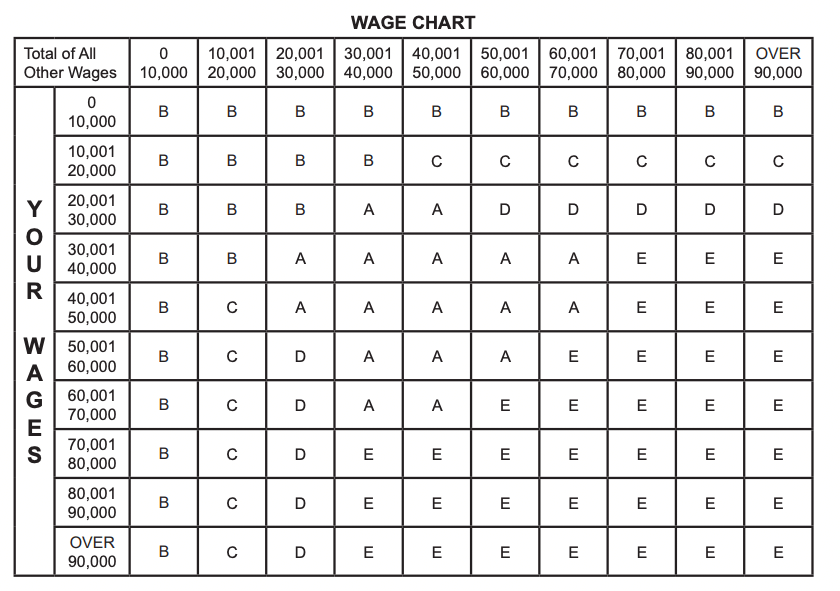

W4 Form Nj - If you need additional withholdings for other income or wages, use. You must complete and submit a form each year certifying you have no new jersey gross. This meeting point indicates the withholding table that best reflects your income situation. Employees should complete an employee’s withholding allowance certificate. You must complete and submit a form each year certifying you have no new jersey gross.

You must complete and submit a form each year certifying you have no new jersey gross. Employees should complete an employee’s withholding allowance certificate. You must complete and submit a form each year certifying you have no new jersey gross. This meeting point indicates the withholding table that best reflects your income situation. If you need additional withholdings for other income or wages, use.

If you need additional withholdings for other income or wages, use. You must complete and submit a form each year certifying you have no new jersey gross. Employees should complete an employee’s withholding allowance certificate. You must complete and submit a form each year certifying you have no new jersey gross. This meeting point indicates the withholding table that best reflects your income situation.

