Tax Form 8233 - A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from.

Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using.

Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or.

16 Form 8233 Templates free to download in PDF

Nonresident alien students, trainees, professors/teachers, and researchers using. A tax treaty withholding exemption (independent personal services, business profits) for part or. Form 8233 is used by nonresident alien individuals to claim exemption from.

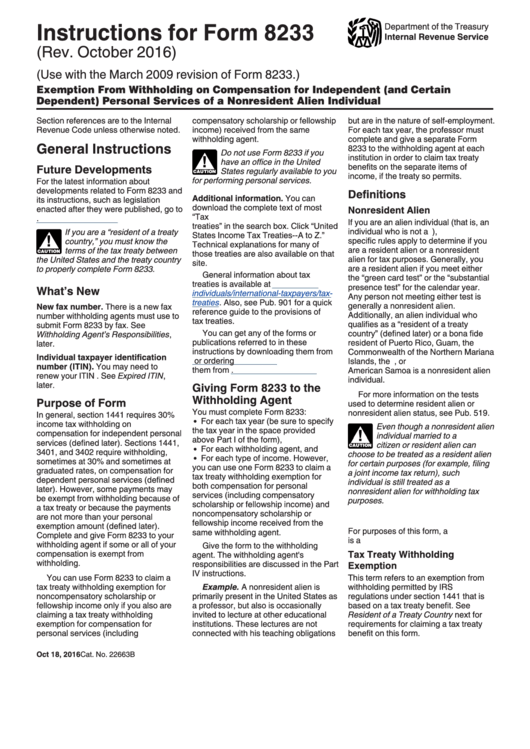

Instructions For Form 8233 2016 printable pdf download

A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from.

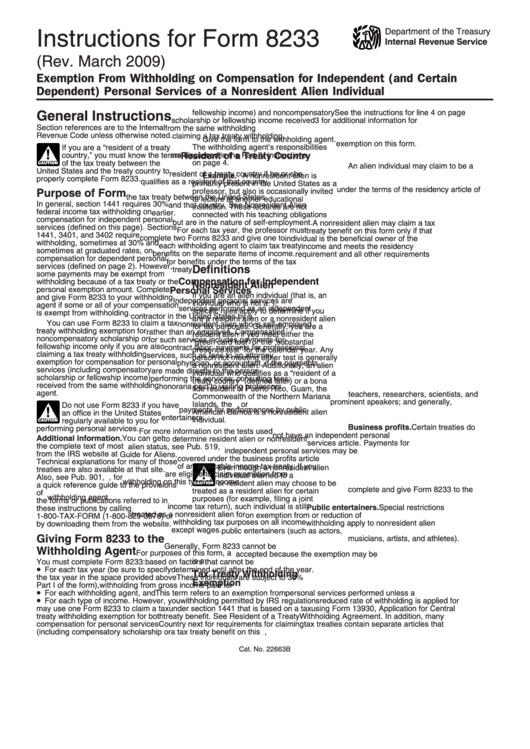

IRS 8233 2001 Fill out Tax Template Online US Legal Forms

A tax treaty withholding exemption (independent personal services, business profits) for part or. Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using.

Top 17 Form 8233 Templates free to download in PDF format

Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using. A tax treaty withholding exemption (independent personal services, business profits) for part or.

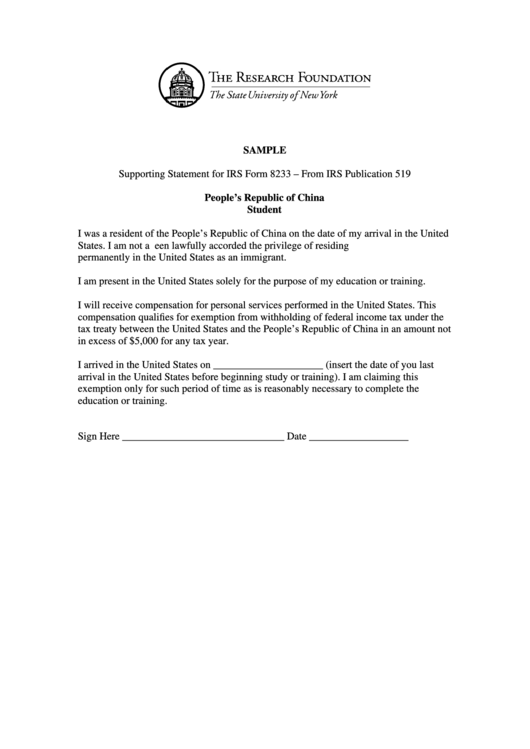

8233 Printable PDF Sample

A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from.

