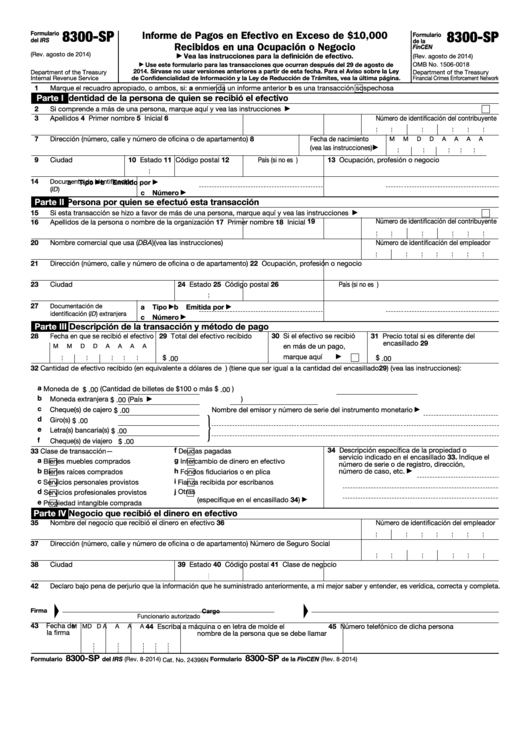

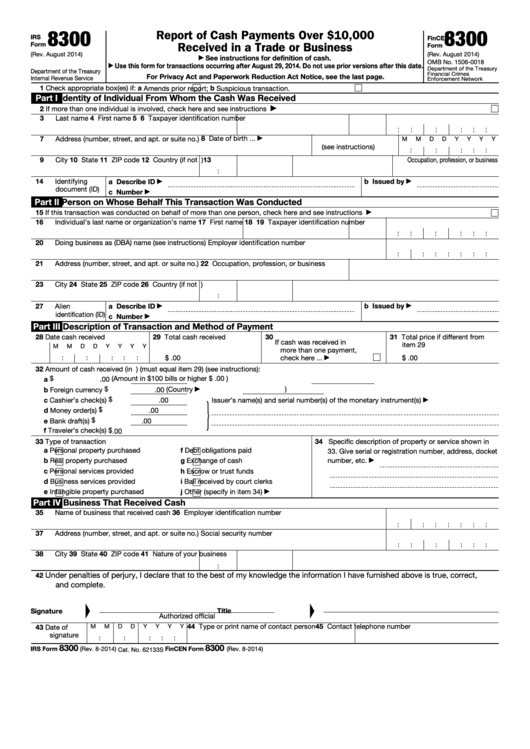

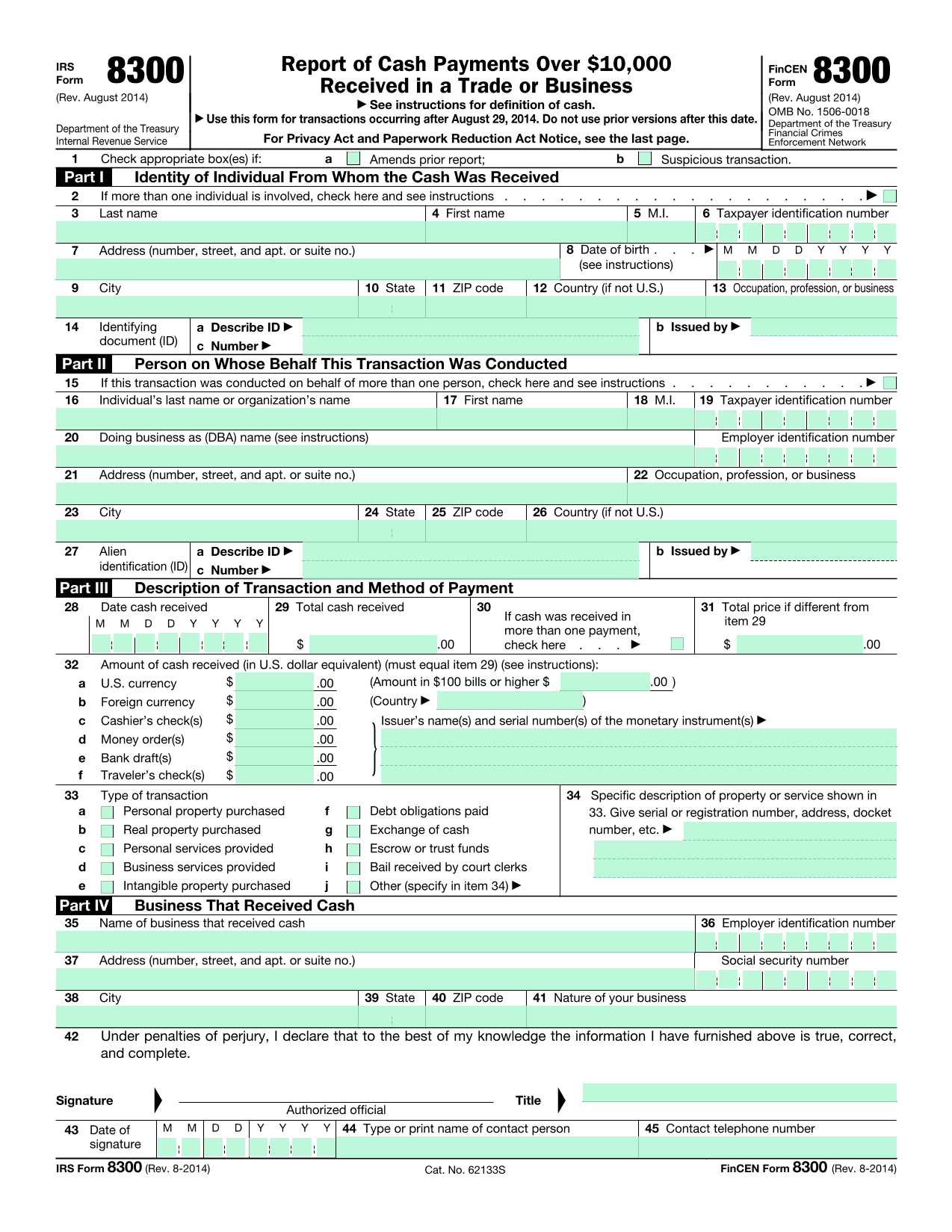

What Is A 8300 Form - Each person engaged in a trade or business who, in the course of that trade or. The law requires trades and businesses report cash payments of more than $10,000 to the. Form 8300 is required for reporting cash payments over $10,000 received in a.

The law requires trades and businesses report cash payments of more than $10,000 to the. Each person engaged in a trade or business who, in the course of that trade or. Form 8300 is required for reporting cash payments over $10,000 received in a.

Each person engaged in a trade or business who, in the course of that trade or. Form 8300 is required for reporting cash payments over $10,000 received in a. The law requires trades and businesses report cash payments of more than $10,000 to the.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Form 8300 is required for reporting cash payments over $10,000 received in a. The law requires trades and businesses report cash payments of more than $10,000 to the. Each person engaged in a trade or business who, in the course of that trade or.

Irs Form 8300 Printable Printable Forms Free Online

Each person engaged in a trade or business who, in the course of that trade or. The law requires trades and businesses report cash payments of more than $10,000 to the. Form 8300 is required for reporting cash payments over $10,000 received in a.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Form 8300 is required for reporting cash payments over $10,000 received in a. Each person engaged in a trade or business who, in the course of that trade or. The law requires trades and businesses report cash payments of more than $10,000 to the.

Top 11 Form 8300 Templates free to download in PDF format