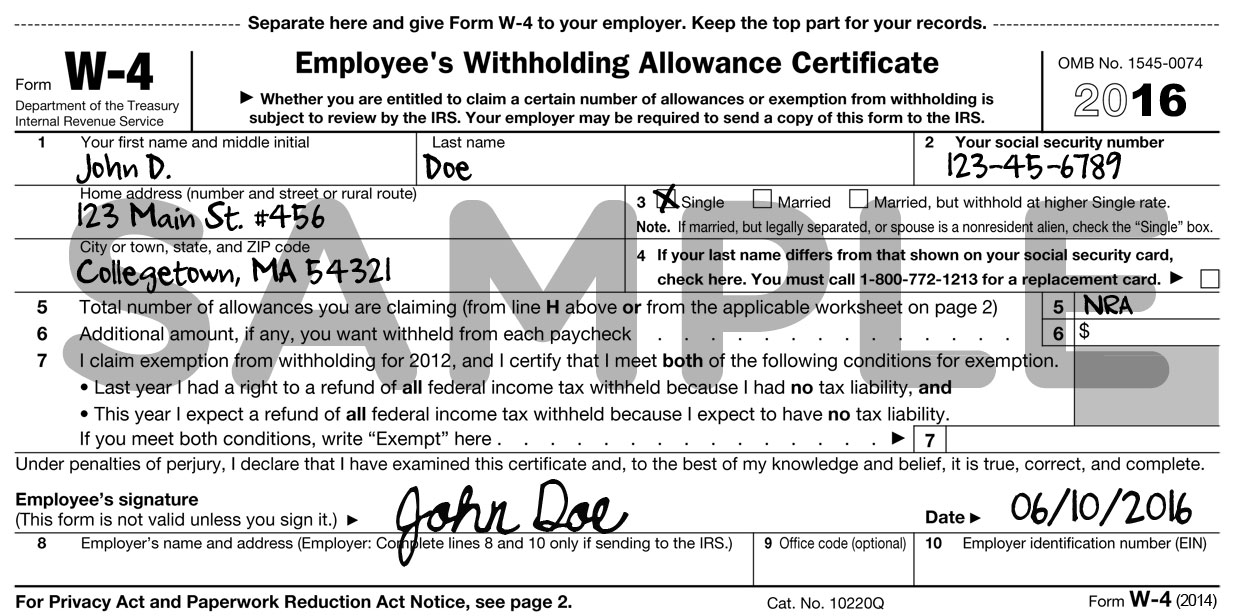

NJ W4 FORM Professional Healthcare Staffing

This meeting point indicates the withholding table that best reflects your income situation. Employees should complete an employee’s withholding allowance certificate. If you need additional withholdings for other income or wages, use. You must complete and submit a form each year certifying you have no new jersey gross. You must complete and submit a form each year certifying you have.

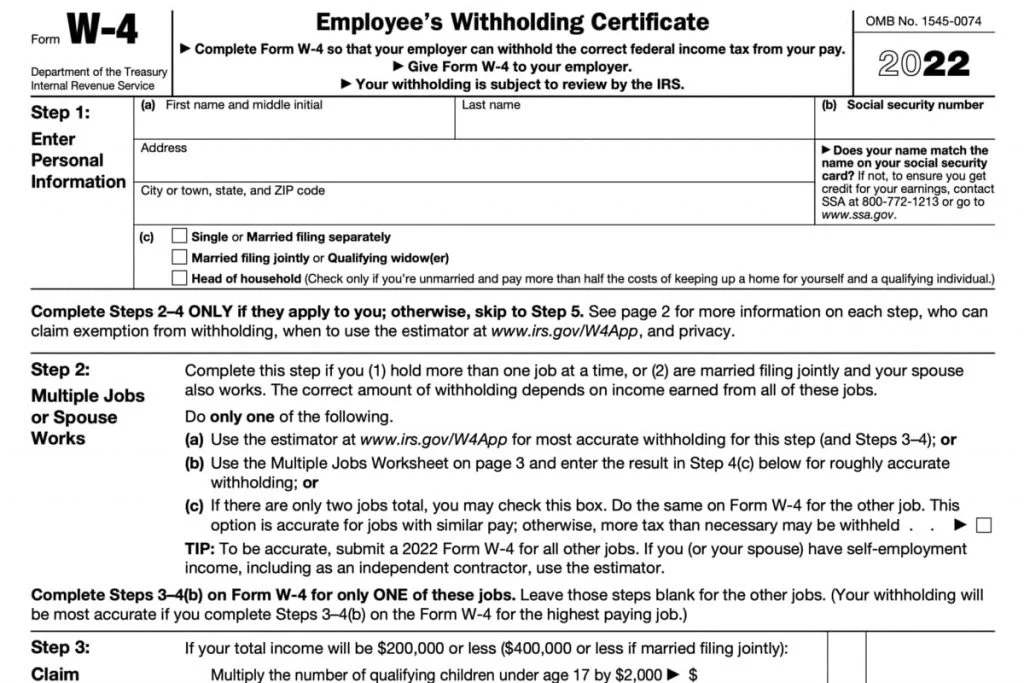

20212025 Form NJ DoT NJW4 Fill Online, Printable, Fillable, Blank

This meeting point indicates the withholding table that best reflects your income situation. You must complete and submit a form each year certifying you have no new jersey gross. If you need additional withholdings for other income or wages, use. Employees should complete an employee’s withholding allowance certificate. You must complete and submit a form each year certifying you have.