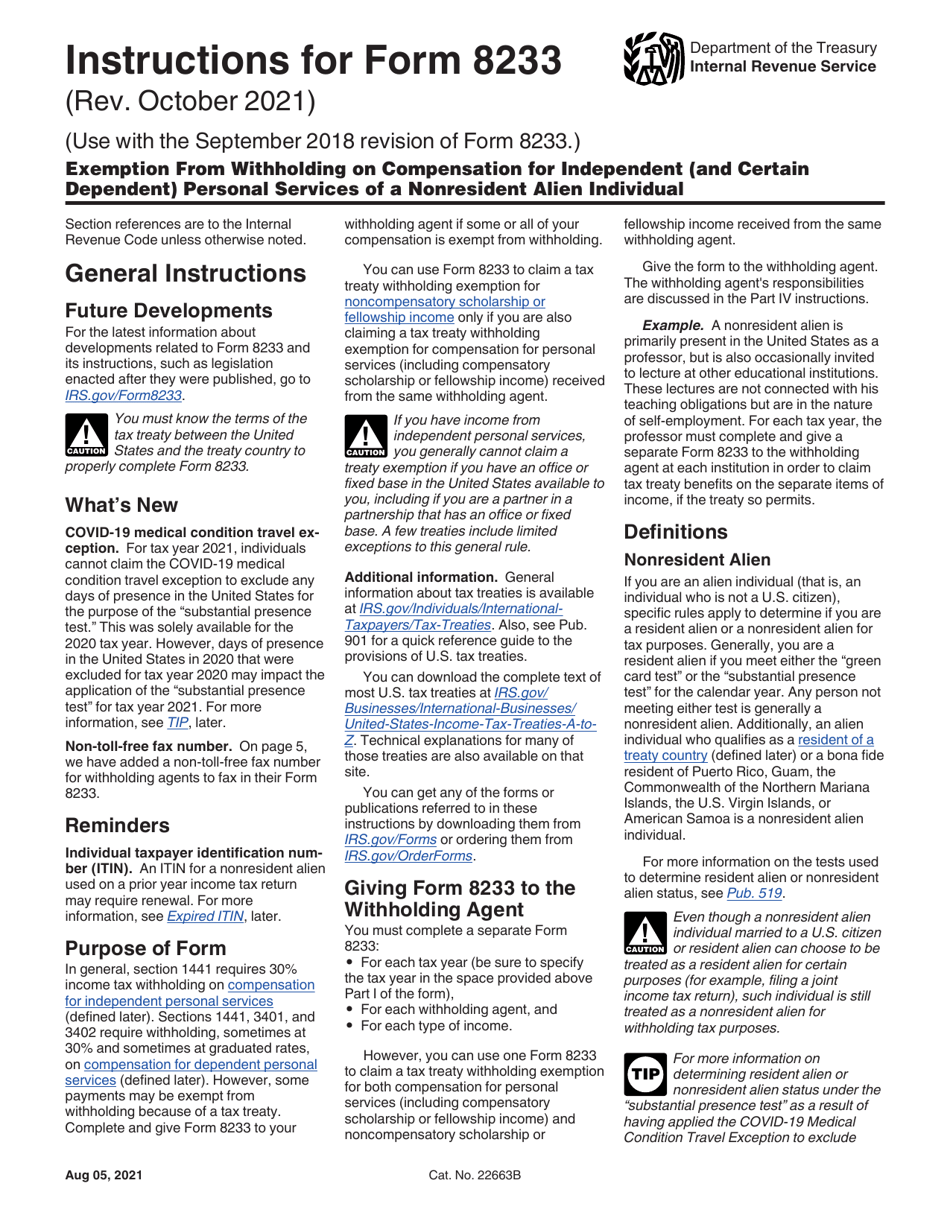

Download Instructions for IRS Form 8233 Exemption From Withholding on

Nonresident alien students, trainees, professors/teachers, and researchers using. A tax treaty withholding exemption (independent personal services, business profits) for part or. Form 8233 is used by nonresident alien individuals to claim exemption from.

List of Form 8233 Tax Treaty Countries With Calculator Internal

Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using. A tax treaty withholding exemption (independent personal services, business profits) for part or.

Understand Form 8233 for NonResident Alien Tax Exemptions Trolley

Nonresident alien students, trainees, professors/teachers, and researchers using. A tax treaty withholding exemption (independent personal services, business profits) for part or. Form 8233 is used by nonresident alien individuals to claim exemption from.

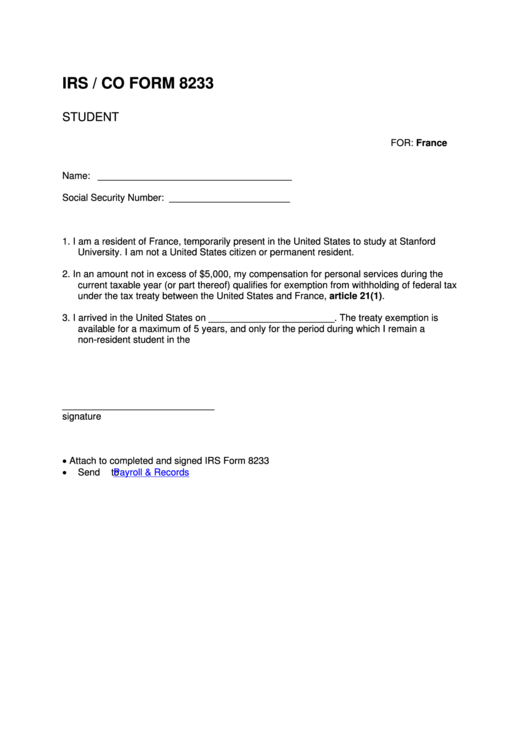

Irs / Co Form 8233 printable pdf download

Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or.

Fill Free fillable Form 8233 Exemption From Withholding on

Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using. A tax treaty withholding exemption (independent personal services, business profits) for part or.

A Tax Treaty Withholding Exemption (Independent Personal Services, Business Profits) For Part Or.

Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using.