Each person engaged in a trade or business who, in the course of that trade or. The law requires trades and businesses report cash payments of more than $10,000 to the. Form 8300 is required for reporting cash payments over $10,000 received in a.

Top 11 Form 8300 Templates free to download in PDF format

Form 8300 is required for reporting cash payments over $10,000 received in a. Each person engaged in a trade or business who, in the course of that trade or. The law requires trades and businesses report cash payments of more than $10,000 to the.

IRS Form 8300

Form 8300 is required for reporting cash payments over $10,000 received in a. Each person engaged in a trade or business who, in the course of that trade or. The law requires trades and businesses report cash payments of more than $10,000 to the.

IRS Form 8300 File Your Tax Return Today! Clean Slate Tax

Form 8300 is required for reporting cash payments over $10,000 received in a. Each person engaged in a trade or business who, in the course of that trade or. The law requires trades and businesses report cash payments of more than $10,000 to the.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Form 8300 is required for reporting cash payments over $10,000 received in a. Each person engaged in a trade or business who, in the course of that trade or. The law requires trades and businesses report cash payments of more than $10,000 to the.

EFile 8300 File Form 8300 Online

Form 8300 is required for reporting cash payments over $10,000 received in a. The law requires trades and businesses report cash payments of more than $10,000 to the. Each person engaged in a trade or business who, in the course of that trade or.

Each Person Engaged In A Trade Or Business Who, In The Course Of That Trade Or.

Form 8300 is required for reporting cash payments over $10,000 received in a. The law requires trades and businesses report cash payments of more than $10,000 to the.