purchaser must state a valid reason for claiming exception or exemption.

State Of Ohio Tax Exemption Form

Building and construction materials and services sold for incorporation into real property. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption.

FREE 10 Sample Tax Exemption Forms In PDF

Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Building and construction materials and services sold for incorporation into real property.

Ohio tax exempt form Fill out & sign online DocHub

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. Building and construction materials and services sold for incorporation into real property.

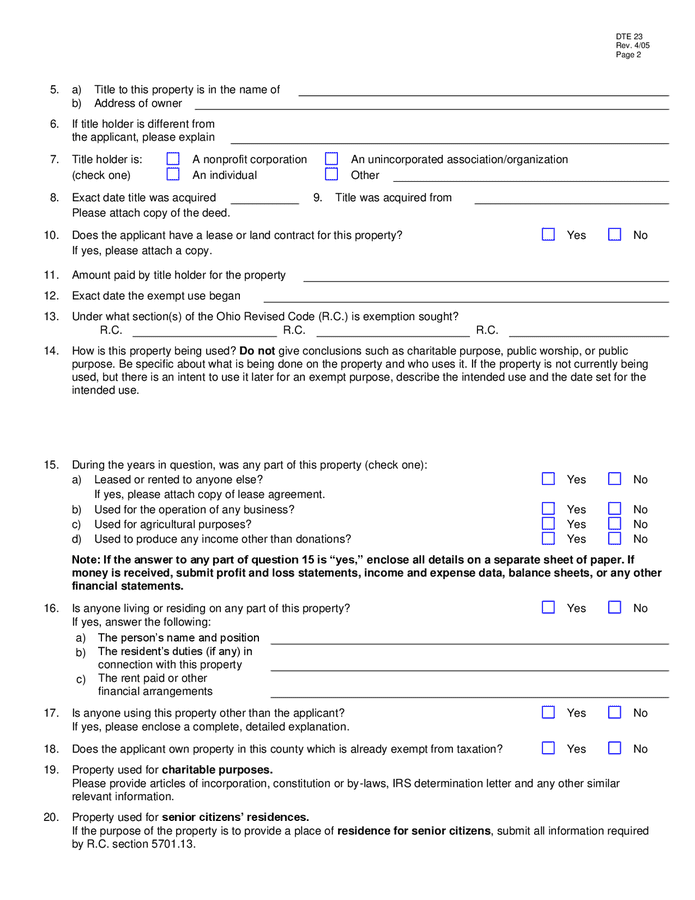

Application for real property tax exemption and remission (Ohio) in

Building and construction materials and services sold for incorporation into real property. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate. Purchaser must state a valid reason for claiming exception or exemption.

Building And Construction Materials And Services Sold For Incorporation Into Real Property.

Purchaser must state a valid reason for claiming exception or exemption. Purchaser must state a valid reason for claiming exception or exemption. Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certifi cate.