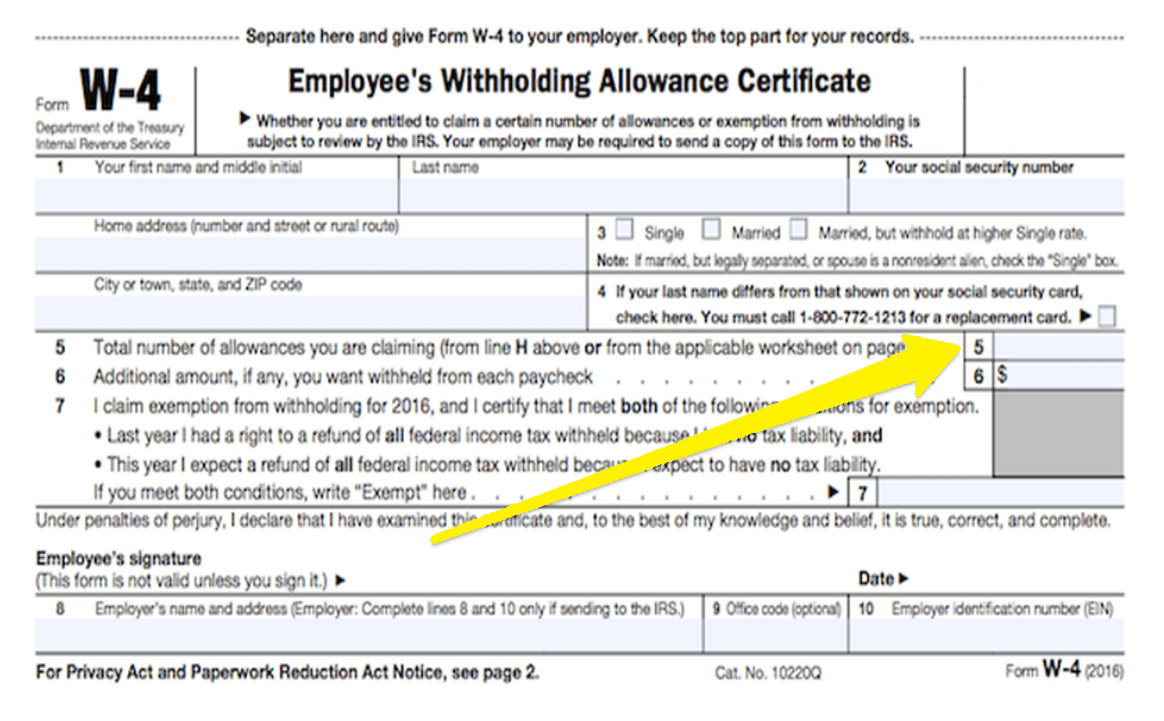

Nj Form W4 Worksheets Library

Employees should complete an employee’s withholding allowance certificate. You must complete and submit a form each year certifying you have no new jersey gross. This meeting point indicates the withholding table that best reflects your income situation. You must complete and submit a form each year certifying you have no new jersey gross. If you need additional withholdings for other.

Nj W4 2024 Form Printable Ardyce Jerrie

If you need additional withholdings for other income or wages, use. You must complete and submit a form each year certifying you have no new jersey gross. Employees should complete an employee’s withholding allowance certificate. This meeting point indicates the withholding table that best reflects your income situation. You must complete and submit a form each year certifying you have.

Your Rights, Taxes, Social Security and Regulations · InterExchange

You must complete and submit a form each year certifying you have no new jersey gross. If you need additional withholdings for other income or wages, use. You must complete and submit a form each year certifying you have no new jersey gross. Employees should complete an employee’s withholding allowance certificate. This meeting point indicates the withholding table that best.

Nj W4 Form Pdf 2024 Printable Kylen Minerva

Employees should complete an employee’s withholding allowance certificate. If you need additional withholdings for other income or wages, use. This meeting point indicates the withholding table that best reflects your income situation. You must complete and submit a form each year certifying you have no new jersey gross. You must complete and submit a form each year certifying you have.

Nj W 4 2021 Form 2022 W4 Form

You must complete and submit a form each year certifying you have no new jersey gross. Employees should complete an employee’s withholding allowance certificate. This meeting point indicates the withholding table that best reflects your income situation. If you need additional withholdings for other income or wages, use. You must complete and submit a form each year certifying you have.

How to Fill Out New Jersey Withholding Form NJW4 + FAQs

You must complete and submit a form each year certifying you have no new jersey gross. You must complete and submit a form each year certifying you have no new jersey gross. Employees should complete an employee’s withholding allowance certificate. This meeting point indicates the withholding table that best reflects your income situation. If you need additional withholdings for other.

2023 W4 Tax Form Printable Forms Free Online

If you need additional withholdings for other income or wages, use. You must complete and submit a form each year certifying you have no new jersey gross. You must complete and submit a form each year certifying you have no new jersey gross. Employees should complete an employee’s withholding allowance certificate. This meeting point indicates the withholding table that best.

W4 Form 2024 Nj Lauri Moselle

You must complete and submit a form each year certifying you have no new jersey gross. You must complete and submit a form each year certifying you have no new jersey gross. This meeting point indicates the withholding table that best reflects your income situation. If you need additional withholdings for other income or wages, use. Employees should complete an.

You Must Complete And Submit A Form Each Year Certifying You Have No New Jersey Gross.

If you need additional withholdings for other income or wages, use. Employees should complete an employee’s withholding allowance certificate. You must complete and submit a form each year certifying you have no new jersey gross. This meeting point indicates the withholding table that best reflects your income situation.

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)